DALLAS — Congress delayed but did not fix a $100 billion hole in federal transportation spending with the enactment last Friday of legislation providing $10.8 billion to extend solvency of the rapidly shrinking Highway Trust Fund by 10 months.

Revenue from the gasoline tax used to build the 48,000-mile interstate highway system is no longer sufficient to meet the need for new roads, expanded transit, and upkeep of existing infrastructure, transportation experts say. The revenue has dwindled due to a combination of inflation since the tax was last increased more than 20 years ago, increasingly stringent increases in federally-mandated conventional vehicle fuel efficiencies, and the addition of more vehicles on the road powered by electricity or other alternative fuels, they say.

A number of alternative funding options for highways exist, including more reliance on investments from public-private partnerships, fees based on vehicle miles traveled, and additional tolling of new and existing highways.

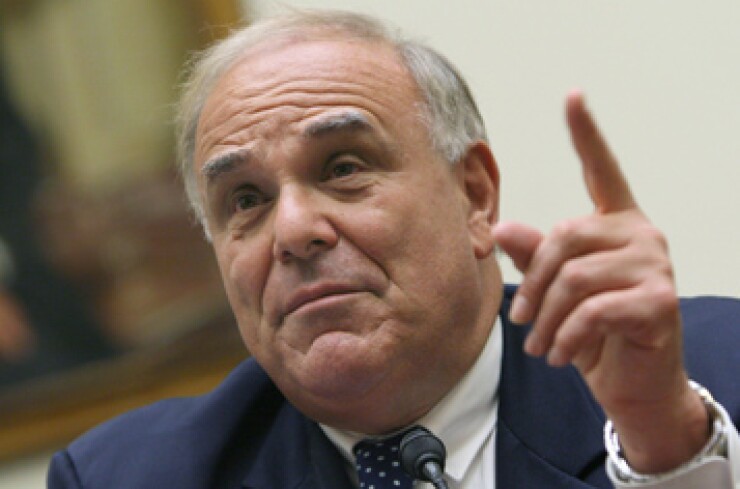

Ed Rendell, former governor of Pennsylvania and current co-chairman of Building America's Future, an infrastructure advocacy group, said the gasoline tax, first levied in the early 1930s, is the most effective way to fund highways at this point but it may be on its way out as the main source of infrastructure spending.

A higher gasoline tax is needed to fund transportation infrastructure spending in the near term, but Congress must find a long-term solution to the HTF's structural imbalance, he said.

"Congress needs to raise the gasoline tax by 15 cents a gallon [from the current 18.4 cents per gallon], index it to inflation, and then sunset it after five to 10 years," Rendell said. "By that time we should have a handle on a miles-traveled fee or some other idea to ease away from the reliance on a gasoline tax."

"Dramatic improvements in vehicle fuel efficiency have eroded the long-term viability of the gas tax as a primary source of transportation revenue," DeGood and Madowitz said. "Raising the gas tax will stabilize the trust fund and provide transitional revenue to serve as a bridge to a mileage-based user fee system."

An increase in the gasoline tax is "the simplest, most straight-forward, and most effective way" to generate the money needed for a national infrastructure program, said Thomas Donahue, president of the U.S. Chamber of Commerce.

The Chamber is willing to consider other proposals for a funding mechanism, but will not support a plan to slash the federal gas tax and shift responsibility for transportation to the states or any other roadblock to a federal role, Donahue said.

Measures to raise the federal gas tax by 12 to 15 cents a gallon and to impose a sales tax on crude oil at the refinery have been introduced in Congress, but Republican House leaders and President Obama oppose a tax increase.

"We need our elected representatives to show some courage and leadership," Donahue said. "They need to do what's right for a change, not what's politically expedient."

The Congressional Budget Office said in a May report to the Senate Finance Committee that revenues in fiscal 2014 from the federal taxes of 18.4 cents per gallon of gasoline and 24.4 cents of diesel will total $38 billion while highway and transit expenditures from the HTF are expected to total $53 billion.

