Climate change risks are becoming clearer for municipal issuers and market participants are counting on more disclosure about how those risks affect credit and global investor perceptions of the market.

The very way issuers disclose — or don’t disclose — those risks to the broader public finance industry is under scrutiny, market participants have recently said, including panelists at The Bond Buyer’s National Outlook Conference this week.

Nearly every panel touched on climate. Industry participants — from investors to data providers to ratings agencies to the issuers themselves — are beginning to speak more aggressively about the need for improved disclosure and increased spending.

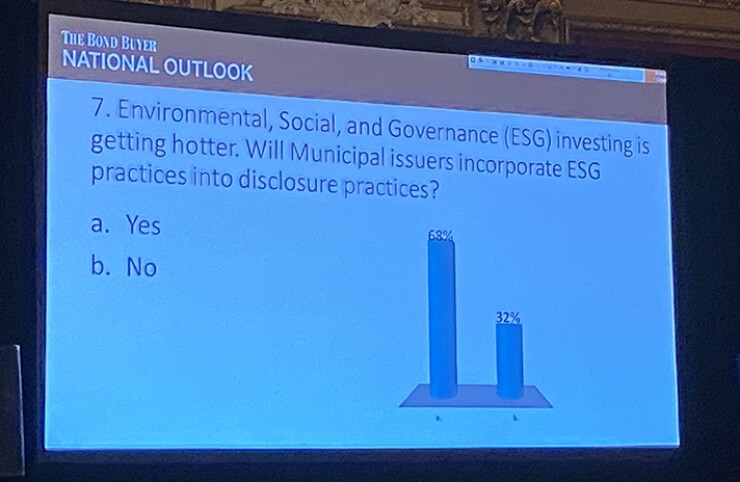

Fifty-two percent of attendees who responded to a live survey

“We would like a little more detail than what is currently out there,” Kurt Forsgren, managing director and head of sustainable finance at S&P Global, said on a climate panel. While rating agencies, investors and bond insurers do their own due diligence on potential credit risks due to climate, essentially “we are still dependent on issuers for information,” he said.

Forsgren said that sometimes current disclosures in official statements can seem a bit “couched” and there is an opportunity to give climate risks relevance and importance in ways that investors can understand.

Build America Mutual Chief Credit Officer Suzanne Finnegan, also speaking on the panel, said BAM considers climate factors when deciding whether it will insure a deal, and takes a “conservative” approach to viewing the potential risks versus the revenue pledges on those deals.

The risks municipal issuers face from climate change are not simply environmental — there are potential increased costs of paying for the infrastructure needs to preemptively deal with climate events and clean up after them. There is a need to assure investors through disclosures that governments are prepared to repay them if the costs become larger than expected. These factors are being discussed across trading floors, board rooms and through letters to investors from the world’s largest asset managers.

“Will cities, for example, be able to afford their infrastructure needs as climate risk reshapes the market for municipal bonds?” Larry Fink, CEO of BlackRock, wrote

The issue could be looked at as a potential carrot and stick relationship for issuers.

William Glasgall, senior vice president and director of state and local initiatives at the Volcker Alliance, said that disclosure of climate risks is “inconsistent and incomplete.” During a panel discussion, Glasgall said that while the Securities and Exchange Commission cannot tell issuers what they have to disclose, there is a potential that it could focus on climate risk and potential defrauding investors similar to how it focused on pension risks that were not disclosed in the past. “If the SEC decides that environmental, climate change is material, we could see enforcement and then we will see disclosure.”

Some issuers are moving in that direction, whether by seeking third-party sustainability designations, focusing on ESG, green and marketing their bonds to investors that have mandates to invest in those types of bonds.

James McIntyre, director of capital markets at NYS Homes and Community Renewal, New York's state affordable housing agency, said that when issuers are planning their deals, “climate cannot sit over here and well, credit sits over there. All the projects we are doing — we are building resiliency into them.”

McIntyre, speaking on an outlook and opportunities panel, noted that he and other issuers, such as the San Francisco Public Utilities Commission, are exploring ways to show their projects are sustainable, most recently

And with the taxable bond boom that has

“Issuers have a strong opportunity in 2020 to tell the story of the municipal market to a much broader investor pool through disclosures on climate risk, ESG factors and green bonds,” said Will MacPherson, managing director at IHS Markit. “An international audience is growing for such disclosures and given the trend in taxable supply and interest in long-dated investments, tools are available to seamlessly expand the conversation into these new pockets of interest. The data is there; it simply needs to be articulated.”

MacPherson said that while the additional disclosure requirements may be viewed as a burden by some, through steady repetition they could become a new standard over time.

“Having more eyes on munis is better for the market as a whole,” he added.

McIntyre also said that international investors in particular are looking to munis as investments in their portfolios, pointing to Dutch and Canadian pension funds as examples, but they have certain mandates to invest in sustainable projects. He said there needs to be an educational effort with international investors and that issuers should “leverage our leverage” in that area.

Daniel Tomson, co-head of public finance at Citi, noted that because of the influx of taxable debt, Citi is deploying its bankers to educate international investors because demand there is a large part of why taxable munis have been well absorbed. Tomson said 2020 could be a bellwether year for the market.

Bob Spangler, co-head of municipal finance at RBC Capital Markets, said that large issuers such as California and New York are focusing more on ESG in their deals and that investors interested in ESG will begin to change issuer behavior, but he cautioned "it’s going to be very slow."

As the current administration rolls back Obama-era environmental protections, it will leave it to the cities and states to take the lead on addressing climate risks.

What’s needed is “a robust federal partner” in dealing with climate change and “right now, that’s not what we have,” said Dan Zarrilli, chief climate policy advisor and OneNYC director in the New York City mayor's office. Zarrilli said that given that reality, the risks New York City faces in particular require the help of the financial markets and his office has plans to “fundamentally reshape this city over the new few decades.”

Zarrilli said that climate change is an “all society” problem which all participants need to take seriously.

“Investors are increasingly ... recognizing that climate risk is investment risk,” Fink wrote. “Indeed, climate change is almost invariably the top issue that clients around the world raise with BlackRock.”