Municipals were steady to weaker in some spots, with yields on longer-dated maturities rising by as much as three basis points on the AAA GO scales.

Meanwhile, New York City will sell about $1.4 billion of general obligation bonds the week of Aug. 24, the comptroller’s office said Thursday.

The inflows continue in this market as Refinitiv Lipper reported $1.8 billion of inflows into muni mutual funds in the week ended Aug. 12, the 15th week in a row of positive results. The last time the muni funds saw an outflow was on May 6.

"There is a juxtaposition here in this market that is undeniable. You've got a retail sector that is dipping its toes into the water but an institutional investor base that is wanting paper," a Pennsylvania trader said. "These flows show that demand is there from both investor fronts, but the spread widening is inevitable because of how tight they got over the past three months once the market settled. Summer is winding down, uncertainty in all markets is evident in participant behaviors and everyone should be ready for what post-Labor Day will bring. Especially ahead of the elections and the volatility that it could bring."

"August is typically such a quiet month in both the markets and in Washington and clearly that is not the case for 2020," she said. "Investors and issuers should keep their ears to the ground."

Action was brisk in the primary as a social bond from an Illinois issuer and Texas deals came to market.

Primary market

Morgan Stanley priced the John D. and Catherine T. MacArthur Foundation’s (Aaa/NR/NR/NR) $125 million of taxable corporate CUSIP

The bonds were priced at par to yield 1.299% on Dec. 1, 2030, 65 basis points above the comparable U.S. Treasury security.

Proceeds will fund grants that target not-for-profits and communities battered by the COVID-19 pandemic and social injustice, with a particular focus on challenges faced by Blacks.

Loop Capital Markets and Ramirez & Co. are co-managers.

Piper Sandler priced Wyandotte County, Kansas City, Kan.’s (A2/A/A/NR) $231.535 million of Series 2020B taxable utility system refunding revenue bonds and $17.010 million of Series 2020A tax-exempt utility system refunding and improvement revenue bonds.

The taxable Series 2020B bonds were priced at par to yield from 0.689% in 2021 to 2.551% in 2035 and 2.681% in 2037.

The exempt Series 2020A were priced to yield from 0.31% with a 3% coupon in 2021 to 1.28% with a 3% coupon in 2030. A 2035 maturity was priced to yield 1.80% with a 3% coupon, a 2040 maturity was priced to yield 2.05% with a 3% coupon and a 2045 maturity was priced to yield 2.24% with a 3% coupon.

FHN Financial Capital Markets received the written award on the Denton Independent School District, Texas’ (NR/AAA/AAA/NR) $278.025 million of Series 2020 unlimited tax school building bonds. The deal is backed by the Permanent School Fund guarantee program.

Citigroup priced the Rockwall Independent School District, Rockwall, Collin and Kaufman Counties, Texas’ (Aaa/AAA/NR/NR) $163.79 million of taxable unlimited tax refunding bonds.The deal is backed by the PSF.

JPMorgan Securities priced as a remarketing the Georgia Development Authorities’ (Baa1/BBB+/BBB+/NR) $212.76 million of pollution control revenue bonds for the Oglethorpe Power Corp.

NYC to sell $1.4B GOs next week

New York City will sell about $1.4 billion of general obligation bonds, the comptroller’s office said Thursday.

The deals are composed of $1.1 billion of tax-exempt fixed-rate bonds and $304 million of taxable fixed-rate bonds. Proceeds will be used to refund certain outstanding bonds for savings.

Citigroup is expected to price the tax-exempts on Wednesday, Aug. 26 after a one-day retail order period. BofA Securities and Ramirez & Co. are co- senior managers.

Also Aug. 26, the city expects to competitively sell around $304 million of taxable fixed-rates.

On Wednesday, the NYC Transitional Finance Authority sold $1.6 billion of future tax secured subordinate refunding bonds, comprised of $1.3 billion of tax-exempt fixed-rate bonds and $275 million of taxable fixed-rates.

The refunding achieved around $374 million in total debt service savings, with approximately $230 million and $141 million of debt service savings in Fiscal 2021 and 2022, respectively, according to a statement from the Mayor’s Bill de Blasio’s Office of Management and Budget, the Office of NYC Comptroller Scott Stringer and the TFA.

Refunding savings on a present value basis total $367 million, or 18.6%, of the refunded par amount, they said.

During the two-day retail order period for the tax-exempt bonds, TFA received $516 million of orders from individual investors, out of which $498 million was usable. During the institutional order period, TFA received $3.9 billion of priority orders, representing a 4.7 times oversubscription.

The exempts were underwritten through TFA’s underwriting syndicate led by book-running lead manager BofA Securities with Citigroup and Ramirez & Co. as co-senior managers.

TFA also competitively sold $275 million of taxables.

The $128 million 1ubseries attracted 11 bidders, with Wells Fargo winning at a true interest cost of 0.680%. The $147 million subseries attracted nine bidders, with UBS winning at a TIC of 2.133%.

"TFAs are indicative of market acceptance of New York paper, with the hope that the city returns to 'normal'," a New York trader said. "The city's GO paper will be a good indicator of what the market should expect for general market sentiment of how it handles this type of deal in a contentious market and political time. The MTA deal was clear that there is demand, but the MTA deemed the rates unacceptable, which is why the fled to the Fed.

