-

All eyes will be on Friday's report, though "it seems most leading indicators suggest job growth will remain healthy, which should keep the bond market selloff going strong," said OANDA's Edward Moya.

October 5 -

Municipal yields fell up to three basis points, depending on the scale, but underperform a better UST market.

October 4 -

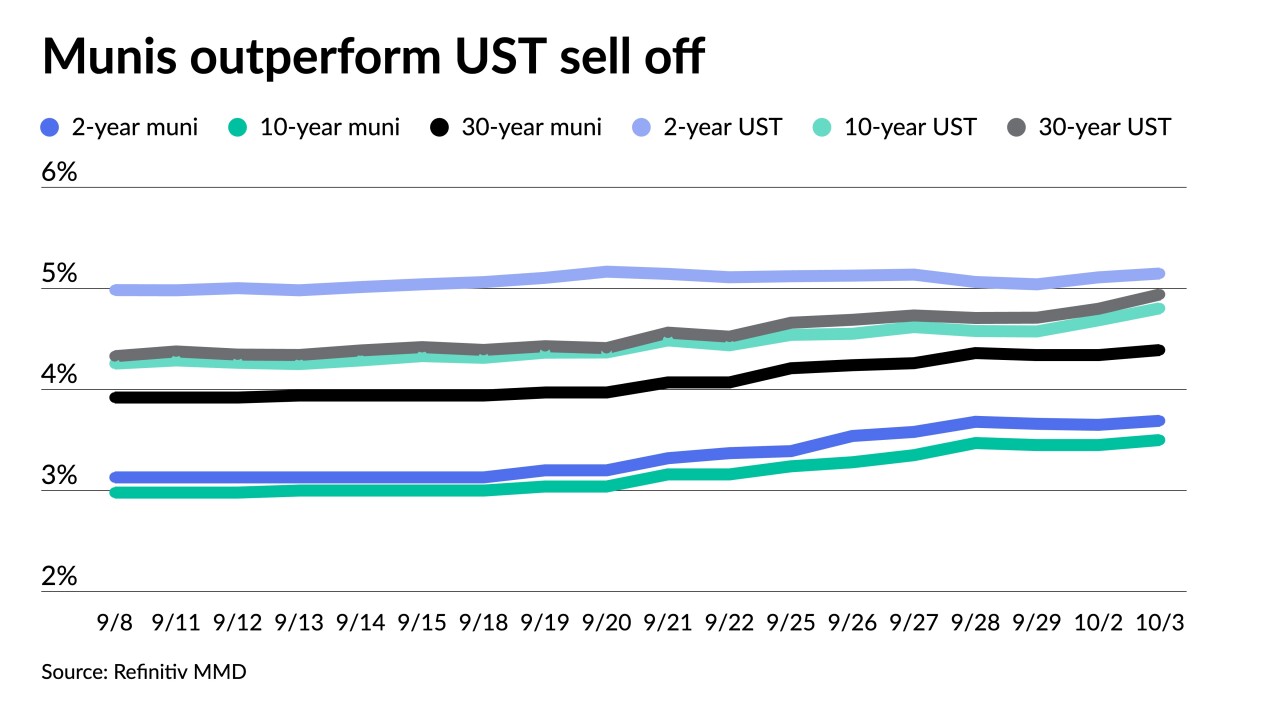

UST rates are driving all things in the muni market, said Jon Mondillo, head of North American Fixed Income at abrdn.

October 3 -

There will be "choppiness in the municipal bond market through the end of the year," said Anders S. Persson, Nuveen's chief investment officer for Global Fixed Income, and Daniel J. Close, Nuveen's head of municipals.

October 2 -

"We were pleased to achieve such strong results, especially in light of the recent volatile market conditions," said Philadelphia Treasurer Jacqueline Dunn.

October 2 -

The Bloomberg Municipal Index and High-Yield Index lost 3.3% and 3.9%, respectively, in September.

September 29 -

September's total volume ticked up 1.2% to $27.585 billion in 531 issues from $27.251 billion in 592 issues a year earlier. However, the month's total is lower than the $30.652 billion 10-year average, according to Refinitiv data.

