-

More supply sold Thursday as the Chicago Transit Authority, the Austin ISD, Texas and Kern HSD, Calif., all came to market.

August 27 -

Ashton Goodfield, head of municipal bonds at DWS Group, talks with Chip Barnett about how the municipal bond market has been coping with the effects of the COVID-19 pandemic and what's in store for the rest of the year. (22 minutes)

August 27 -

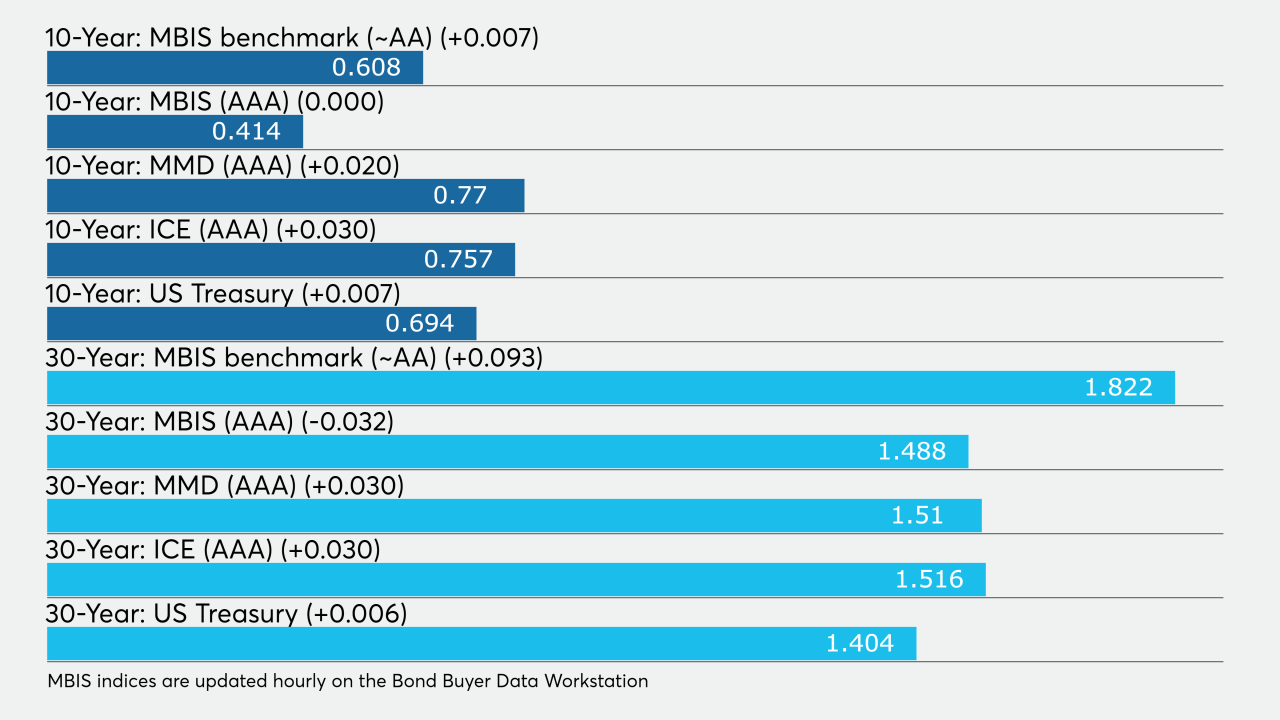

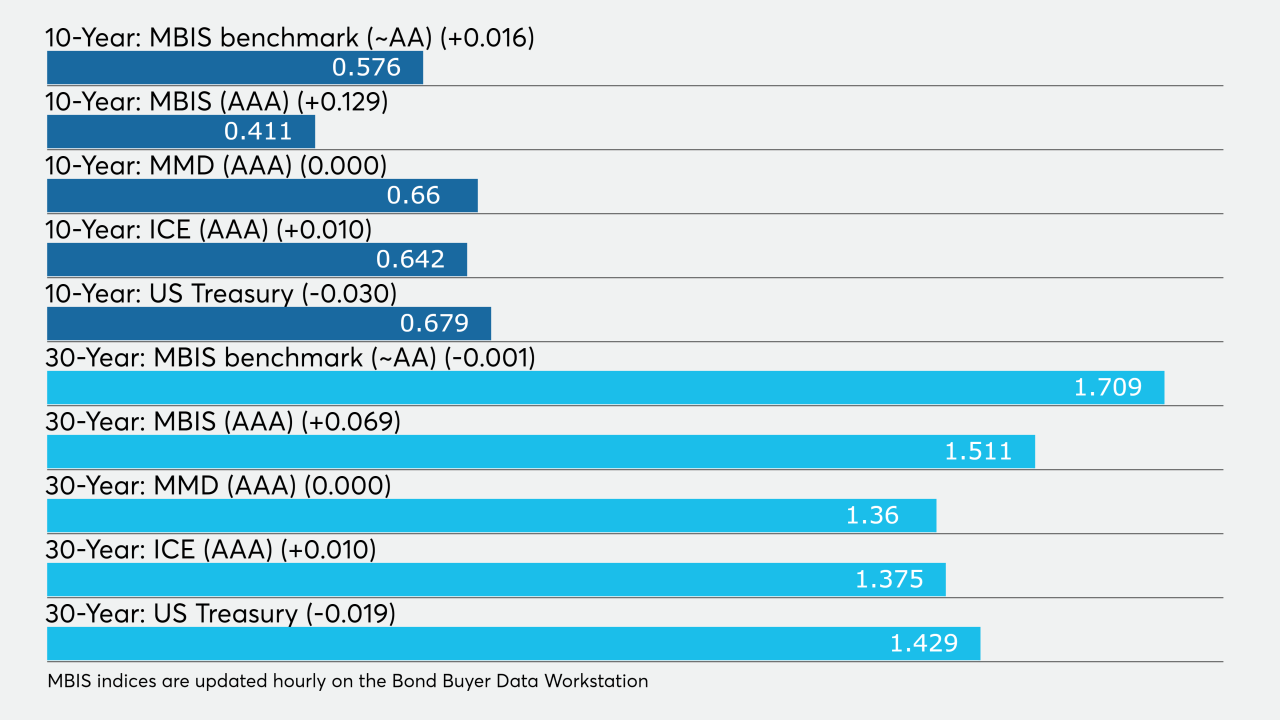

Munis continued to weaken with yields on the AAA scales rising by as much as three basis points.

