The Tennessee State School Bond Authority is taking advantage of low rates to come to market with its largest-ever bond sale.

The authority will issue $716 million of taxables this week to provide debt service savings while also funding a higher education science project.

Jefferies is pricing the Series 2021A taxable educational facilities second program bonds on Monday and Tuesday. The issue is tentatively structured as serials running from 2021 to 2035 with terms in 2040 and 2045.

“This deal is the largest debt issue that we have ever done in the history of the School Bond Authority,” said Sandra Thompson, director of the Division of State Government Finance.

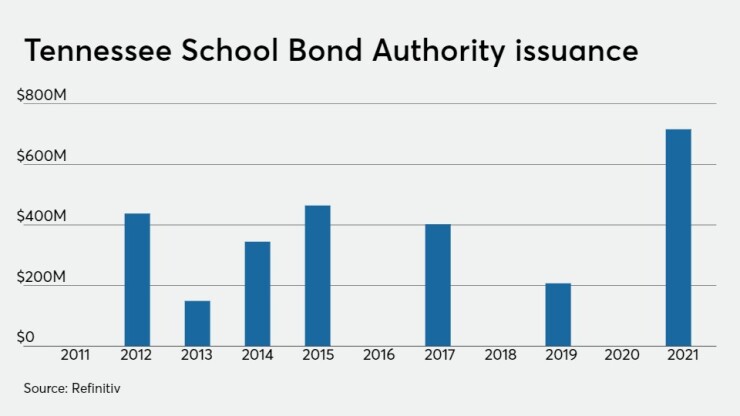

Since 2011, the SBA has sold only about $2 billion of debt with the most issuance occurring in 2015 when it sold $464 million. It was not in the market in 2016, 2018 or 2020.

Proceeds of the issue will go mostly to refund previously issued debt.

With interest rates so low now, it made sense to go with a taxable issue and refund as much debt as possible, Thompson said.

While a precise figure will be determined after the sale, she estimates there will be between $85 million and $90 million in aggregate net present value savings, approximately 16% of the refunded par amount.

Some of the proceeds will fund a bioworks project for the University of Tennessee Health Science Center in Memphis.

The deal is rated Aa1 by Moody’s Investors Service and AA-plus by both S&P Global Ratings and Fitch Ratings.

Co-managers include FHN Financial Capital Markets, Morgan Stanley, Piper Sandler, Raymond James and Wells Fargo Securities.

PFM Financial Advisors is the financial advisor; Hawkins Delafield & Wood is the bond counsel.