September 29 -

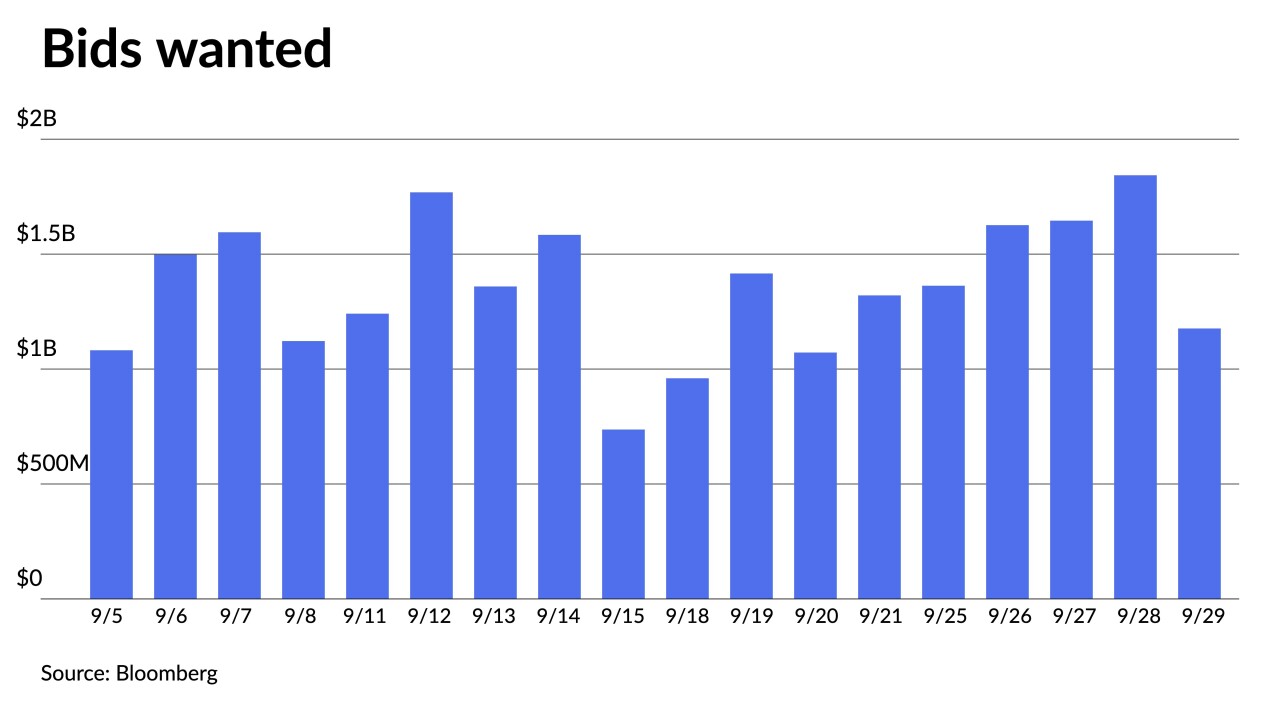

The last time muni mutual funds saw outflows top $1 billion was the week ending May 31 when they were $1.345 billion.

September 28 -

California priced $625 million in State Public Works Board lease revenue bonds this week.

September 28 -

"The market has taken to heart the [Federal Open Market Committee] actions from last week," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

September 27 -

Yields have "risen substantially over the last week as the market seeks to find at least a minor level of balance or equilibrium," said Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities.

September 26 -

Data for the second quarter show the face amount of munis outstanding rose 0.4% quarter-over-quarter, or $15.5 billion, to $4.043 trillion.

September 26 -

The district plans an aggressive capital program in the next few years to meet rising demand and transition away from coal-fired plants.

September 26 -

"People are just kind of sitting on their hands and being careful because MMD is raising yields every day and people don't know which way this is heading," said John Farawell of Roosevelt & Cross.

September 25 -

The Texas Water Development Board leads the new-issue calendar with $1 billion of revenue bonds.

