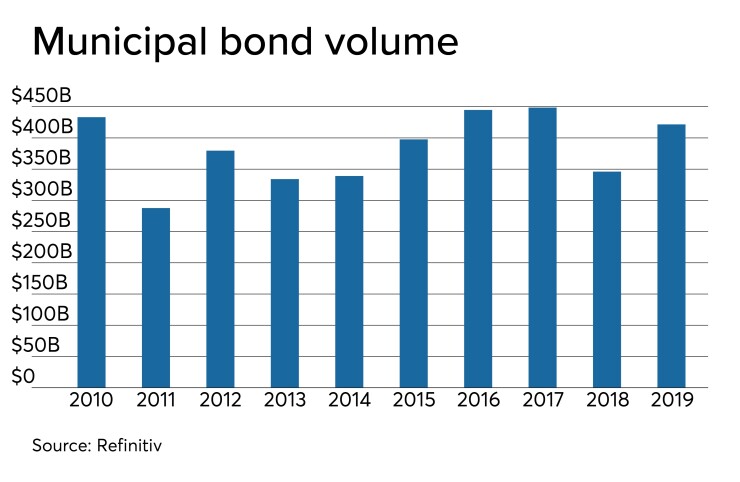

The municipal bond market eclipsed the $400 billion mark for the fourth time since 2010, thanks to taxable trend that led to a vault in fourth quarter volume.

Municipal issuance picked up the pace in December to the tune of $40.79 billion, with taxable bonds accounting for about a quarter of the month's supply. For the year, volume jumped 21.8% to $421.69 billion from $346.06 billion in 2018

Tom Kozlik, head of municipal strategy and credit at Hilltop Securities said that he wasn't surprised by December's high volume.

“We have seen interest build over the last several months and knew it was not going to die down,” he said. “And, we also saw some issues roll over to January. This is leading us to believe that the optimistic issuer sentiment could very well continue into the 2020.”

December volume this year is 57.1% higher than last year and 2019’s fourth quarter total of $143.01 billion was 54.1% higher than last year’s.

“Issuance was very much challenged until interest rates dropped at the end of the summer,” Kozlik said. “It was really the surprise shift in monetary policy, the lower interest rate environment, and the interest in and use of taxable advance refundings that jump-started issuance in 2019.”

Taxable bond volume more than doubled in December to $11.25 billion from $4.09 billion at the end of 2018. For the year, taxable issuance rose to $67.27 billion from $29.95 billion.

Taxable issuance averaged between $20 and $30 billion from 2011 through 2018 and this year’s total was the highest since 2010 – the last year of Build America Bonds, when the market saw a whopping $151.88 billion.

Brian Musielak, senior portfolio manager for Commerce Trust Co. said market participants at the beginning of the year didn't expect the issuance of taxable bonds to refund tax-exempt.

"As a result, the tax cuts and jobs act, which eliminated tax-exempt advanced refundings, combined with the decline in interest rates, really made it possible this year,” he said. “I am not surprised with the amount of issuance, given the decline in interest rates this year, but I am surprised with the composition of it.”

Musielak said he does not see the taxable trend continuing for all of 2020, though it may extend through the first half or more likely the first quarter.

"It is interest rate-dependent. While we don’t see the Fed moving short-term interest rates higher, that doesn’t mean long-term rates can’t go higher, which we see happening," he said. “During the first half of the year, we should still see sizable taxable bond issuance. If the issuance is there, the demand will be there.”

The economics for taxable refunding opportunities were present for the whole year.

"It is very typical of the muni market to follow and lag behind," Musielak said.

Refunding volume for the month more than tripled to $11.99 billion in 295 deals from $3.02 billion in 107 deals a year earlier. New-money volume increased 19.7% to $22.53 billion. Combined new-money and refunding issuance jumped 51.9% from December 2018 to $6.26 billion.