"When the city itself sells GOs, we'll all be watching with a careful eye on the reception it will receive. New York City has been through tough times before — now is something very different. I'm hopeful that it will navigate this current mess," he said.

Lipper reports $1.8B inflow

Investors continued to pour cash into bond funds, the latest data shows.

In the week ended Aug. 19, weekly reporting tax-exempt mutual funds saw $1.831 billion of inflows, after inflows of $2.313 billion in the previous week, according to data released by Refinitiv Lipper Thursday.

It was the 15th week in a row that investors put cash into the bond funds.

Exchange-traded muni funds reported inflows of $88.059 million, after inflows of $385.7620 million in the previous week. Ex-ETFs, muni funds saw inflows of $1.742 billion after inflows of $1.927 billion in the prior week.

The four-week moving average remained positive at $1.887 billion, after being in the green at $1.954 billion in the previous week.

Long-term muni bond funds had inflows of $1.011 billion in the latest week after inflows of $1.224 billion in the previous week. Intermediate-term funds had outflows of $274.189 million after inflows of $215.339 million in the prior week.

National funds had inflows of $1.736 billion after inflows of $2.127 billion while high-yield muni funds reported inflows of $217.326 million in the latest week, after inflows of $343.887 million the previous week.

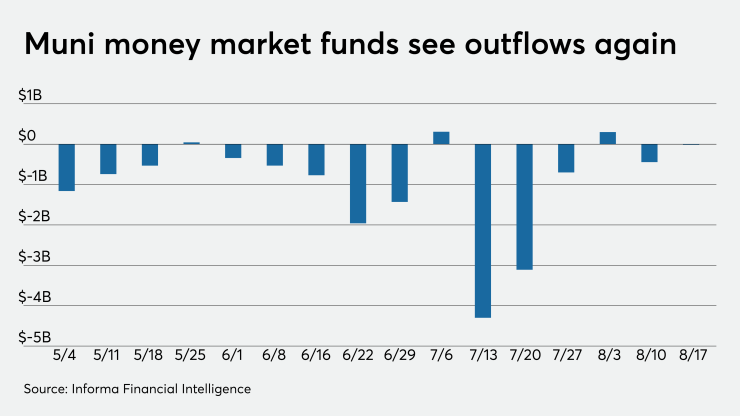

Money market muni funds fall $15M

Tax-exempt municipal money market fund assets fell $14.8 million, bringing total net assets to $121.82 billion in the week ended Aug. 17, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds was unchanged at 0.2% from the previous week.

Taxable money-fund assets decreased $7.73 billion in the week ended Aug. 17, bringing total net assets to $4.371 trillion.

The average, seven-day simple yield for the 775 taxable reporting funds remained at 0.03% from the prior week.

Overall, the combined total net assets of the 962 reporting money funds fell $7.75 billion in the week ended Aug. 18.

Secondary market

Some trades of note Thursday:

NY Dorm Columbia University 5s of 2021 traded at 0.16%-0.15%. Howard County, Maryland 5s of 2023 at 0.19%-0.18%. Georgia GOs, 5s of 2028, traded at 0.63%-0.61%. In early March before the crisis hit, it was trading at 1.10%-1.09%.

Delaware GOs, 5s of 2028, traded at 0.59%. Maryland GOs 5s of 2028 traded at 0.61%. Georgia GOs 5s in the 10-year traded at 0.75%-0.74%. University of Texas revs, 5s of 2030, traded at 0.88%-0.85%, Monday they were at 0.82%-0.84%.

Out longer, Alvin Texas schools, 3s of 2040, traded at 1.50%-1.45%. Washington GOs, 5s of 2045, traded at 1.54%-1.44%. On the 30-year, Goose Creek, Texas ISD 4s of 2050 traded at 1.71%-1.65% after originally pricing at 1.81% late last week.

Municipals were weaker on the long end of the curve, according to the final readings on Refinitiv MMD’s AAA benchmark scale.

Yields were unchanged at 0.13% in 2021 and 0.14% in 2022. The yield on the 10-year muni was up three basis points to 0.73% while the 30-year yield rose three basis points to 1.46%.

The 10-year muni-to-Treasury ratio was calculated at 113.4% while the 30-year muni-to-Treasury ratio stood at 106.0%, according to MMD.

“Muni yields are rising again today,” ICE Data Services said Thursday. “Trade volumes are consistent with yesterday’s levels.”

The ICE AAA municipal yield curve showed the 2021 maturity unchanged at 0.120% and the 2022 maturity steady at 0.131%. The 10-year maturity was up three basis points to 0.708% and the 30-year increased three basis points to 1.467%.

ICE reported the 10-year muni-to-Treasury ratio stood at 117% while the 30-year ratio was at 104%.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.12% and the 2022 maturity at 0.13% while the 10-year muni was at 0.73% and the 30-year stood at 1.45%.

The BVAL AAA curve showed the curve mostly unchanged with the 2021 maturity yielding 0.11% and the 2022 maturity at 0.12%, while the 10-year muni was at 0.68%, plus 1 basis point and the 30-year at 1.44%, plus 1.

Munis were little changed on the MBIS benchmark and AAA scales.

Treasuries were stronger as stock prices traded up.

The three-month Treasury note was yielding 0.108%, the 10-year Treasury was yielding 0.643% and the 30-year Treasury was yielding 1.376%.

The Dow rose 0.20%, the S&P 500 increased 0.37% and the Nasdaq gained 1.09%.