-

Issuance dropped 26.7% in January, tax-exempt issuance fell 32.6% while refundings and taxables saw smaller declines. Part of the drops were due to the typical nature of lighter January issuance but also issuer anticipation of potential federal aid to combat the pandemic.

January 29 -

The Foothill-Eastern toll road authority in California made a tender offer ahead of a planned sale, and exchanged the bulk of the debt it wanted to refund.

January 28 -

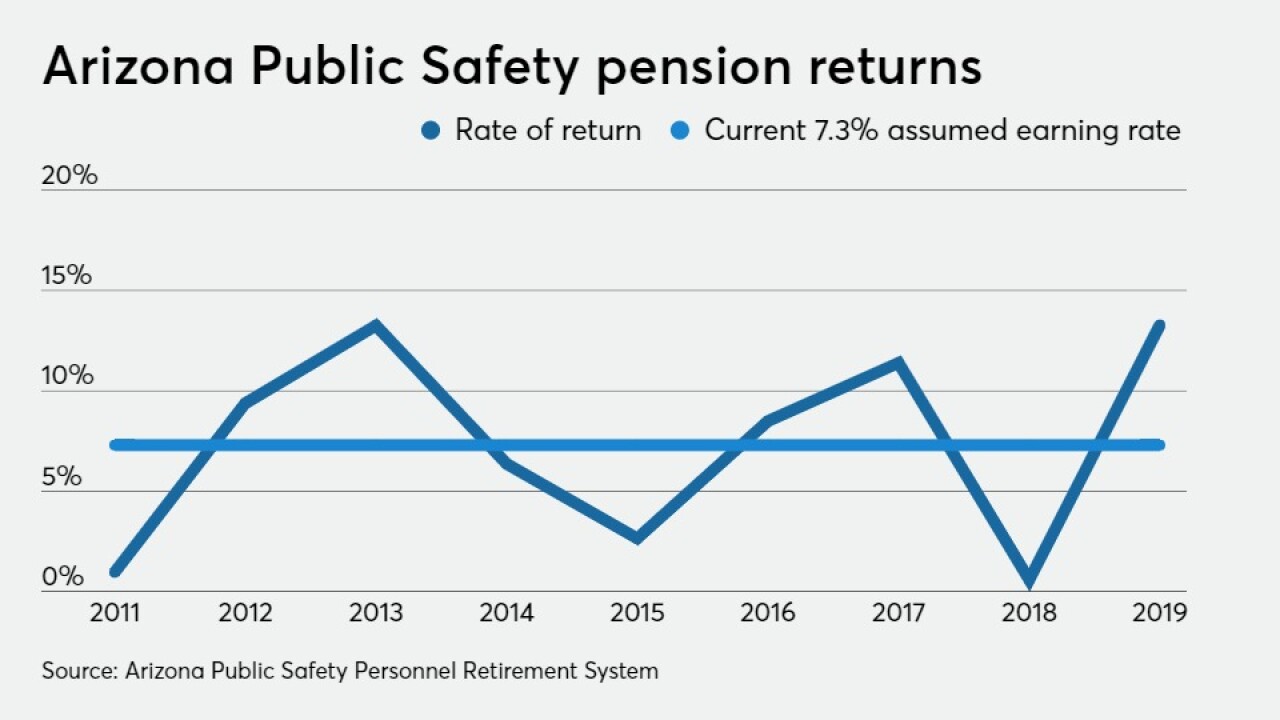

With interest rates at historic lows and stock market returns at record highs, Tucson sees a ripe opportunity to issue pension debt.

January 25 -

This would be the Government Finance Officers Association's first best practice document on ESG.

January 20 -

Tax-exempt performance is dependent on what supply looks like versus taxables. The 30-day visible supply shows more than 30% taxables on tap, though some analysts say the taxable increase makes exempts more attractive.

January 19 -

Powell, speaking on a livestreamed event, said interest rates will be raised "no time soon" and there will be plenty of notice "well in advance of active consideration."

January 14 -

Municipals were little changed Monday as participants await the larger new-issue calendar while equities and U.S. Treasuries react to news out of Washington and COVID-19 ravages the globe.

January 11 -

As issuance rose in 2020, so did municipal bond insurance usage, with $34.167 billion wrapped, or 7.5% insured total issuance from almost 5.7% in 2019.

January 11 -

After one of the worst sell-offs in municipal market history as COVID-19 began its rampage in March, the market rebounded to set the all-time record.

December 31 -

A record year of overall issuance, led by a boom in taxables, tells the story of a growing muni market with a broader, more diverse investor base.

December 24 -

Paltry supply will force the secondary to handle the rest of 2020; New York City taxable general obligation bonds trade up by nearly 20 basis points on intermediate bonds.

December 18 -

The entire municipal exempt yield curve is seeing consolidation with a 125 basis point spread between one and 30 years, and sub-1% yields are holding firm inside of 15 years.

December 17 -

This was the inaugural issuance under the “No Place Like Home” program, the first large municipal bond program created to invest in homeless housing infrastructure and secured directly by taxes on high-income residents.

December 16 -

ICI reported another $2.3 billion of inflows, new deals continue the march to lower yields and benchmarks rose a basis point seven years and out for the first time since the beginning of December.

December 16 -

Even with COVID-19-related shutdowns — a New York City lockdown may be imminent — issuers are pricing bonds into an extremely low-rate environment.

December 14 -

The LBJ Infrastructure Group, operator of managed lanes on a Dallas highway, will sell $1.2 billion of bonds through a conduit issuer.

December 14 -

Munis firmed Friday, only the second time in December they weren't flat, and more than a few participants are waiting on yields to rise before getting involved, particularly given the rich muni/treasury ratios and low absolute yields.

December 11 -

Bid list volume is trending higher into the end of the year, but its share as measured against overall high demand does not pose much of a threat, analysts say. Refinitiv Lipper reports $992 million of inflows.

December 10 -

COVID-19 brought the primary to a standstill in March and April. The municipal market is now set to eclipse $450 billion of issuance in 2020, a record.

December 10 -

Munis are likely to lag Treasuries in some fashion once year-end empathy settles in mid-month and ratios become a factor.

December 1