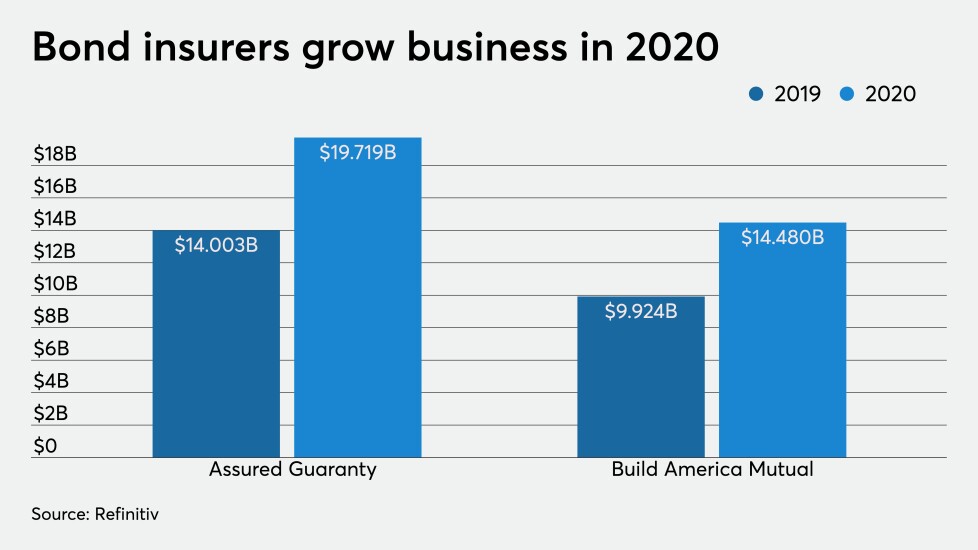

Bond insurers grew their business in 2020 to $34.167 billion from $23.927 billion in 2019 as more investors demand and issuers purchase insurance for their deals in very uncertain times.

Assured Guaranty and its subsidiary Municipal Assurance Corp. wrapped $19.719 billion with 57.7% of market share while Build America Mutual insured $14.448 billion with 42.3% market share, both large increases from 2019.

As issuance ballooned to $474 billion in 2020, the insurance industry wrapped 7.5%, up from almost 5.7% in 2019.

“Our product shines brighter when investors are reminded that municipal issuers can have credit issues. Assured Guaranty saw a 41% increase year-over-year in insured primary-market par for a total of $20 billion, representing 58% of the total insured volume, across nearly 1,000 transactions," said Robert Tucker, senior managing director at Assured. “Additionally, and especially during uncertain markets, our insurance can provide an avenue for government entities to save financing costs and sometimes to place securities with buyers that would not have purchased their uninsured paper.”

Sean McCarthy, CEO of Build America Mutual noted there was greater utilization of insurance on larger and higher-rated transactions.

"That comes into play because we have such a robust surveillance effort, and because we enhance transparency by publishing a BAM Credit Profile for free on our website for every transaction and update it every year," McCarthy said. "That’s particularly important for taxable buyers — whether international or domestic — because they have less experience analyzing munis, so having the extra layer of BAM’s guaranty and the transparency is particularly valuable to them."