-

Trade volume increased by just 4% compared to 2019 following a volatile year for munis.

March 3 -

From the use of taxables to forward deliveries, refunding deals drove an overall 15.8% hike in Midwest bond volume that exceeded the national average.

March 2 -

The prominent private university will add $600 million to corporate CUSIP deal numbers that recorded a more than 200% increase last year.

March 1 -

While issuance fell significantly from 2020, it was higher than January's and only the fifth time in 35 years that volume exceeded $30 billion in February.

February 26 -

Taxable deals and refinancings fueled the 2020 volume spike as issuers adjusted to the coronavirus. The pandemic still looms over 2021.

February 26 -

The deal was the largest in the authority’s history, with the lowest ever interest rate for one of its sales and netting a record-breaking $112 million in interest cost savings.

February 24 -

HJ Sims has used Cinderella bonds, tender offers and forward deliveries to help senior living clients refinance without tax-exempt advance refundings.

February 10 -

The taxable refunding will lower debt service obligations for the airport car rental facility, hit hard by the coronavirus pandemic, through fiscal 2025.

February 8 -

Taking advantage of low rates, the state's School Bond Authority is selling the largest bond issue in its history to refund outstanding debt.

February 8 -

The $136 million refunding is also backed by the state's appropriation pledge; a political dispute over how to handle unclaimed property was resolved last year.

February 3 -

Issuance dropped 26.7% in January, tax-exempt issuance fell 32.6% while refundings and taxables saw smaller declines. Part of the drops were due to the typical nature of lighter January issuance but also issuer anticipation of potential federal aid to combat the pandemic.

January 29 -

The Foothill-Eastern toll road authority in California made a tender offer ahead of a planned sale, and exchanged the bulk of the debt it wanted to refund.

January 28 -

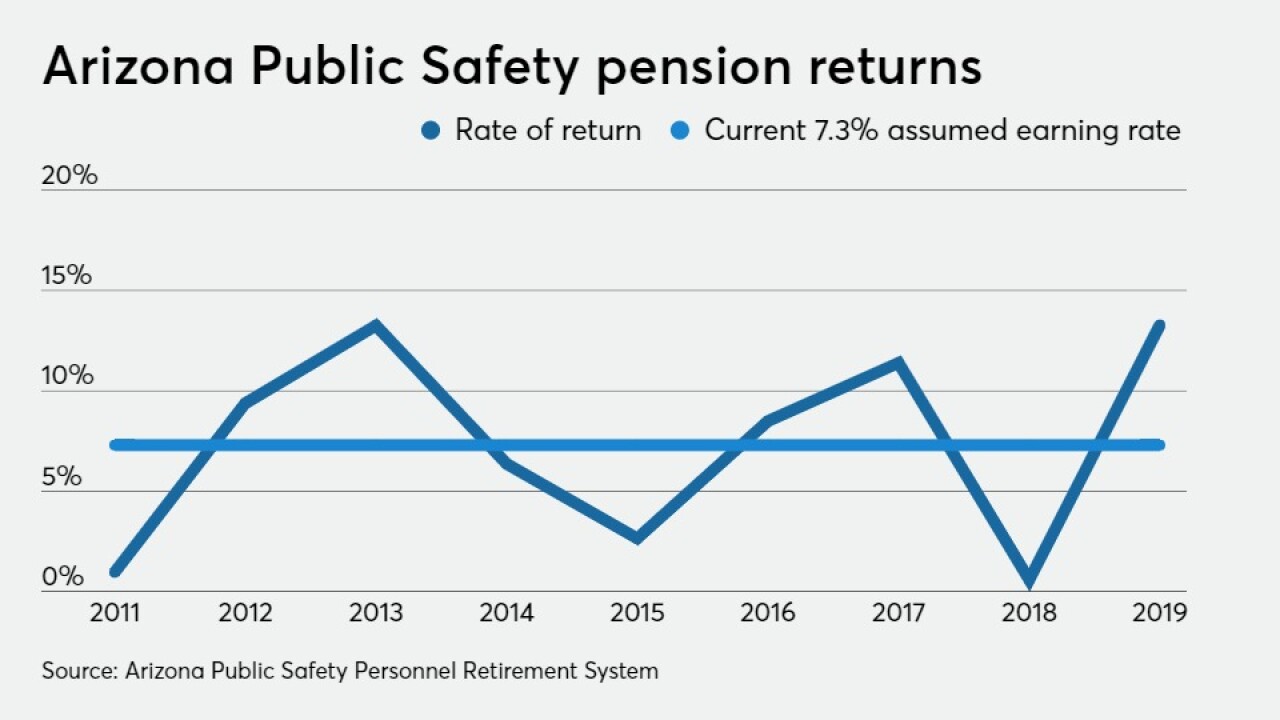

With interest rates at historic lows and stock market returns at record highs, Tucson sees a ripe opportunity to issue pension debt.

January 25 -

This would be the Government Finance Officers Association's first best practice document on ESG.

January 20 -

Tax-exempt performance is dependent on what supply looks like versus taxables. The 30-day visible supply shows more than 30% taxables on tap, though some analysts say the taxable increase makes exempts more attractive.

January 19 -

Powell, speaking on a livestreamed event, said interest rates will be raised "no time soon" and there will be plenty of notice "well in advance of active consideration."

January 14 -

Municipals were little changed Monday as participants await the larger new-issue calendar while equities and U.S. Treasuries react to news out of Washington and COVID-19 ravages the globe.

January 11 -

As issuance rose in 2020, so did municipal bond insurance usage, with $34.167 billion wrapped, or 7.5% insured total issuance from almost 5.7% in 2019.

January 11 -

After one of the worst sell-offs in municipal market history as COVID-19 began its rampage in March, the market rebounded to set the all-time record.

December 31 -

A record year of overall issuance, led by a boom in taxables, tells the story of a growing muni market with a broader, more diverse investor base.

December 24