-

Covenant's issuing tax-exempt debt to retire some variable-rate, term loan bank debt and taxable bonds to fund construction of a rehabilitation facility.

February 25 -

For the third time in four years, long-term municipal bond volume has surpassed the $400 billion mark — this time thanks to a second half surge in taxable issuance that took the market by storm.

February 24 -

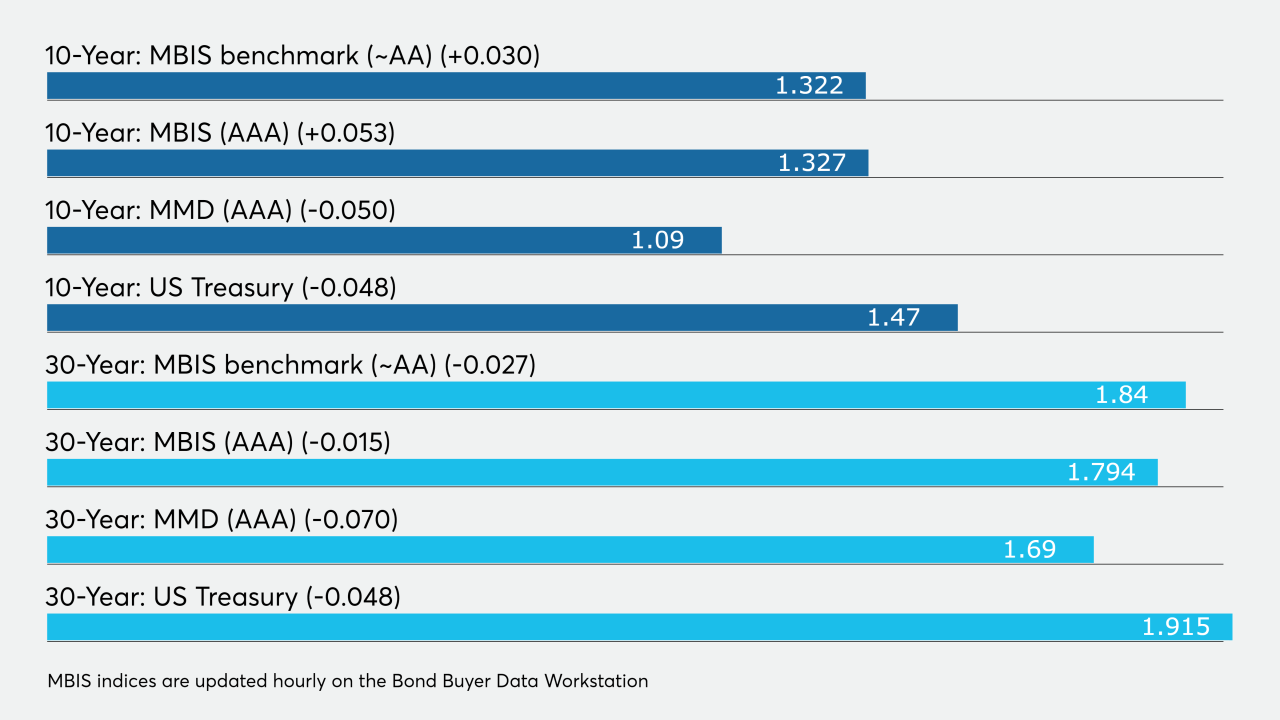

Bond yields keep grinding lower ahead of the largest issuance week of 2020, clocking in at $13 billion.

February 21 -

BlackRock's Sean Carney discusses the new era of challenges for muniland, including climate change and cyber security. He also opines about the growing trend of taxable issuance. Aaron Weitzman hosts.

February 13 -

The Community Preservation Corp. says its inaugural sustainability offering is the single largest bond sale by a community development financial institution.

February 11 -

Investors will see less-common names, higher-quality new issues in $8.3B week.

February 10 -

Municipal investors should go long as the short end is expensive, strategists say.

February 7 -

The muni market was weaker again on Wednesday with yields on the rise, yet that did not slow down the primary. It did not matter if it was tax-exempt or taxable — they were gone in a flash.

February 5 -

The municipal market has been on a tear in terms of fundamentals and technicals that are driving the market and there isn’t much in the near-term likely to stymie that tone.