September 22 -

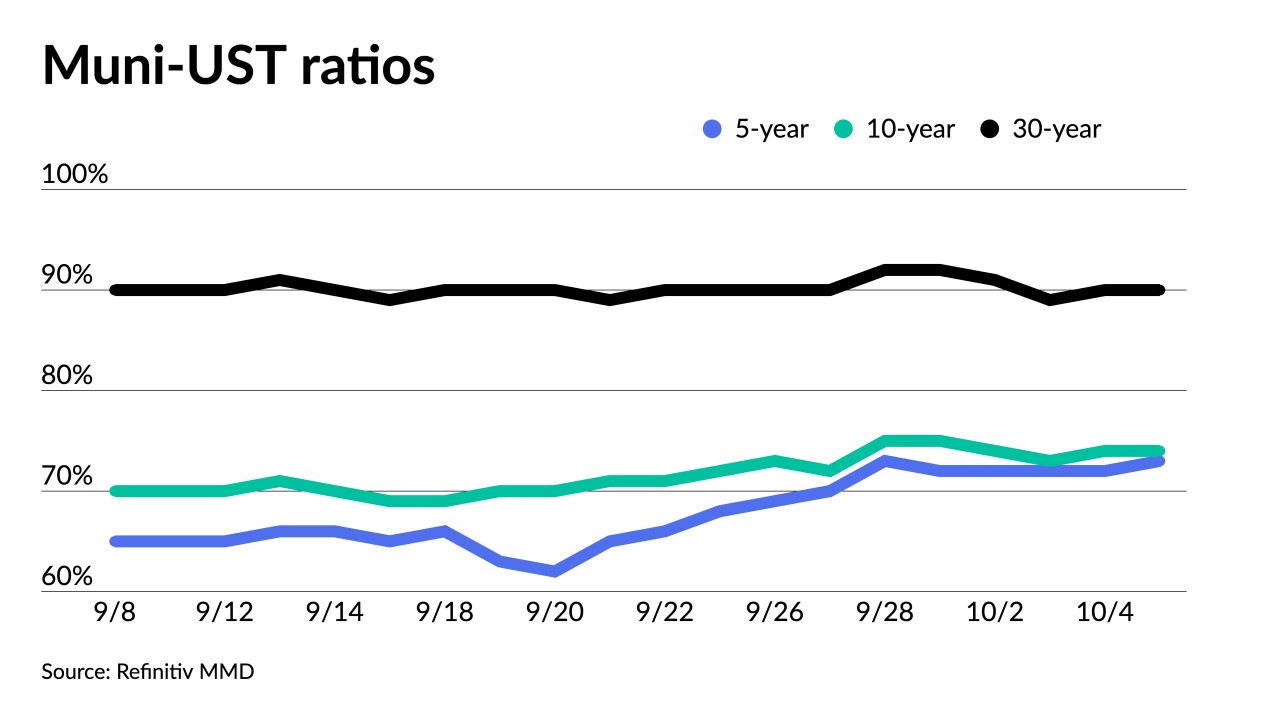

The general bias toward muni rates is that they would be a bit higher with technicals "being a little less supportive than they were in August, plus what we heard with from the Fed 'higher for longer,' and potentially another hike," said Jeff MacDonald, head of Fixed Income Strategies at Fiduciary Trust International.

September 21 -

As was expected, the FOMC held rates in a range between 5.25% and 5.50%, but the dot plot in the Summary of Economic Projections showed 12 of 19 members expect another 25-basis-point rate hike this year.

September 20 -

Fund flows "should be moving along a more positive trajectory, but they have yet to do so with munis unable to break free of the Treasury market's tight grip," Oppenheimer's Jeff Lipton said.

September 19 -

With a light new-issue calendar ahead of the FOMC meeting, "secondary flows may benefit from greater attention," said Kim Olsan, senior vice president at FHN Financial.

September 18 -

"We believe investors should take advantage of the current high rates environment: investors should pick and choose bonds selectively in the coming weeks in anticipation of this tightening cycle's end after November," BofA strategists said.

September 15