Tucson, Arizona, plans to leverage low interest rates in a bull market to turn about half of its unfunded public safety pension fund obligations into bond obligations.

City officials claim they can save $800 million over 25 years by issuing $659.8 million of taxable certificates of participation.

Pension bond boosters see strong timing signals for this type of deal as investment returns reduce unfunded obligations, assuming the investments purchased with the bond proceeds perform.

“The market has remained favorable with current true interest cost remaining at about 2.8%,” Tucson Chief financial officer Joyce Garland told the city council at its Jan. 5 meeting. “The city is anticipated to achieve at least a 75% funded level, the highest funded level in Arizona. This level of funding has positive credit implications.”

FHN Financial Capital Markets is book runner on the deal, led by head of public finance Ajay Thomas, with Stifel as co-senior manager and five co-managers. The deal is tentatively expected to price Feb. 3.

Piper Sandler & Co. is financial advisor with Ballard Spahr as bond counsel.

Serial maturities are expected to run from 2022 through 2035. The certificates received underlying ratings of A1 by Moody’s Investors Service, AA-minus by S&P Global Ratings and A-plus by Fitch Ratings. Outlooks are stable.

"While the current issuance has weakened the city's debt metrics due to the large addition to its net direct debt, we believe that the additional flexibility provided by the trust somewhat offsets our view of the otherwise high debt burden and contributes to what we consider a credible plan to manage its large pension liability," said S&P Global Ratings credit analyst Alyssa Farrell.

The bonds may also carry insurance from Assured Guaranty Mutual, with ratings of AA by S&P, AA-plus by Kroll Bond Rating Agency, and A2 by Moody's.

As instruments of market arbitrage, public pension bonds are taxable under federal law.

With an estimated population of 545,000, Tucson in southern Arizona is the seat of Pima County and home to the University of Arizona. Major employers include Raytheon Missile Systems, Davis-Monthan Air Force Base and a number of national corporations.

Tucson's economy was firmly growing before the pandemic outbreak and Gov. Doug Ducey’s declaration of an emergency in March.

“Fitch anticipates additional near-term tax base growth once normal business activity resumes, based on current reported construction activity, planned development, and appreciation of existing properties,” analyst Jose Hernandez said.

Tucson was expecting a 25% drop in revenues, but through January 2020 the trend has been positive, analysts said.

Local sales tax receipts for the fiscal year are projected to total nearly $226 million, about 1% below the original budgeted amount.

State shared sales tax revenues are expected to total $57.1 million, or roughly 3% higher than the $55.5 million originally budgeted.

“Management currently projects fiscal 2020 general fund results to include a net surplus and addition to reserves of more than $59.2 million (nearly 12.4% of projected spending), as a result of the better than anticipated revenue performance, spending reductions, and use of various coronavirus-related federal financial assistance,” Hernandez wrote. “The city projects the general fund ending balance to approximate $184.8 million of which $55 million is committed to budget stabilization and $50.4 million unassigned.”

The city received a $44 million Federal Transportation Administration grant for public transportation system assistance and $95.6 million in federal Coronavirus Relief Fund monies. About $24 million in federal Coronavirus Relief Fund were allowed to go to salaries and community support.

Nearly $25 million in remaining CRF funds will be included in the fiscal 2020 general fund ending balance and applied to the fiscal 2021 budget in anticipation of additional pandemic-related spending.

Tucson funds the retirement benefits for government employees using contributions from the city and individual employees. Police and fire employees are in the Arizona Public Safety Personnel Retirement System.

In 2021, the city will put $77 million of general fund dollars into the pension fund. Without this issue of certificates, the city’s required contribution was expected to grow to $240 million by 2046.

Before this issue, Tuscon's piece of PSPRS was underfunded by about $1.5 billion.

The state pension fund generated $182 million last fiscal year, a 0.91% net-of-fee investment return.

Trust assets were valued at more than $10.9 billion by the fiscal year end of June 30, 2020. Overall performance hit a wall with the outbreak of the virus and emergency measures in March.

“Last fiscal year proved extremely difficult for nearly all investors but we can accept that the PSPRS portfolio provided the stability, resilience and positive returns that it was designed to deliver,” said Harry Papp, chairman of the PSPRS Investment Committee. “We’ve seen a substantial recovery in public and private markets since late-June and we’ll continue to focus on the long-term health and performance of the fund.”

