April’s surge of state personal income tax receipts is unlikely to be replicated as tax payment patterns settle down in the wake of 2017 changes to federal tax law.

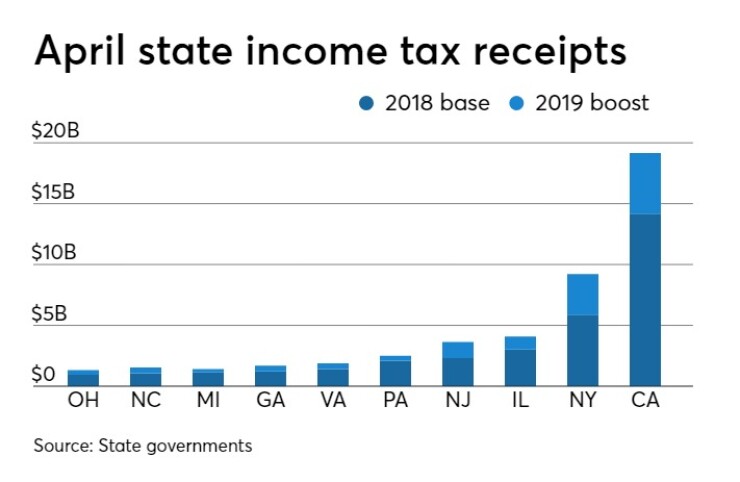

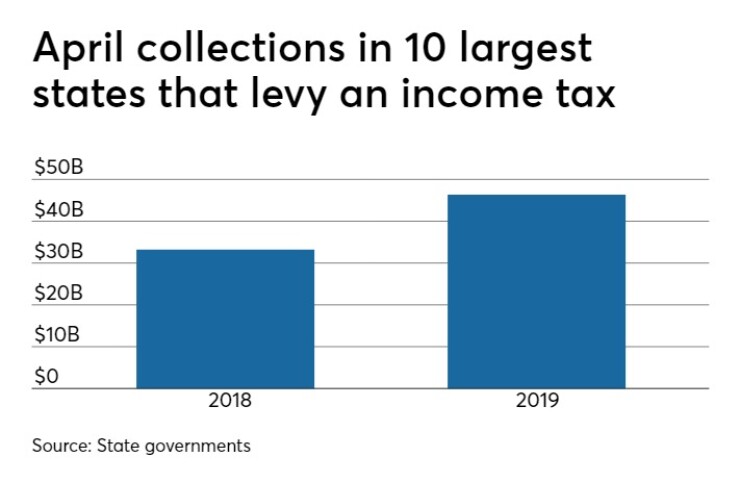

The 10 most populous U.S. states that levy income taxes all saw April revenue spikes, in many cases after missing projections in the previous months.

“It was a really tough year for estimating revenue,” said William Glasgall, senior vice president of the Volcker Alliance.

April income tax collections in those 10 states was up almost 40% year-over-year, to $46.3 billion from $33.2 billion.

“I would be surprised if next April we have the same surprise,” said Lucy Dadayan, senior research associate at the Urban Institute. “We should not expect the same strength next year.”

That $13.1 billion spike is attributed to the continuing shakeout from the 2017 federal tax legislation, which gave taxpayers reasons to change payment patterns, both on a one-time basis and over the long run.

Dadayan said many states revised their personal income tax revenue forecasts downward after steep December declines caused by lack of incentives for taxpayers to prepay 2018 taxes and large fluctuations in the stock market that month. She cautioned that this year’s strong April numbers may not be repeated next year since taxpayers will have had more time to understand the new laws and determine when it is best for them to file.

Ohio personal income tax receipts were up more than 39% year-over-year, and data “strongly implies that taxpayers did indeed shift some of their tax payments from quarterly estimated returns and toward annual returns,” according to the state’s

Fiscal-year-to-date figures indicate 6.4% growth in overall PIT collections in a median state, and most will close the 2019 fiscal year with no budget gaps, according to the Urban Institute’s State Tax and Economic Review data.

The April surge at least temporarily eased concerns about how the new $10,000 limit on federal tax deductions for state and local taxes will impact states with high marginal income tax rates and property taxes.

The largest income tax revenue surge came in the largest state, one definitely impacted by the SALT deduction limits.

California collected $19.17 billion in April income taxes compared to $15 billion that was estimated in state budget documents and $14.17 billion received in April 2018. The Golden State’s income tax revenue for the first 10 months of the 2019 fiscal year is now close to its $80.66 billion projection at $80.57 billion and up from $76.09 billion recorded in the same period a year earlier.

S&P Global Ratings credit analyst David Hitchcock said in addition to a shift toward later tax payments due to the SALT cap, California also got an

Glasgall said it is too early to determine if positive income tax revenues for the higher-taxed states mean that they won’t be as negatively affected by the SALT cap as initially feared, because some of the numbers may have been “distorted” by high variances of withholding in 2017 and 2018.

He said whether the economy can remain strong in 2020 is a big wild card for next year’s revenues and underscores the need for states to build up rainy day funds this year.

“Given the unknowns with the economy and federal funding it puts a premium on states saving money,” Glasgall said. “It’s going to be a difficult year to plan for, which is why it’s a good idea for states to do budget stress testing.”

Hitchcock said that while each state has its own specific circumstances for personal income tax gains, the positive 2019 numbers indicate that SALT caps don’t appear to be the short-term “broad systemic” risk to a state’s credit quality that was initially feared. He said the first full year of the federal tax overhaul underscored the challenging balancing act facing analysts when judging early tax revenue numbers.

“Any time there is uncertainty it raises risks,” Hitchcock said. “States were saying all along it was a timing issue and that is what ended up being the case.”

The April revenue surprise was a particular boost for cash-strapped states like Illinois, which has grappled with a deep pension burden and structurally unbalanced budgets. Illinois personal income tax receipts rose 35% last month compared with April 2018 to $4.08 billion. The Prairie State’s income tax collections are now 9% ahead of last year’s pace through 10 months at $19.3 billion.

The preliminary analysis of Illinois officials pointed to non-wage taxes like capital gains and dividends playing a large part in the revenue surge.

“As a result, this significant one month overperformance cannot safely be extrapolated into future underlying growth,” according to the

New Jersey, which like Illinois has also been dogged by rising pension liabilities, achieved

New York saw a 57% rise in PIT receipts for April 2019 at $9.21 billion after the state closed its 2019 fiscal year on March 31 $2.3 billion below earlier projections.

“New York was in a tougher situation than other states because of having an April 1 budget deadline so they had to close the year with a deficit,” Dadayan said. “Other states are in better shape because of their fiscal years starting on July 1 or later.”

Yvette Shields, Nora Colomer, Keeley Webster, Richard Williamson and Shelly Sigo contributed to this story.