Gasoline and diesel tax revenues are expected to go up only $1 billion over the next 10 years to $39 billion in 2024, CBO said.

Collections from the gasoline tax will drop 1% as vehicles become more fuel efficient, but a 3% increase from the diesel tax and a sales tax on large trucks would provide some relief. The two taxes provide 90% of the revenue dedicated to the HTF, CBO said, with the remainder from taxes on heavy trucks and tires.

An increase in the federal gasoline tax of five cents per gallon would be needed to offset a decline in collections due to the higher fuel standards, CBO said. Existing federal standards require an average fuel efficiency of 36.6 miles per gallon in 2017 and 54.5 mpg in 2024, up from the current 29.4 mpg.

If the gasoline tax had been indexed to inflation when Congress last raised it, the tax rate would now be about 30 cents per gallon, said Scott Zuchorski, senior director of Fitch's global infrastructure and project financing group.

Federal regulation raising the average fuel efficiency of new vehicles will cause a 13% reduction in revenues from the fuels taxes by 2032 even if the per-gallon tax rate goes up, Zuchorski said.

"This illustrates the need for other sustainable long-term sources of revenue to address the country's growing transportation funding requirements," he said in a report on the status of the Highway Trust Fund.

The gasoline tax is quickly losing steam and purchasing power, according to the Institute on Taxation and Economic Policy, a Washington-based non-profit that studies state and federal tax policies.

"The gasoline tax is the single largest source of funding for transportation infrastructure in the United States, but the tax is on an unsustainable course," ITEP said. "Sluggish gas tax revenue growth has put strain on transportation budgets at the federal and state levels, and has led to countless debates around the country about how best to pay for America's infrastructure."

A 6% drop in gas tax collections since the 1990s can be attributed to more fuel-efficient vehicles, but failure to index federal and state gas tax rates to inflation is the major culprit, said ITEP.

If the federal gasoline tax had been linked to inflation in 1997, annual revenues would be $20 billion higher and sufficient to fund transportation spending without transfers from the general fund, it said.

"In the long-run, a replacement to the gas tax will be needed if fuel efficiency dramatically improves and many drivers come to own vehicles that use little or no gasoline," the group said.

Over the past six years, Congress has transferred almost $70 billion into the highway fund from the general fund as dedicated tax revenues have stagnated and expenditures continue to climb.

The most recent trust fund patch that extends the solvency of the highway fund through May 31, 2015 relies on a transfer of $9.8 billion from the general fund into the highway fund, along with a $1 billion shift from a fund set up to repair and replace leaking underground gasoline and oil storage tanks. President Obama signed the highway bailout legislation on Aug. 8.

CBO said this summer that funding a six-year highway bill at current spending levels plus the average annual increase would require supplementing federal taxes on gasoline and diesel with more general fund transfers or $100 billion of new revenue. A 10-year bill deepens the shortfall to some $170 billion.

Highway spending would have to be cut 30% through 2024 and transit spending by 65% if only the currently dedicated taxes are used to support federal transportation expenditures, CBO economist Joseph Kile said. If lawmakers want to match expected expenditures with gasoline tax revenues, he said, the current 18.4 cent tax would need to go up by 10 cents to 15 cents per gallon beginning in 2015.

Otherwise, Kile said, a transfer from the general fund of $18 billion would be needed in fiscal 2015 to keep the fund solvent with annual transfers of $13 billion to $18 billion through 2024.

The highway fund had a $23 billion surplus in fiscal 2000, but expenditures have exceeded dedicated revenues since 2008.

Maintaining the existing inventory of transportation infrastructure is not getting cheaper either.

Federal, state, and local government transportation spending is about $100 billion a year, the Transportation Department said in its latest biannual report on surface transportation, but up to $146 billion is needed to extend and maintain roads and bridges. The American Society of Civil Engineers estimates that $93 billion a year of additional infrastructure spending is needed to work off the maintenance backlog and still meet capacity demands.