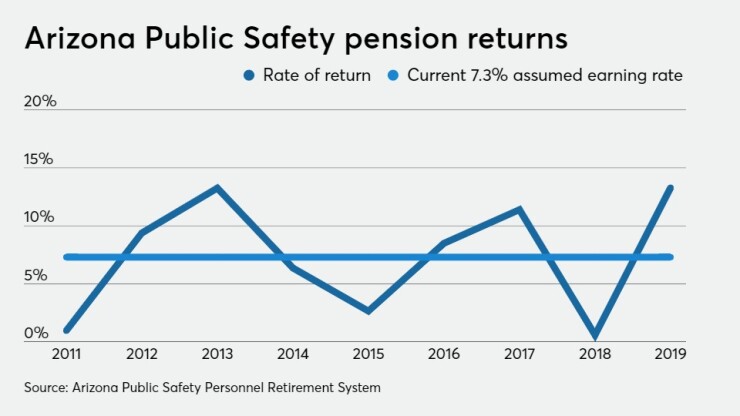

The 2020 fiscal year returns and returns over longer time frames fell below the 7.3% long-term assumed earnings rate set by the PSPRS Board of Trustees.

“Our plan is to continue to be opportunistic, taking advantage of diverse investment opportunities and pushing long-term returns upwards,” said PSPRS Chief Investment Officer Mark Steed. “The investment team, our board, and our consultants recognize that this was an extreme year for volatility. Fortunately, the PSPRS portfolio has been crafted to diminish risk, which helped the fund perform fairly well under the circumstances.”

Girard Miller, a retired investment and public finance professional and writer for Governing magazine, said that current economic conditions favor the issuance of pension obligation bonds.

“If done properly and timely, the net cost to taxpayers for funding the public pension plan will be dramatically lower,” Miller wrote in a recent article.

According to the National Institute for Retirement Security, the term of a pension bond plays a significant role in the likelihood that returns will exceed borrowing costs.

“When looking at equity returns over different periods of time, longer periods correspond with less volatility,” a December report from NIRS noted. “For instance, stock market returns during a five or 10-year period have significant volatility. However, that volatility decreases significantly when looking at 20 or 30-year periods.”

The standard deviation for single year returns since 1900 is 19.5%, according to the report. Over five-year periods, the standard deviation falls to 8.1%. The volatility of 30-year returns is only 2.3%.

The actuarial firm Milliman Inc. reported an exceptionally strong fourth quarter for its

The funded ratio is the highest in the history of Milliman's Public Pension Funding Study and marks a big swing from Q1 2020, at the onset of the COVID-19 pandemic, when the funded ratio hit a low of 66%.

That also means Tucson’s pension fund is taking the risk of buying high into an frothy equities market — the S&P 500 was up 19% over six months as of Monday morning and the Nasdaq is up 30%.

"The first and fourth quarters of 2020 illustrate just how closely public pension funding is tied to the vagaries of the market," said Becky Sielman, author of Milliman's Public Pension Funding Study. "Given the swings we saw this past year, the start of 2021 is a good time for plan sponsors to revisit their plans' investment portfolios to make sure the investment strategy matches their current risk appetite.”

There's an element of risk — pension fund investments don't always go up in value, but the bond obligation remains either way.

That's why Government Finance Officers Association

"Failing to achieve the targeted rate of return burdens the issuer with both the debt service requirements of the taxable bonds and the unfunded pension liabilities that remain unmet," the GFOA writes in its advisory.

In any case, the low interest rate environment has

Plans in the Milliman index saw an estimated investment return of 8.36% in Q4 2020, resulting in a $388 billion gain in the market value of assets. That was offset by about $25 billion flowing out of the plans, as benefits paid out exceeded contributions coming in from employers and plan members.

Twenty-nine plans now stand above the 90% funded mark, compared with 12 plans at the end of Q2 2020, according to Milliman. At the lower end of the spectrum, four plans moved above 60% funded, bringing the total number of plans under that mark to 22.

Net asset performance for pension funds was well above the expected 6.5% annual investment gain, Milliman reported. During 2020, pension assets posted an annual return of 11.72% following the strong 2019 investment gain of 15.66%.