-

A tighter cap on local property tax rates for some cities and counties will factor negatively into future bond ratings, analysts warn.

June 13 -

Municipal issuers are benefiting from lower interest rates and investor demand that seem at least partly driven by the nearly constant talk of tariffs and trade wars.

June 13 -

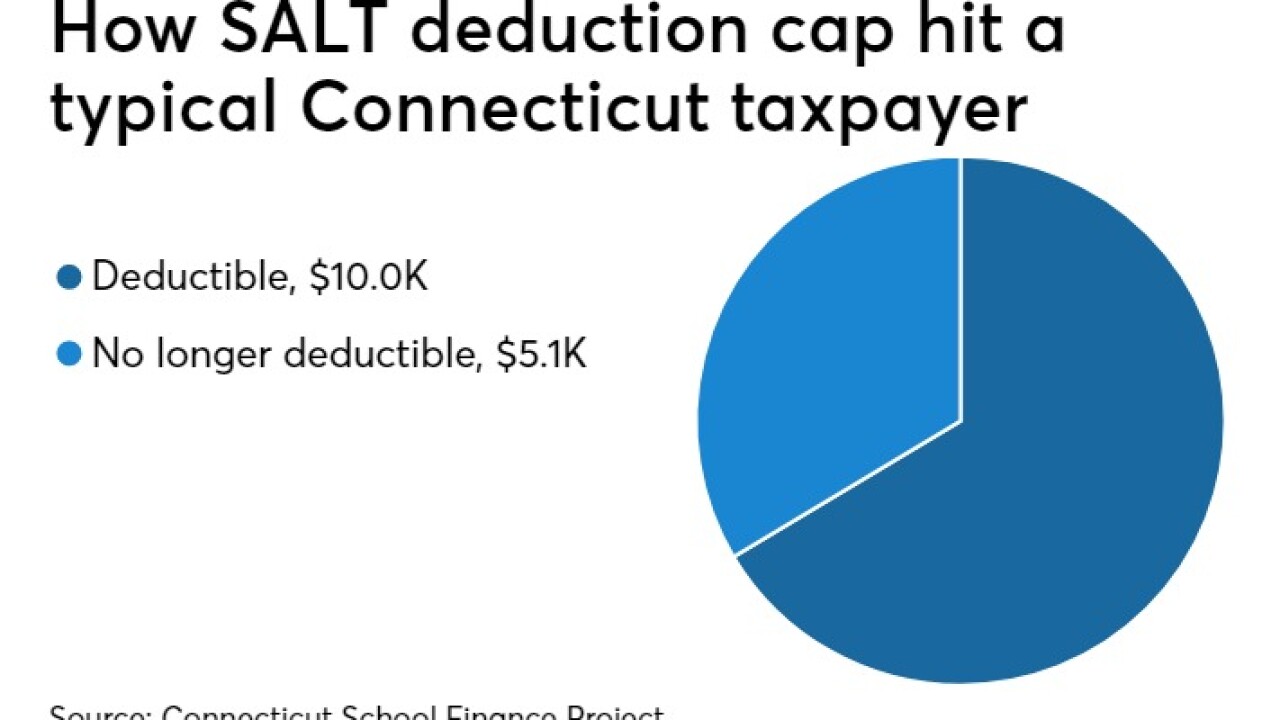

The limit on the SALT deduction caused an estimated 10.88 million individual taxpayers to lose $323.1 billion in tax deductions for the 2018 tax year, the Treasury Inspector General for Tax Administration reported in February.

June 12 -

Texas surpassed $3 billion in sales tax revenue, the highest total for any month on record.

June 4 -

Bills to limit the revenue flexibility of local governments and put more state funding toward schools were driven by a desire to limit property taxes.

June 3 -

The General Assembly is sending a Constitutional amendment to voters for the measure that would raise $3 billion annually.

June 3 -

Gov. Ned Lamont and Connecticut lawmakers are studying a proposal to essentially exchange much of the state’s income tax for a payroll tax.

May 30 -

Illinois lawmakers gave first-year Gov. J.B. Pritzker a victory on a cornerstone of his fiscal plan for the troubled state.

May 28 -

Infrastructure ranked No. 2 behind only the related issue of economic development as a top priority for mayors during 153 State of the City addresses delivered this year the National League of Cities reported.

May 23 -

The measure, backed by Gov. J.B. Pritzker, cleared the House Revenue and Finance Committee on a party-line vote.

May 21 -

The 10 most populous U.S. states that levy income taxes all saw April revenue spikes, in many cases after missing projections in the previous months.

May 21 -

Long-term leases with container shipping tenants protect ports in the short to medium term should trade decline.

May 16 -

Stephen Benjamin, mayor of Columbia, South Carolina, said P3s already work in metropolitan areas and dialogue needs to be opened with smaller cities looking at P3s.

May 15 -

Nebraska's largest school district has more than $770 million of unfunded pension liabilities after some pension fund investments turned sour.

May 14 -

Dallas-Fort Worth International Airport expects to save money with the refunding deal as it advances plans for a new terminal and refurbished runways.

May 14 -

The gains are putting to rest speculation that tax reform would hurt high-tax, Democratic-leaning states.

May 14 The Volcker Alliance

The Volcker Alliance -

Lawmakers have to wait another week for the governor's five-year infrastructure plan.

May 9 -

Gov. J.B. Pritzker's about-face on re-amortizing to reduce next year's pension contribution is one less negative rating factor, agency analysts said.

May 9 -

The Treasury and Internal Revenue Service sent the final regulation to the White House Office of Management and Budget over six weeks ago.

May 7 -

The New Jersey governor is using an unexpected tax collection surge to boost his push to hike income tax rates for the highest earners.

May 7