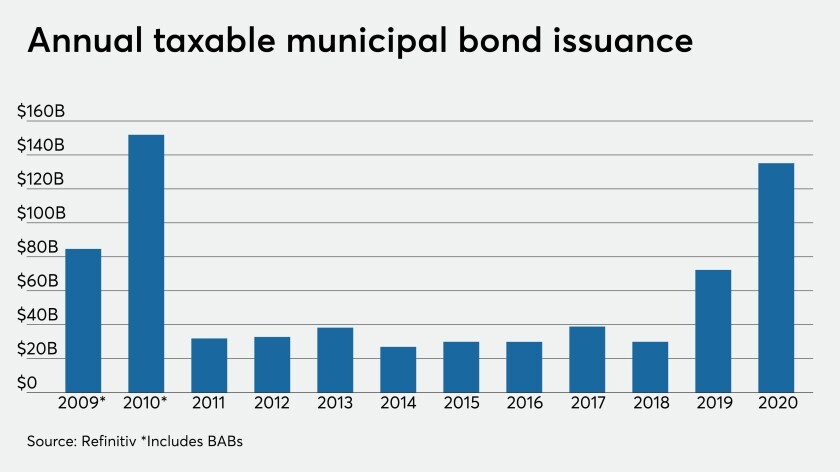

A record year of overall issuance, led by a boom in taxables, tells the story of a growing muni market with a broader, more diverse investor base.

The new-issue calendar falls to an estimated $1.154 billion, with $939.1 million negotiated deals on tap and $214.8 million of competitives.

Chicago went to market Wednesday with $454.37 million of STSC refunding bonds, amid heated budget talks. Goldman took down $75 million of the bonds.

"What we plan to tell the SEC is that municipal securities in general shouldn't be subject to Reg. AB," BDA's Michael Decker said.

Meridiam, ACS Infrastructure Development, Sacyr Infrastructure USA LLC and Plenary Americas are among the firms that have signaled interest in the project.

The $6.3 billion all-funds budget was amended in the wake of the Nov. 4 defeat of a property tax rate increase that would have raised $109.5 million in revenue.

The deal would give the company time to seek additional equity, debt and federal funds.