Municipal bonds firmed by one to two basis points on Friday, only the second time this month that triple-A benchmarks moved in any direction, as lower-than-usual December supply has kept municipal rates historically low.

Triple-A benchmarks have only moved three basis points in total since the beginning of the month.

Investors will see a $9 billion primary calendar in the last full trading week of the year, led by billion-dollar taxable deals out of New York City and Texas. Connecticut will price $800 million of general obligation bonds and triple-A-rated Illinois Finance Authority will price green bonds. AA+ rated New York Urban Development Corp. has $1.6 billion of exempt and taxable general purpose bonds in four deals on the competitive calendar.

Of an estimated $20 billion of scheduled redemptions over the next 30 days, about $12 billion is expected to price as new issues, which creates the typical January effect of low supply/high demand that came a month early in December.

More than a few participants are waiting on yields to rise before getting involved, particularly given the currently rich muni/treasury ratios and low absolute yields.

That said, Greg Saulnier, managing analyst at Refinitiv MMD noted several participants "also admit that they do not see a short-term rise in yields coming prior to year-end because the typical weeks of $10 billion to $12 billion-plus issuance that we are accustomed to seeing in the early weeks of December are just not materializing.

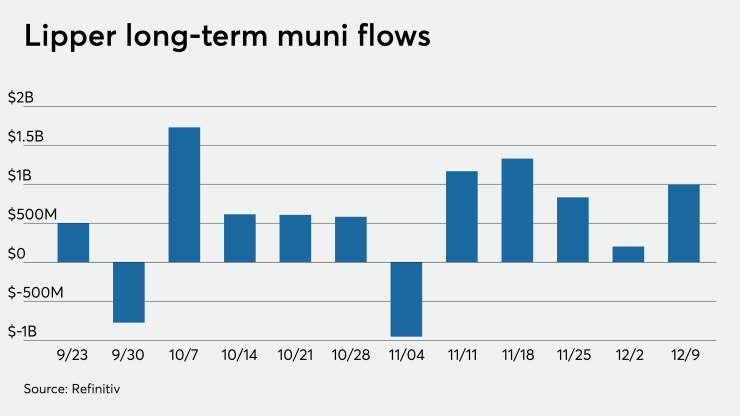

"Couple that with roughly $4.5 billion in muni fund inflows over the past five weeks and the ongoing stalemate over fiscal stimulus in Washington and you have the recipe for a very firm bid-side into the New Year," Saulnier said.

New York City,

High-grade paper is simply not available and most of the new issues this week were single-A, BBB and nonrated credits like the Puerto Rico Aqueduct and Sewer Authority and Florida's Brightline deal, which priced to yield 7.75% with a 7.375% coupon in 2049.

New York Metropolitan Transportation Authority

The Texas PAB Surface Transportation Corporation is set to price $1.18 billion of taxable LBJ Infrastructure Group LLC I-635 managed lane project senior lien revenue refunding bonds next week with a Baa3 rating from Moody's Investors Service. The 2020C senior lien bond proceeds will be used to voluntarily repay about $1.1 billion of subordinate lien TIFIA loans.

Year-end posturing

The municipal market’s posture on Friday was steady, and is expected to continue that way through year-end, as demand and inflows remain strong, according to Dan Heckman, senior fixed income strategist at U.S. Bank Wealth Management.

“Today has been a repeat of the last several weeks,” he said. “We see tremendous demand and the market is strong.”

Heckman said the reasons for the strength include the anticipated reopening of COVID-impacted businesses and services, which will help municipalities from a revenue standpoint, as well as the anticipation of higher tax rates in 2021.

“Outside of those states with more severe shutdown orders, most of the tax revenues are coming in higher than expected, and municipalities have been more aggressive about cutting expenses, unfortunately at the cost of people losing their jobs,” Heckman said.

At the same time, municipals have uncharacteristically outperforming Treasuries over the past 30 days as the short end remains rich and the long end is unchanged.

“On the long end rates have increased, but that has had zero impact on longer-term municipals,” Heckman explained. “Pricing levels on muni bonds in the secondary market are thin and are expensive from our view.”

“We have been focused on new issues, but this week we have elected to back off from the market because the levels are, we think, getting a little too far ahead of themselves,” Heckman added.

He predicted that muni outperformance will continue as long as the fear of higher taxes exists. “If that [fear] goes away, then munis could be susceptible to some profit-taking,” he said.

Despite the duration and interest rate risk on the long end, Heckman said he is comfortable buying new issues in the 10-year area and beyond since the 10-year Treasury note is still not yielding equivalent to the longer term municipal yield.

“Until that dynamic changes, we view longer end as most attractive,” he said.

“The short end is extremely, extremely expensive and we have been avoiding that for some time,” Heckman said.

Next week will be the last full week of market activity before the holiday season kicks in, according to Heckman, who said he expects the climate to remain steady. “If it could get stronger that would be surprising,” he said. “After next week there will be little to no new issue supply and investors will continue to scramble to invest cash,” he added.

“People are not only worn out over COVID, but cash balances earning nothing,” he continued. “So, there will be a mad scramble to get cash levels down.”