Raising the gasoline tax to a level where it could support total transportation infrastructure needs would be impossible, Zuchorski said.

Tolling

"To keep up with the actual transportation infrastructure need in the U.S. as estimated by the CBO, Fitch projects the gas tax would need to rise to 75 cents to 80 cents per gallon, which appears both politically and economically untenable," he said.

Additional tolling may be the answer, Zuchorski said.

"In Fitch's view, if strategically implemented, tolling can help better link costs for parts of the roadway network to the ultimate users and better manage highway capacity," he said.

President Obama's proposed four-year $302 billion Grow America Act transportation program would allow states to toll existing lanes on interstate highways if the revenue is dedicated to system maintenance.

A higher gasoline tax may be part of the answer to transportation funding, at least in the short term, said Pat Jones, president of the International Bridge, Tunnel and Turnpike Association, but more tolling options would help ease the funding crunch.

"Rebuilding the interstate highways will cost hundreds of billions of dollars over the next several decades and current funding sources alone are not equal to the task," Jones said. "States should have the flexibility to use tolling and other viable funding and financing options that make the most sense for them."

Tolling preserves the user-pay approach of the gasoline tax, Jones said.

"The gasoline tax has been great and will be good for the short term, but in the long term it is not sustainable," he said. "Tolling would be another tool that states could use to rebuild their roads and bridges."

But a recent Associated Press poll found that 46% of those surveyed objected to allowing private companies to build new roads and bridges in exchange for the right to charge tolls. None of the several highway funding proposals found favor in the poll, as 40% said they would not support a mileage-based road fee to pay for road construction and maintenance. Only 20% were in favor of tolling. Most also objected to any increase in the current federal fuels taxes, with 58% opposed and 14% backing an unspecified tax increase.

Miles Morin, a spokesman for the Alliance for Toll-Free Interstates, said tolls on existing interstates would force traffic onto state and local routes, increasing congestion and costs. Tolling has poor poll numbers because it's bad public policy, he said.

"Transportation infrastructure needs improvements, but of all the ways to fund them, tolling existing interstates is the worst," he said.

Vehicle Miles Traveled

Charging motorists for each vehicle mile traveled rather than the fuel that is consumed would capture the revenue lost through more efficient cars. Proponents like the idea because the fees would be based on actual gas usage. But critics warn it would jeopardize individual privacy rights and be expensive to implement.

The CBO has estimated that a fee or tax or 1.3 cents per vehicle mile traveled (VMT) would generate the same amount of revenue as the current gasoline and diesel taxes, and a levy of 1.85 cents per mile would fully fund federal transportation spending.

Kevin DeGood, director of infrastructure policy at the Center for American Progress and economist Michael Madowitz said Congress should raise the gas tax by 15 cents and authorize 10 to 15 state-based demonstration projects for testing the reliability of different types of VMT systems that protect privacy rights.

With the uncertainties plaguing future federal transportation funding and declines in the purchasing power of their own gasoline taxes, many states are looking to increase their own infrastructure spending.

Seven states have reformed or increased their gasoline taxes since February 2013, and more than 50% of Americans live in states with index-linked gasoline taxes, ITEP said. However, two dozen states have not raised their gasoline taxes in more than 10 years, and the rate has been unchanged for more than two decades in sixteen states.

Unindexed state gas tax rates are down an average of 17% in purchasing power from 1990 when adjusted for construction cost inflation, ITEP said, the equivalent of a 5 cent per gallon decrease in the state tax. Eighteen states and the District of Columbia link the gasoline tax rate to inflation, but 32 do not.

If those states had indexed their gas tax to construction costs when it was last raised by lawmakers, they would be bringing in more than $10 billion in additional gas tax revenue every year, ITEP said. New Jersey and Tennessee would each see more than $500 million of additional annual revenue with an indexed gas tax.