“New-money issuance, should continue to grow even if rates go higher," Musielak said. "A lot of pent-up demand for transportation and infrastructure projects — productive use of new issuance.”

Issuance of bonds with interest subject to the Alternative Minimum rose to $1.74 billion from $975 million.

Issuance of revenue bonds gained 48.6% to $31.59 billion, while general obligation bond sales more than doubled to $9.19 billion.

Negotiated deal volume was up 78.5% to $33.95 billion. Competitive sales increased 145.4% to $5.26 billion.

Deals wrapped by bond insurance in December increased 100.4% to $2.84 billion in 129 deals from $1.42 billion in 76 transactions the same month last year.

There were a lot of positives in munis but in Kozlik’s mind, demand was one of the key defining items of the year.

“The 50-plus plus weeks of flows into municipal funds could have been a stumbling block, but issuance has been trying to keep pace with demand,” he said. “Issuers were able to find a way to subvert the limitation placed on their ability to experience savings as a result of the 2017 tax policy.”

Musielak agreed with Kozlik, about the fund flows streak munis saw for the whole year.

“One of the most shocking things I’ve seen this year, has been the retail flows into munis and out of equities. Very surprising, flows have continued the second half of the year despite how low yields are. We think this is more to do with fear of equity market correction than the appeal of munis,” he said.

Musielak added that he does expect a reversal of the retail flows into munis for 2020.

Seven sectors increased volume in December, with transportation making the biggest jump, to $9.74 billion from $4.13 billion. Public Facilities issuance increased to $1.14 billion from $496 million and general purpose volume rose to $9.78 billion from $4.93 billion.

One sector Musielak sees growing in 2020 is the Housing market, which will follow general economic conditions. “We continue to see upward trend in issuance, particularly related to affordable housing. Muni market is set up to help with that problem,” he said.

Six types of issuers increased levels from a year ago, while issuance by the rest of the sectors declined at least 44.4%. State governments rose to $1.96 billion from $345 million, state agencies increased to $15.93 billion from $7.65 billion and local authority issuance was higher to $11.92 billion from $7.60 billion.

California again led all states in terms of muni bond issuance in 2019. Issuers in the Golden State sold $60.17 billion of municipal bonds; New York remained in second place with $45.45 billion; Texas stayed third with $43.67 billion; Florida was next with $21.79 billion; and Pennsylvania rounded out the top five with $17.91 billion.

Massachusetts was next with $13.79 billion, followed by Colorado with $12.63 billion, Ohio with $12.55 billion, then New Jersey with $11.70 billion and finishing the top 10 is Georgia with $11.10 billion.

With 2019 now over with the big question is: will munis breach the $400 billion mark again in 2020?

Kozlik believes they will, as his issuance forecast is for $450 billion in 2020.

“In many ways a forecast above $400 billion for 2020 is driven by an interest rate assumption, as we believe that if rates stay near where they are now or drop a little that the refunding pace could remain strong,” he said. “But, we also think there is going to be a small uptick in new money issuance. Overall, we expect that issuers are not going to want to miss out on a chance to sell debt at these low levels.”

Musielak disagrees, and doubts the market will make it to the $400 billion mark.

“Two drivers to muni supply are fiscal policy and interest rates. Both of those can impact refundings," he said. "Given our outlook that longer-term rates move higher, we do not think new issue volume will reach $400 billion next year, barring any changes in fiscal policy that could drive refundings.”

Kozlik said a change in monetary policy was far and away one of the leading themes for 2019.

“At this time last year we were expecting multiple rate hikes and instead the Fed reversed course and dropped their rate target multiple times,” Kozlik said.

As far as returns go, munis finished the year above 7%. Musielak believes that returns for the asset class are going to gravitate back to current yields.

"The appreciation due to the decline of interest rates is not likely to repeat next year in our view," he said. "You really don’t want to see a repeat in terms of performance, because that would mean yields are so low, which is generally a bad sign for economic conditions.”