Looking forward, he said there could be some weakness going into the first quarter. “If the elections in Georgia went in the way of a split government, significantly higher tax rates move off the table for a little while, which makes the tax-exempt yield equivalency not as attractive,” Heckman said.

Primary market

New York City is set to price $1.5 billion of taxable general obligation bonds, serials in 2022-2036 and 2021-2028. Jefferies LLC is bookrunner on the deal.

The Texas PAB Surface Transportation Corporation is set to price $1.18 billion of taxable LBJ Infrastructure Group LLC I-635 managed lane project senior lien revenue refunding bonds next week with a Baa3 rating from Moody's Investors Service. The 2020C senior lien bond proceeds will be used to voluntarily repay about $1.1 billion of subordinate lien TIFIA loans. BofA Securities is lead manager.

The State of Connecticut (A1/A/A+/AA-) is set to price $800 million of general obligation bonds on Tuesday. The serials mature from 2022-2041, led by Jefferies.

Harris County, Texas, (Aa2//AA/) plans $437 million of toll road first lien revenue and refunding bonds led by Goldman, Sachs & Co. LLC.

The Illinois Finance Authority (NR/AAA/AAA/NR) plans to issue $435 million of Illinois Clean Water Initiative revolving fund revenue green bonds, 2021-2032, with terms in 2033, 2034, 2035, 2036, 2037, 2038, 2039, 2040, and 2041. Citigroup Global Markets will run the books.

The New York City Health and Hospitals Corp. (Aa3/A+/A+/NR) will price $330 million of health system revenue bonds. Morgan Stanley & Co. LLC is head underwriter.

The Dutchess County Local Development Corp. (/BB+//) is set to price $250 million of Bard College project revenue bonds in two series, 2038-2051 and 2022-2038. KeyBanc Capital Markets is bookrunner.

The Frisco Independent School District (Aaa/AAA//) will price $200 million of Collin and Denton County unlimited tax school building and refunding bonds, insured by the Permanent School Fund Guarantee program, serials 2021-2040; terms 2045,2051.

The Frisco Independent School District is also set to price $109 million of taxable refunding bonds Tuesday. RBC Capital Markets is bookrunner.

The City and County of Honolulu, Hawaii, (Aa2///AA/) plans to price $183 million of taxable wastewater system revenue refunding bonds on Tuesday. BofA Securities is lead underwriter.

The Maryland Economic Development Corporation (NR/NR/NR/NR) is set to price $133 million Port Covington Project special obligation bonds with terms in 2030, 2040 and 2050. Citigroup Global Markets Inc. in head underwriter.

The CSCDA Community Improvement Authority, California, (NR/NR/NR/NR) is set to price $116 million of essential housing revenue bonds, terms in 2054. RBC Capital Markets Inc. is head underwriter.

Secondary market

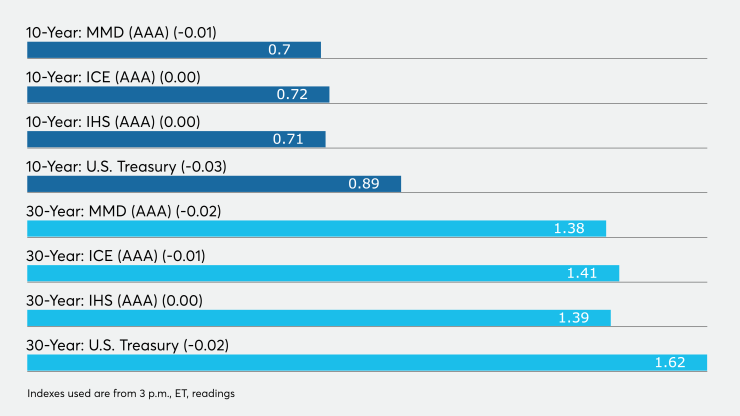

High-grade municipals firmed by one to two basis points, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were at 0.13% in 2021 and 0.14% in 2022. The yield on the 10-year at 0.70% while the yield on the 30-year was at 1.39%.

The 10-year muni-to-Treasury ratio was calculated at 78% while the 30-year muni-to-Treasury ratio stood at 85%, according to MMD.

The ICE AAA municipal yield curve showed short maturities at 0.13% in 2021 and 0.14% in 2022. The 10-year maturity was at 0.70% while the 30-year yield was a basis point lower at 1.41%.

The 10-year muni-to-Treasury ratio was calculated at 78% while the 30-year muni-to-Treasury ratio stood at 87%, according to ICE.

The IHS Markit municipal analytics AAA curve showed short yields at 0.11% and 0.12% in 2021 and 2022, respectively, and the 10-year steady at 0.69% as the 30-year yield was at 1.39%.

Treasuries improved as equities were weaker. The 10-year Treasury was yielding 0.89% and the 30-year Treasury was yielding 1.62%. The Dow rose 47 points, the S&P 500 fell 0.13%, while the Nasdaq fell 0.23%.

Bond Buyer indexes mostly unchanged

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, slipped two basis points to 3.48% from 3.50% in the previous week.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields was unchanged from 2.13% from the prior week.

The 11-bond GO Index of higher-grade 11-year GOs was flat from 1.66% the week before.

The Bond Buyer's Revenue Bond Index was steady from 2.58% last week.