February 4 -

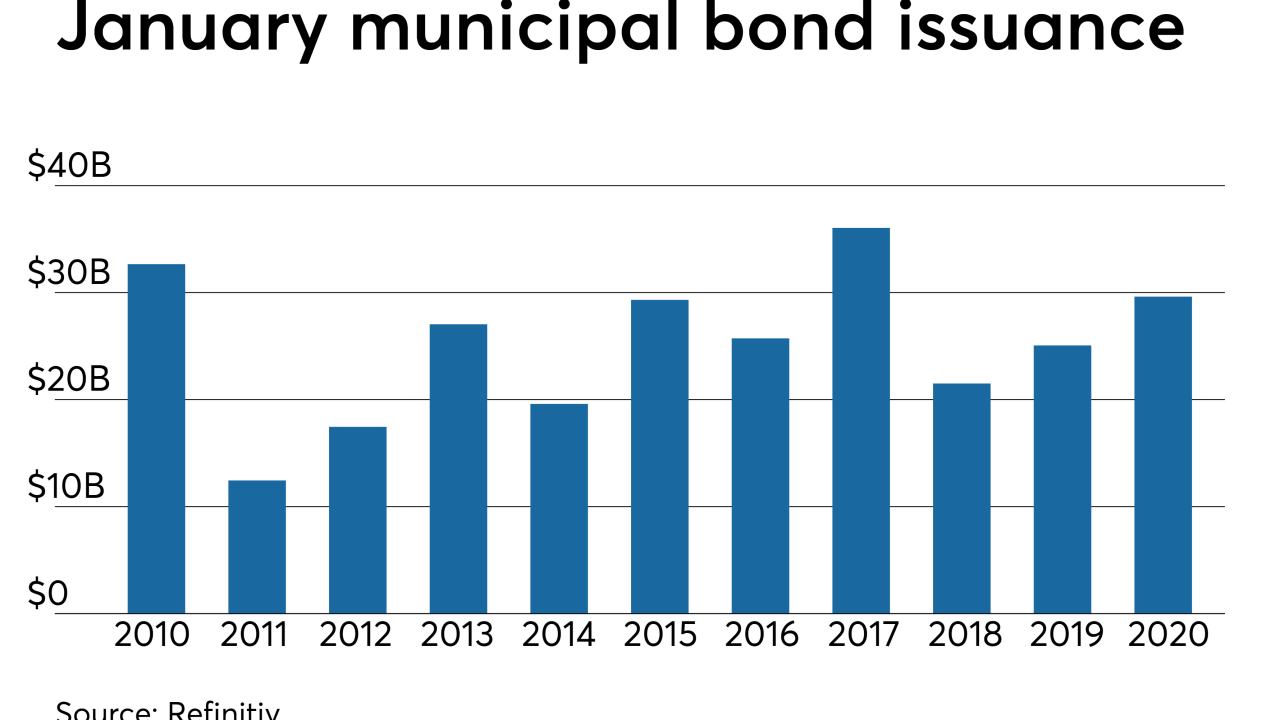

After a 117% increase in taxable bond issuance in January, the trend continues.

February 3 -

Thanks to the taxable tear, the municipal market saw the third highest volume for the month of January in the past 10 years.

January 31 -

While scrutiny of climate risks grows for municipal bond issuers, so do opportunities to broaden investor interest.

January 30 -

The high-demand market environment boosted Philadelphia’s first general obligation bond deal of 2020.

January 22 -

A calm rate outlook, a focus on taxable municipals, and a stable credit outlook are drivers of the current outlook and market convictions for Gary Pollack of Deutsche Bank. John Hallacy hosts.

January 16 -

Look for an expanded buyer base, including an international focus, as a new decade in munis dawns

January 14 Arizent, The Bond Buyer

Arizent, The Bond Buyer -

Many investors are positioning for the late cycle, according to guest Robert Waldner Jr., CFA , chief strategist and head of macro research at Invesco. He points to the demise of the Phillips curve; the Fed thinking in "real" terms, and a gradual increase in yields on the long end. He also discusses the appeal to global clients of taxable municipals. John Hallacy hosts.

January 9 -

Municipals look to be well positioned entering 2020 against a strong backdrop of market technicals and stable credit outlook.

January 2 -

The municipal bond market eclipsed the $400 billion mark for the fourth time since 2010, thanks to taxable trend that led to a vault in fourth quarter volume.

December 31 -

Gary Hall of Siebert Williams Shank talks with Chip Barnett about the recent merger which created the largest minority- and women-owned investment bank in the U.S. He looks back at his time at the MSRB and looks ahead to what the market may see in 2020.

December 26 -

As there are just eight full work days remaining in the year, muni market leaders believe that 2020 will look a lot like 2019 — high volume, increasing taxable issuance and strong demand.

December 16