Municipal bonds were unchanged Thursday in quiet pre-holiday trading. The market closed early ahead of the full close on Friday for the Christmas holiday. Trading will resume on Monday.

Yields on top-rated munis were flat, remaining steady across the AAA scale. Treasury bonds were slightly stronger as equities traded slightly higher.

In the primary, there are no negotiated or competitive deals over $25 million slated for next week. IHS Ipreo estimates the week's volume at $7.3 million in a calendar composed only of negotiated bonds.

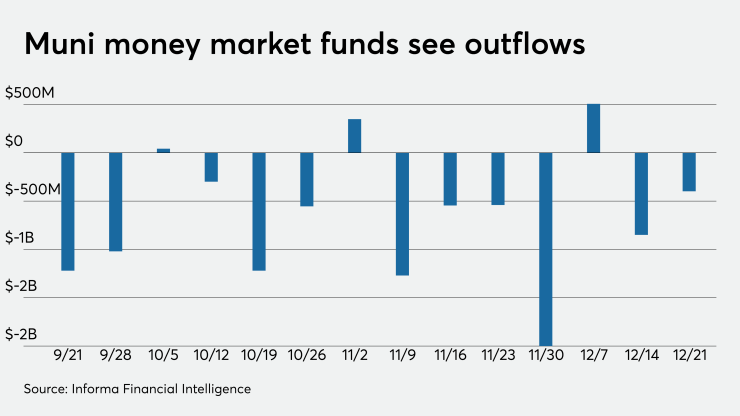

Informa: Money market muni funds fell $399M

Tax-exempt municipal money market fund assets fell $398.6 million, bringing total net assets to $106.99 billion in the week ended Dec. 21, according to the Money Fund Report, a publication of Informa Financial Intelligence.

In the week ended Dec. 14, tax-free fund assets decreased by $849.7 million to $107.39 billion.

The average seven-day simple yield for the 185 tax-free and municipal money-market funds remained at 0.01% from the previous week.

Taxable money-fund assets increased $6.71 billion in the week ended Dec. 22, bringing total net assets to $4.150 trillion.

The average, seven-day simple yield for the 779 taxable reporting funds remained at 0.02% from the prior week.

Overall, the combined total net assets of the 964 reporting money funds rose $6.31 billion in the week ended Dec. 22.

Lipton: Eyes wide open into 2021

As 2021 gets set to begin, the duration and performance of the U.S. economic recovery will be closely aligned with how successful the rollout of the newly approved vaccines against COVID-19 will be, said Jeff Lipton, managing director and head of municipal credit and market strategy for municipal capital markets at Oppenheimer & Co.

“In our view, advancing COVID-19 transmission rates coupled with state and local responses to impose new lockdown restrictions, will drive the political narrative as well as economic advancement,” he said. “Those sectors of the economy most susceptible to trailing performance given lockdown measures, such as leisure/hospitality and air travel, will find themselves struggling to protect their margins.”

He also noted the concern over news of a mutated and potentially more debilitating strain of the virus that has hit the U.K.

“This development could create headwinds to an already complex distribution schedule for newly developed vaccines, leading to revisions in our growth outlook and potentially more Central Bank intervention,” he said.

Lipton lauded the just-approved federal stimulus package, saying it would be helpful to the economy.

“We must also find comfort in the bipartisan $900 billion fiscal relief legislation that has eluded passage throughout the summer and fall months,” he said. “While we can debate the adequacy of the overall package, any plan is better than none at all, and perhaps there will be additional federal support within the early months of a Biden presidency without all of the political trappings and false starts that delayed passage of any type of deal.”

He said municipals continued to show strength and resiliency.

“We are constantly reminded that the municipal asset class displays unwavering economic and financial resiliency, particularly during recessionary periods,” Lipton said. “Having said this, the most conservative-centric portfolios should consider liquid (relatively) issuer names that offer scale and those that show stable to improving credit metrics (pre-COVID).”

Secondary market

High-grade municipals were flat on Thursday, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were steady at 0.13% in 2021 and 0.14% in 2022. Out longer, the yield on the 10-year muni was flat at 0.71% while the yield on the 30-year remained at 1.39%.

The 10-year muni-to-Treasury ratio was calculated at 75.9% while the 30-year muni-to-Treasury ratio stood at 83.2%, according to MMD.

The ICE AAA municipal yield curve showed short maturities flat at 0.12% in 2021 and 0.14% in 2022. The 10-year maturity was unchanged at 0.70% and the 30-year yield was steady at 1.41%.

The 10-year muni-to-Treasury ratio was calculated at 74% while the 30-year muni-to-Treasury ratio stood at 85%, according to ICE.

The IHS Markit municipal analytics AAA curve showed yields steady at 0.13% in 2021 and 0.14% in 2022. The 10-year was at 0.66% as the 30-year yield was at 1.36%.

Treasuries were stronger as stock prices traded up.

The three-month Treasury note was yielding 0.90%, the 10-year Treasury was yielding 0.94% and the 30-year Treasury was yielding 1.68%. The Dow rose 0.23%, the S&P 500 increased 0.35% and the Nasdaq gained 0.26%.