-

The authority is bringing $950 million of taxable bonds and $1.7 billion of tax-exempts.

October 10 -

Green bonds and taxables dominate the Massachusetts Water Resources Authority's $620 million sale.

October 9 -

The deal allows the university to shed a master trust indenture and concentrate its debt under the University of Nebraska Facilities Corp.

October 8 -

Most of the deal from Connecticut's largest city will be taxable, with the lion's share going to a pension fund.

October 8 -

The municipal market continues to flex its muscles even as the U.S. economy seems to be slowing, which could lead to an even flatter yield curve.

October 4 -

Municipal bond volume continues to accelerate, closing out the month of September 39.1% higher and the quarter 17.8% higher than a year earlier, as issuers flocked to market with taxable deals.

September 30 -

Low taxable rates will allow the state to reap 10% present value savings while advance refunding $285 million of tax-exempt GO debt.

September 26 -

Downtown Dallas has seen a revival in recent years with residential conversions and more pedestrian-friendly design paid for with tax-increment financing.

September 23 -

Texas A&M University System will price $430 million of taxable bonds, including $230 million to advance refund tax-exempt debt.

July 22 -

CommonSpirit Health will sell $2.7 billion of taxable bonds and $3.1 billion of tax-exempt debt, with BBB-plus ratings, into a supply-starved market.

July 18 -

Dallas-Fort Worth International Airport plans to add a sixth terminal that could cost up to $3.5 billion as it approaches its 45th anniversary.

May 21 -

Austin Energy expects to reduce the cost of power from an East Texas biomass plant by buying the Nacogdoches facility.

May 20 -

Dallas-Fort Worth International Airport expects to save money with the refunding deal as it advances plans for a new terminal and refurbished runways.

May 14 -

Taxable municipal bonds have been in the spotlight of late and investors are eating them up.

May 6 -

A few taxable deals came into a weaker market today, highlighting the significance of what issuers can tap into by issuing taxable munis.

April 17 -

The airport authority in Ohio is using capital facility charges to back bonds for the facility.

April 16 -

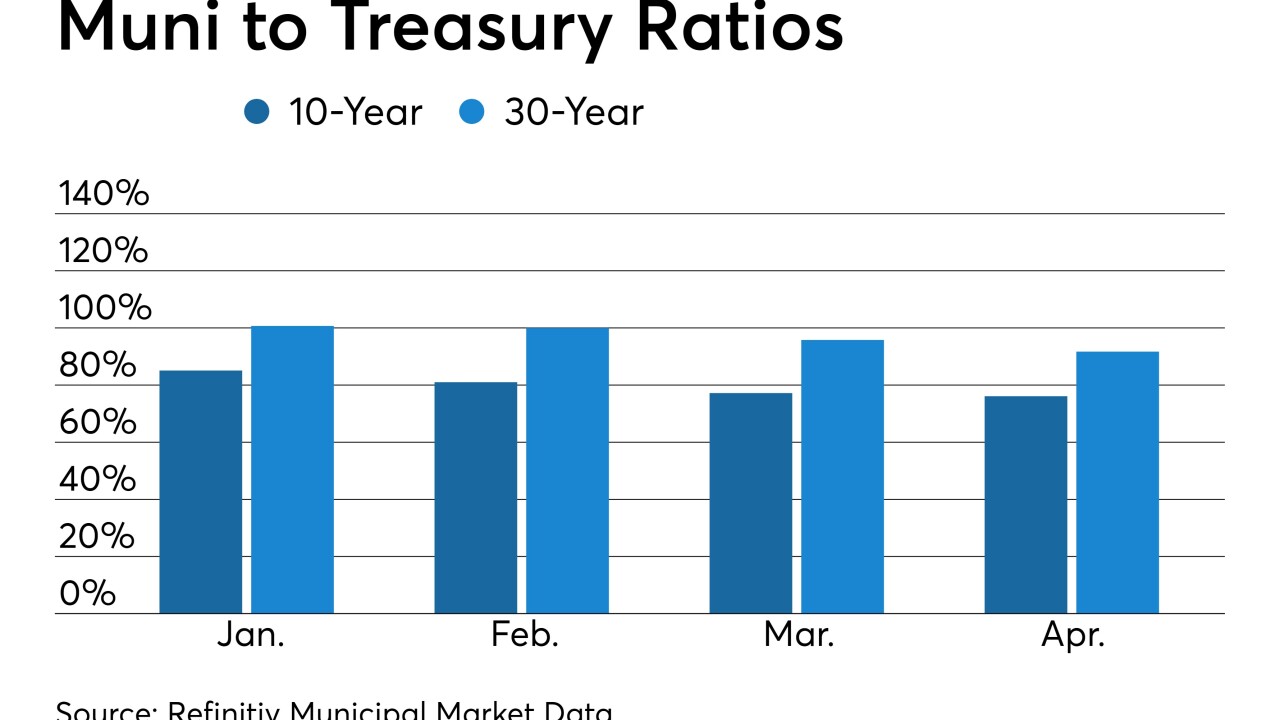

Undersupply and demand for the muni exemption in high tax states are expected to help municipal bonds outperform in the second quarter.

April 5 -

Michigan State sold taxable bonds to finance a legal settlement in the Larry Nassar sexual abuse cases.

February 12 -

The University of Michigan plans to sell $225 million of bonds that will include taxable and tax-exempt debt, with bonds structured with a put option in the mix.

February 6 -

The 2007 bond authorization for the Cancer Prevention Research Institute of Texas is nearly tapped out, sparking debate about what comes next.

February 4