-

Both Janney and Huntington are among the top 30 underwriters in the muni market and are neck in neck.

December 12 -

Pasadena and the Rose Bowl Operating Co. are suing UCLA, saying plans to relocate football games to SoFi stadium could jeopardize $130 million in revenue bonds.

December 12 -

"With its third straight rate cut, the Fed is sending a clear message: it's no longer just watching inflation — it's managing risk," said Gina Bolvin, president of Bolvin Wealth Management Group.

December 11 -

The bonds are to be used for a variety of projects aimed at recovering from multiple natural disasters that struck Lake Charles in 2020 and 2021.

December 11 -

Both parties agree the federal permitting process drives up infrastructure costs.

December 11 -

A vote Wednesday by Chicago's city council would speed up budget hearings and signals that a majority of alders may go their own way on the budget.

December 11 -

The changing climate is increasing insurance rates for residents and cities and lowering property values in areas that face more frequent and intense disasters.

December 11 -

Muni yields were little changed, and have barely moved over the past several trading sessions, said Kim Olsan, senior fixed income portfolio manager at NewSquare.

December 10 -

AllianceBernstein hired four municipal credit special situations analysts based in its Dallas office.

December 10 -

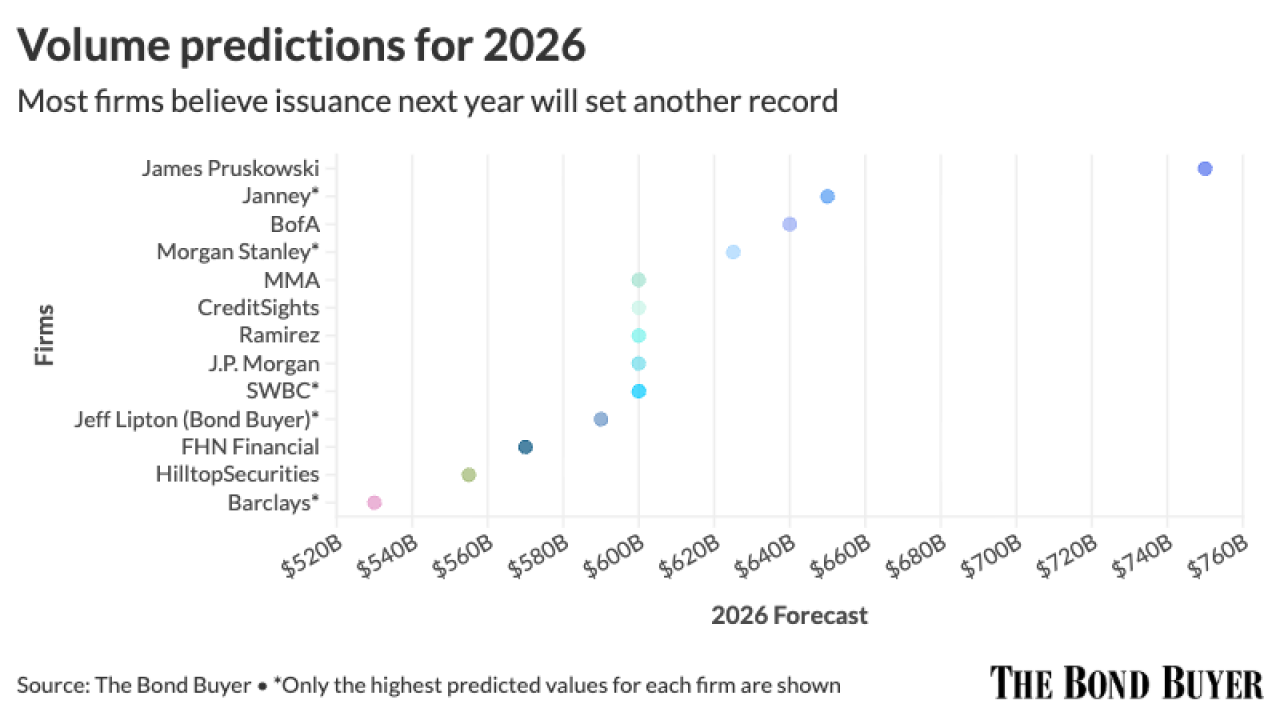

Municipal bond supply projections for next year range from a high of $750-plus billion to a low of $520 billion, with most firms expecting issuance to hover around $600 billion, easily surpassing 2025's record.

December 10 -

Photos from The Bond Buyer's 2025 Deal of the Year awards gala.

December 10 -

A 2025 state law prohibits cities from increasing their property tax revenue if they fail to produce a timely annual financial audit.

December 9 -

Omaha Public Power District will go to market the week of Jan. 5 with about $164 million of Series 2026A separate electric system revenue refunding bonds.

December 9 -

While muni returns moved lower last week, year-to-date returns still hover around 4%, said Jason Wong, vice president of municipals at AmeriVet Securities.

December 9 -

Concerns about Brightline have dragged down performance in the high yield sector this year.

December 9 -

While the plan of reorganization says bondholders will get 100% of principal, it won't be for 12 years. And they will lose some interest.

December 9 -

The state comptroller's office purchased about $5 million of shares in a bitcoin exchange traded fund last month for a newly created strategic reserve.

December 9 -

Legislation to increase the affordable housing supply which often includes bond sales is getting attention in Congress as the bipartisan ROAD to Housing Act hits a speed bump.

December 9 -

Four of Dallas Area Rapid Transit's 13 member cities took action to ask voters in May whether they want to withdraw from the agency.

December 9 -

Issuers mostly avoided pricing deals in the previous weeks the Fed met this year, but that's not the case this week, said Pat Luby, head of municipal strategy at CreditSights, and Wilson Lees, an analyst at the firm.

December 8