August 26 -

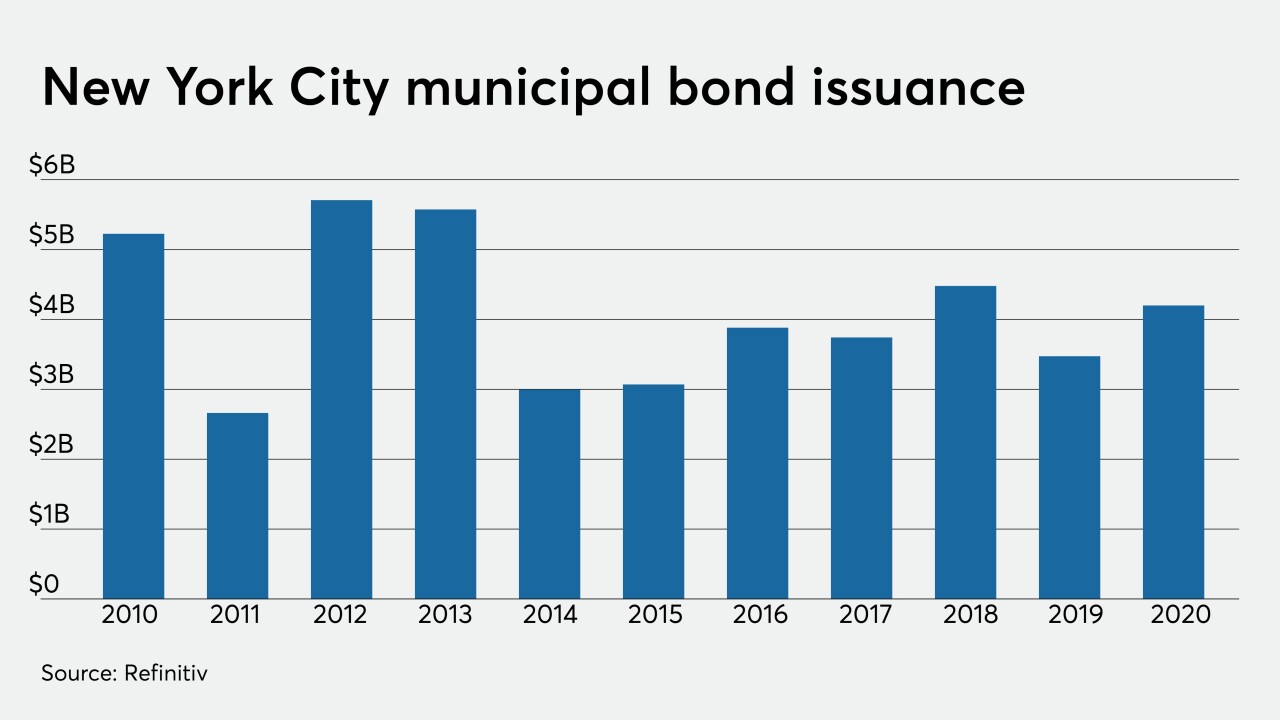

Municipals turned weaker on the long end Tuesday as NYC's tax-exempt GOs were priced for retail investors.

August 25 -

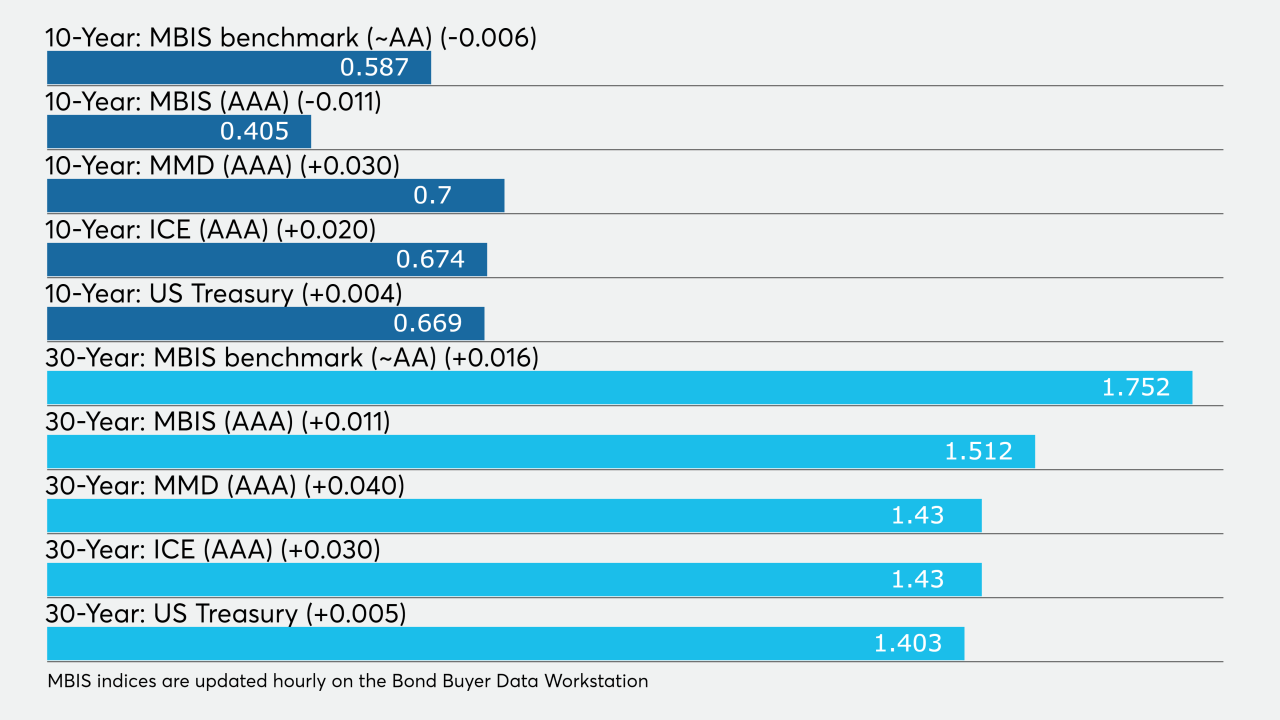

Municipal bonds ended unchanged on Monday ahead of this week $8 billion of new issuance.

August 24 -

Municipals were little changed on Friday after a market moved that took long yields up by as much as 15 basis points since mid-month.

August 21 -

Municipals were steady to weaker, with yields up by as much as three basis points on the long end Thursday.

August 20 -

The muni market steadied Wednesday as a strong dose of supply hit the screens.

August 19 -

Municipals were slightly weaker on Tuesday as investors take stock of inventories and exceedingly low yields for a market that might be ripe for a correction.

August 18 -

Municipal investors are somewhat tepid on current low rates Monday ahead of the week's $`11.5 billion of new supply.

August 17