-

The new-issue calendar builds from almost nothing to $2.4 billion in the first week of the New Year, with deals ranging from education to taxables to social bonds on tap for investors.

December 31 -

Dominick D'Eramo, head of fixed income at Wilmington Trust Investment Advisors, talks with Chip Barnett about how the municipal bond market did in 2020 and what may be on tap for munis in the new year. (12 minutes)

December 31 -

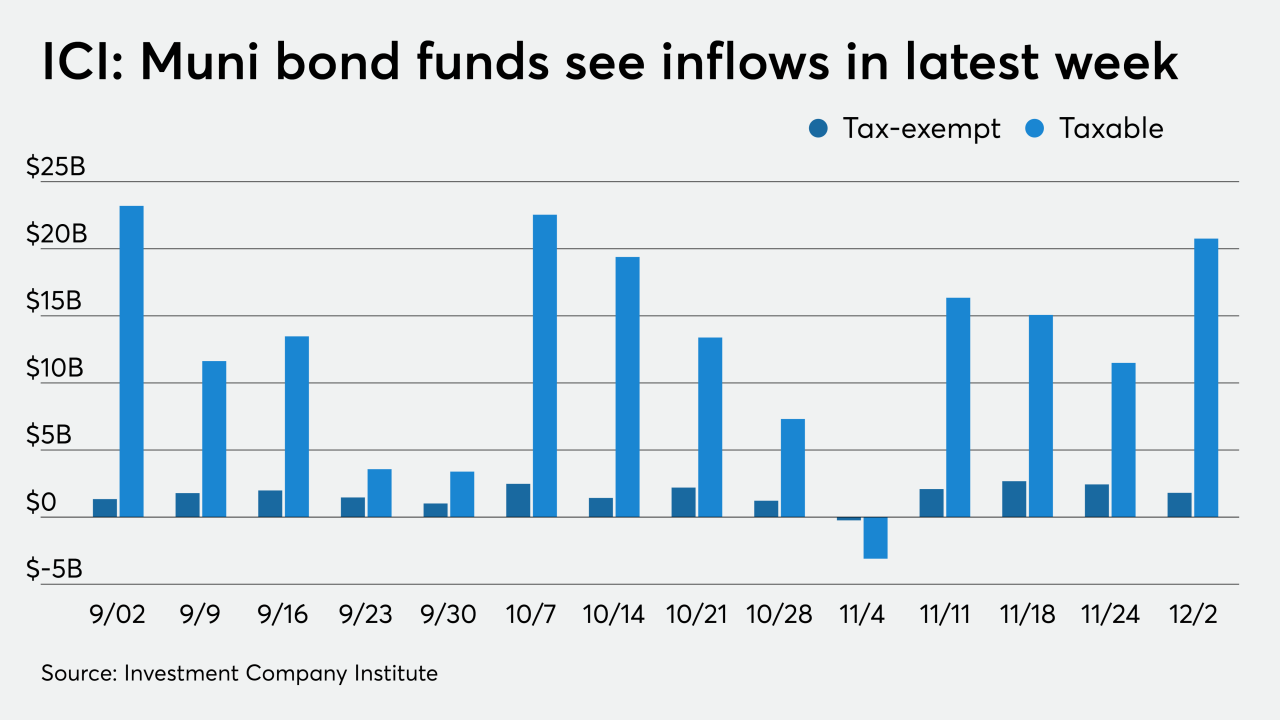

Municipal bond funds saw $2.086 billion of inflows in the week ended Dec. 22, the Investment Company Institute reported Wednesday after a $2.517 billion inflow the week prior.

December 30 -

While there are no major sales on the calendar for this week, some larger deals from and Texas, California, New Jersey and Colorado issuers are on tap for the first few weeks of 2021.

December 29 -

Refinitiv Lipper reported tax-exempt mutual funds saw $1.288 billion of inflows in the week ended Dec. 23, the seventh week in a row investors put cash into the funds.

December 28 -

IHS Ipreo estimates the week's bond volume at $7.3 million in a calendar composed only of small negotiated deals.

December 24 -

The muni market headed into holiday hibernation on the last full trading day of the week.

December 23 -

Taxable munis have posted the highest returns among all fixed-income indexes this year, BofA said.

December 22 -

Munis were flat Monday as the entire curve was said to be undergoing a consolidation.

December 21 -

Paltry supply will force the secondary to handle the rest of 2020; New York City taxable general obligation bonds trade up by nearly 20 basis points on intermediate bonds.

December 18 -

The entire municipal exempt yield curve is seeing consolidation with a 125 basis point spread between one and 30 years, and sub-1% yields are holding firm inside of 15 years.

December 17 -

ICI reported another $2.3 billion of inflows, new deals continue the march to lower yields and benchmarks rose a basis point seven years and out for the first time since the beginning of December.

December 16 -

The state of Illinois sold $2 billion of three-year notes to the Federal Reserve's Municipal Liquidity Facility at 3.42%.

December 15 -

Even with COVID-19-related shutdowns — a New York City lockdown may be imminent — issuers are pricing bonds into an extremely low-rate environment.

December 14 -

Munis firmed Friday, only the second time in December they weren't flat, and more than a few participants are waiting on yields to rise before getting involved, particularly given the rich muni/treasury ratios and low absolute yields.

December 11 -

Bid list volume is trending higher into the end of the year, but its share as measured against overall high demand does not pose much of a threat, analysts say. Refinitiv Lipper reports $992 million of inflows.

December 10 -

Muni benchmarks were steady while new deals re-priced to lower yields in a tale of two markets. ICI reported more inflows.

December 9 -

Strong technicals, low supply, yield-seekers keep munis outperforming.

December 8 -

The primary's diversity of credits and size relative to November has grown, but it is just not enough to push yields higher as redemptions flood the market. Some analysts still say a mild correction at least is due.

December 7 -

A heavier calendar still will not fulfill the $20 billion-plus of December redemptions. Muni/UST 10-year ratios fell to 74% as the UST 10-year came closer to 1.00%.

December 4