Municipal bonds were little changed Tuesday as the market took stock of 2020 and looked ahead to what 2021 might have in store. Yields on top-rated munis were flat across AAA scales.

As the year comes to a close, the municipal bond market is essentially "cured from a functionality standpoint," according to John Mousseau, president and chief executive officer of Cumberland Advisors.

“Muni yields across the board are significantly lower than they were at the start of the year, and in the short end they are MUCH LOWER,” he wrote in a Tuesday market commentary. “Compared to the end of March, when the muni market had righted itself, overall yields are also much lower, particularly in the shorter end of the yield curve, reflecting the lowering of short-term interest rates by the Fed in March and the return of liquidity to the market in general and the short-term market in particular.”

He said municipal credit has been resilient throughout the coronavirus pandemic.

“Yes, there have been some downgrades, and there will be more. But the most salient feature of high-grade municipal bonds has shone through in 2020, and that is the fact that municipal issuers enjoy a monopoly on taxing power and the provision of essential services,”Mousseau said. “And as we have seen in this past year, the larger infrastructure-type issuers enjoy broad institutional support from both the investing public and Congress. And just as important, even issuers with structural problems, such as New Jersey and Illinois, still have broad municipal market access, albeit at higher yields than the market.”

But he noted that municipalities across the country still needed some help.

“To say all this is not to discount the fact that state and local governments will need some further help. As we write this, they were not included in the latest stimulus bill, which the president has finally signed,”Mousseau said. “But they will benefit in a secondary sense from the spending by individuals and by corporations able to take advantage of another round of PPP. We think that the new Congress in 2021 will add another bill that addresses direct aid to state and local governments. There is still plenty of distress out there.”

And it's good riddance to 2020, says Matt Fabian, partner at Municipal Market Analytics.

“Saying goodbye to 2020 is not terribly hard. It is difficult to put a positive spin on a year in which a global pandemic ravaged lives and livelihoods and stole from us normal social interaction,” he said in a Tuesday market note. “We decided to end the year reflecting on some developments that happened amid the chaos of the pandemic that could have a longer-term positive impact on the municipal market.”

Some of the things he noted:

- Issuers' willingness to provide voluntary disclosure on EMMA increased;

- Climate risks and disclosure of such are becoming more of a factor in credit assessments;

- The Federal government stepped in early and prevented a collapse of the economy;

- Doing something about the social issues undermining the health of the U.S., in particular racial and income inequality, gained support from the majority of the country;

- Public and private lending markets provided working capital when needed, again;

- Strong bondholder security packages proved their value;

- Credit challenges are not being created by the rating agencies;

- The benefits of, and appreciation for, bond insurance were increasingly recognized, again; and

- Safe sector defaults and bankruptcies remain extremely low.

And into year end, it's steady and quiet.

"The financial markets are seeing little need for price changes ahead of year-end, benchmark municipal bond yields floating through last week’s shortened schedule without adjustment, and U.S. Treasuries trending slightly positive along a flatter curve," Fabian said.

Primary market

There are no negotiated or competitive deals over $25 million slated in the primary this last week of the year.

However, volume will start building next week when the City and County of Denver School District No. 1, Colo.'s $450 million of general obligation bonds are priced by RBC Capital Markets; the New Jersey Economic Development Authority’s $350 million of Series 2021 QQQ school facilities construction social bonds will be priced by Loop Capital Markets; and the California Infrastructure and Economic Development Bank’s $271.5 million of Series 2021A, B and C refunding revenue bonds for the Los Angeles County Museum of Art project will be priced by Wells Fargo Securities.

But supply will really ramp up the second week of January when the Texas Private Activity Bond Corp. is set to come to market with $1.17 billion of taxable Series 2020C senior lien revenue refunding bonds for the LBJ Infrastructure Group’s I-635 Managed Lanes project.

Secondary market

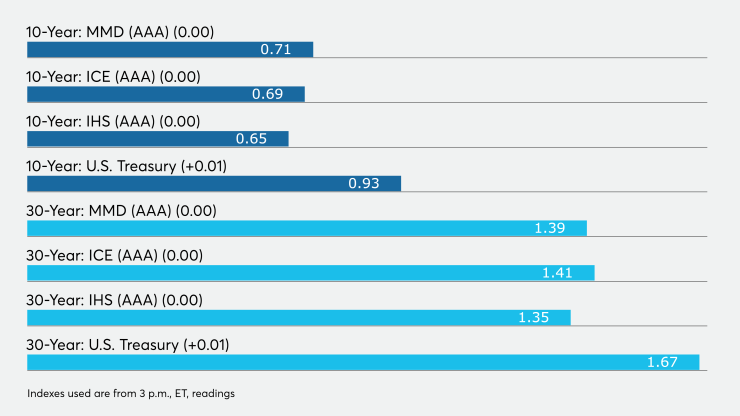

High-grade municipals were flat on Tuesday, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were steady at 0.13% in 2021 and 0.14% in 2022. Out longer, the yield on the 10-year muni was flat at 0.71% while the yield on the 30-year remained at 1.39%. The 10-year muni-to-Treasury ratio was calculated at 75.9% while the 30-year muni-to-Treasury ratio stood at 83.0%, according to MMD.

The ICE AAA municipal yield curve showed short maturities flat at 0.12% in 2021 and 0.14% in 2022. The 10-year maturity was unchanged at 0.70% and the 30-year yield was steady at 1.41%. The 10-year muni-to-Treasury ratio was calculated at 74% while the 30-year muni-to-Treasury ratio stood at 85%, according to ICE.

The IHS Markit municipal analytics AAA curve showed yields steady at 0.13% in 2021 and 0.14% in 2022. The 10-year was at 0.65% as the 30-year yield was at 1.35%.

Treasuries were stronger as stock prices traded down. The three-month Treasury note was yielding 0.09%, the 10-year Treasury was yielding 0.93% and the 30-year Treasury was yielding 1.67%. The Dow fell 0.25%, the S&P 500 decreased 0.20% and the Nasdaq declined0.40%.