Municipals turned weaker Tuesday as yields on long-dated maturities on the AAA muni scales moved as much as two basis points higher.

Retail investors were treated to New York City’s general obligation bond offering ahead of Wednesday’s institutional pricing.

Primary market

Citigroup priced NYC’s (Aa1/AA/AA/NR) $1.1 billion of Fiscal 2021 Series A and B tax-exempt GOs for retail investors.

The $941.36 million of Series A Subseries A-1 GOs were priced for retail to yield from 0.45% with 3% and 5% coupons in a split 2023 maturity to 1.80% with a 4% coupon in 2034.

The $158.165 million of Series B Subseries B-1 GOs were priced for retail to yield 0.25% with a 2% coupon in 2020 and to yield from 0.79% with a 3% coupon in 2026 to 1.53% with a 5% coupon in 2032.

The city will also competitively sell $304.15 million of taxable GOs in two offerings Wednesday, consisting of $159.935 million and $144.215 million.

“Given the challenges ahead for the city — including the $9 billion budget gap for two years — the deal priced very well,” said John Hallacy, founder of John Hallacy Consulting LLC.

“Although these transactions are relatively short, the longer maturities are in the intermediate part of the curve that is usually more of a challenge,” Hallacy said. “That was not a high hurdle in this sale. The forthcoming taxable offering will provide more on the feedback loop.”

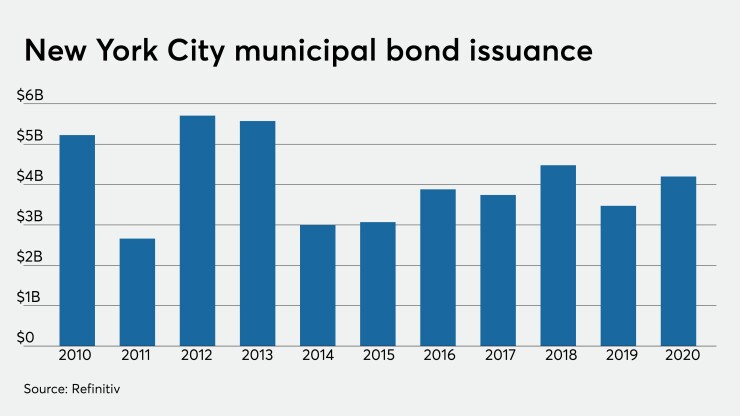

At the end of the second quarter of fiscal 2020, the city had about $38 billion of GO debt outstanding. That's not counting the various city authorities, such as the Transitional Finance Authority, which has $39 billion of debt outstanding and the Municipal Water Finance Authority, which has $31 billion outstanding.

JPMorgan Securities priced the Delaware Transportation Authority’s (Aa1/AA+/NR/NR) $215.405 million of transportation system senior revenue bonds.

The deal was priced to yield from 0.13% with a 5% coupon in 2023 to 1.63% with a 4% coupon in 2040.

BofA Securities priced Fairfax County, Va.’s (Aaa/AAA/AAA/NR) $294.6 million of taxable public improvement refunding bonds.

The bonds were priced at par to yield from 0.205% (+5 bps to UST) in 2021 to 1.833% (+115 bps to UST) in 2035.

Essex County, N.J., competitively sold $140 million of bonds and notes on Tuesday.

Mesirow Financial won the $96.22 million of general improvement bonds (Aaa//AA+/) with a true interest cost of 1.9899%. The bonds were priced to yield from 0.15% with a 5% coupon in 2021 to 2.26% with a 2.125% coupon in 2050.

JPMorgan won the $43.98 million of bond anticipation notes (MIG1///) with a bid of 2% and a premium of $780,644.99, an effective rate of 0.220056%.

On Wednesday, JPMorgan Securities is set to price

JPMorgan is also set to price the University of Chicago’s (Aa2/AA-/AA+/NR) $300 million of taxable corporate CUSIP fixed-rate bonds on Wednesday.

On Thursday, Siebert Williams Shank is expected to price the

Secondary market

Municipals were steady to weaker out long, according to the final readings on Refinitiv MMD’s AAA benchmark scale.

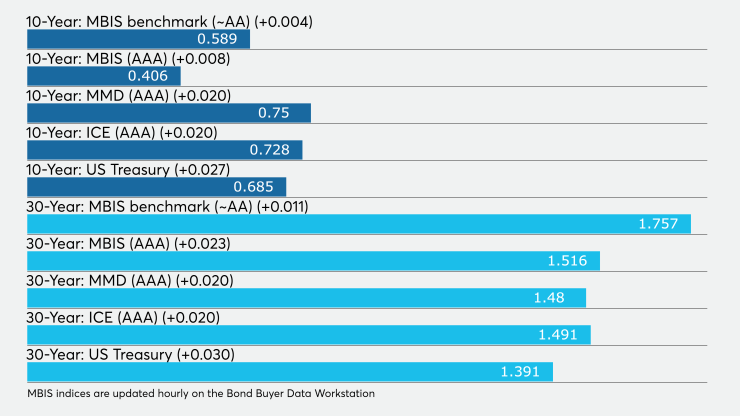

Yields were unchanged at 0.13% in 2021 and 0.14% in 2022. The yield on the 10-year muni rose two basis points to 0.75% while the 30-year yield gained two basis points to 1.48%.

The 10-year muni-to-Treasury ratio was calculated at 110.0% while the 30-year muni-to-Treasury ratio stood at 106.7%, according to MMD.

Municipal bonds were continuing their recent decline, ICE Data Services said.

“Yields on the ICE muni curve are one to 2 1/2 basis points higher today throughout the curve,” ICE said. “Trade volumes have picked up today, in line with levels from last week.”

The ICE AAA municipal yield curve showed the 2021 maturity up one basis point to 0.130% and the 2022 maturity one basis point higher at 0.138%. The 10-year maturity rose two basis points to 0.728% and the 30-year gained two basis points to 1.491%.

ICE reported the 10-year muni-to-Treasury ratio stood at 112% while the 30-year ratio was at 105%.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.12% and the 2022 maturity at 0.13% while the 10-year muni was at 0.75% and the 30-year stood at 1.47%.

Munis were little changed on the MBIS benchmark and AAA scales.

Treasuries were weaker as stock prices traded mixed.

The three-month Treasury note was yielding 0.112%, the 10-year Treasury was yielding 0.685% and the 30-year Treasury was yielding 1.391%.

The Dow fell 0.32%, the S&P 500 increased 0.27% and the Nasdaq gained 0.64%.