Some local governments have begun formal assessments about whether electric services to their communities should be municipalized or whether their existing franchise agreements can be updated in their favor.

-

The negative outlook affects about $1.1 billion in combined GO and lease revenue debt, according to Fitch.

July 11 -

The Harris School of Public Policy is launching a new course, "Careers in Municipal Finance," designed to grow the public finance talent pipeline.

July 11 -

-

The comprehensive federal tax bill President Trump signed July 4 is credit negative for universities, Moody's Ratings said.

July 11 -

New York issuers lead a $9 billion slate.

July 11

The House Appropriations Committee kicks things off with markups of three infrastructure-related funding bills this week, including transportation.

The policy shift may crowd out some projects, warned Baruch Feigenbaum, senior managing director of transportation policy at Reason Foundation.

Housing advocates are celebrating the passage of the One Big Beautiful Bill for the boost in Low Income Housing Tax Credits which is projected to boost the use of private activity bonds.

The top issuers for the first half of 2025 put out a combined 89 issuances amounting to more than $39 billion in par value.

In this panel from The Bond Buyer's recent Southeast Public Finance event, top public finance officials from Atlanta, Charlotte, Nashville, Alabama, and Florida share how they evaluate bankers, bond counsel, and municipal advisors, and what makes a pitch fall flat.

From elite universities to rural hospitals and ports, federal actions are shifting the muni credit landscape. IR+M's Wesly Pate explains how buy-side firms are reacting.

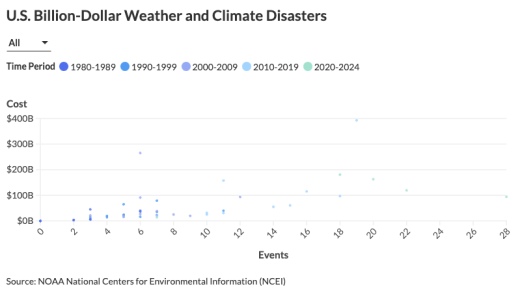

The steady demand for municipal bonds in high-risk areas underscores the complex relationship between climate change and financial markets.

Oppenheimer's Head of Public Finance Beth Coolidge and Columbus Auditor Megan Kilgore delve into the future of public finance and human infrastructure on a wide range of topics, from affordable housing and workforce development to public health, climate resiliency, and digital access.

As extreme weather events occur with more frequency across the country, Michael Gaughan, executive director of the Vermont Bond Bank, says municipal bond banks can help smaller communities deal with the effects of them. Gaughan speaks with The Bond Buyer's Lynne Funk on the effects of climate change and how the various levels of government can work together to address it.

Kelly Hancock resigned his state senate seat and assumed a position that will make him acting comptroller after current Comptroller Glenn Hegar leaves office.

Tom Kozlik said he was particularly concerned about the impact of a scaled-back FEMA on issuers in the Southeast.

As Congress grinds through the budget reconciliation, fixed income market experts are eyeballing an uncontrolled national debt while dreading a heavy-handed response from the Treasury bond market.

-

The House Appropriations Committee kicks things off with markups of three infrastructure-related funding bills this week, including transportation.

8m ago -

Tim Ruby has joined Wells Fargo as its healthcare, higher education and not-for-profit division executive. He will be based in Chicago.

3h ago -

New York City lawmakers spent big on social services. But the budget still leaves the city exposed to cuts by the Trump administration and congressional GOP.

6h ago -

As long as the Oversight Board offers virtually nothing to many PREPA bondholders, the bankruptcy is likely to be tied up for years in litigation.

July 10 -

"Municipal outperformance against taxable sectors has moved short-term ratios on or through their 252-day moving averages, while intermediate and long maturities are holding at or above average ranges," said Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

July 9