-

The nation's second-largest county heads into the market next week with a GO refunding buoyed by an upgrade and an outlook boost.

November 9 -

Municipals were quiet on Monday following Friday's rally and ahead of the $9.6 billion estimated to be priced early in the week before the Veterans Day holiday close Thursday. Connecticut priced for retail.

November 8 -

Dallas Area Rapid Transit is enjoying a lift in tax revenues amid a drop in ridership during the pandemic.

November 8 -

The long end of the municipal curve rallied under a backdrop of stronger-than-expected October jobs data and upward revesions to the prior two months ahead of the arrival of $9.6 billion next week.

November 5 -

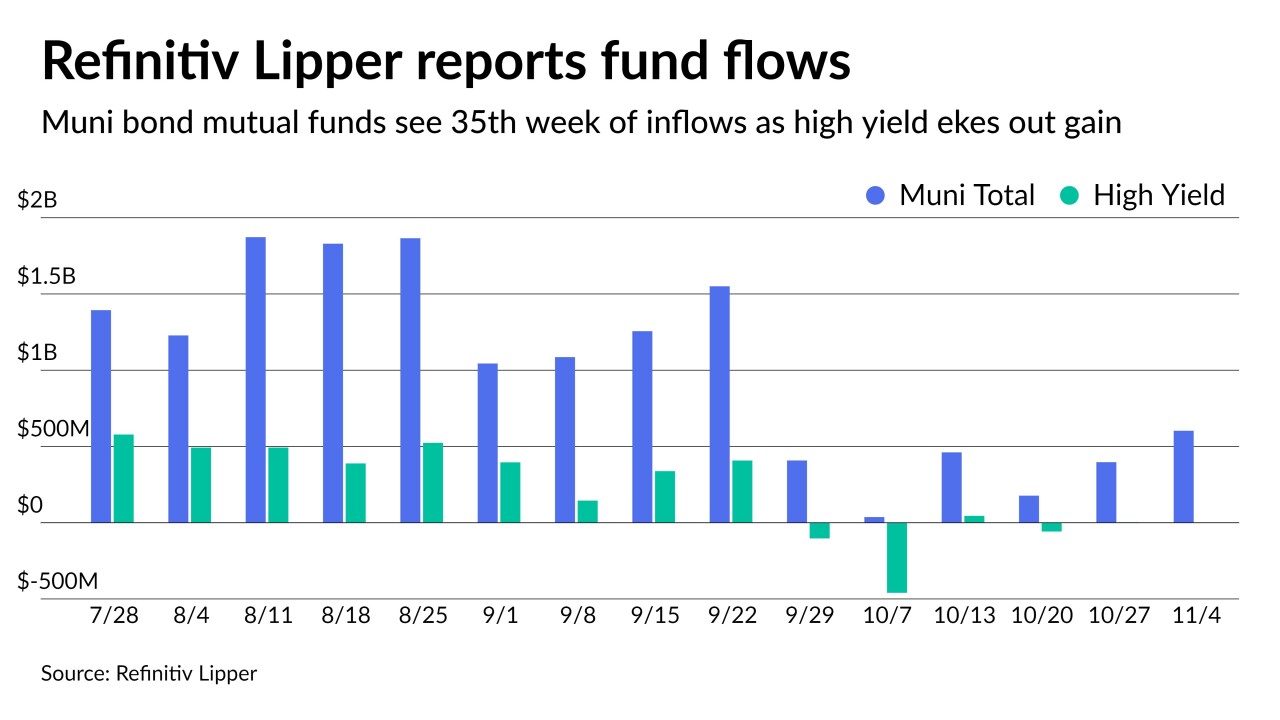

For 35 weeks in a row, investors have put cash into municipal bond funds as Refinitiv Lipper reported $603 million of inflows while high-yield funds eked out a gain of slightly more than $1 million.

November 4 -

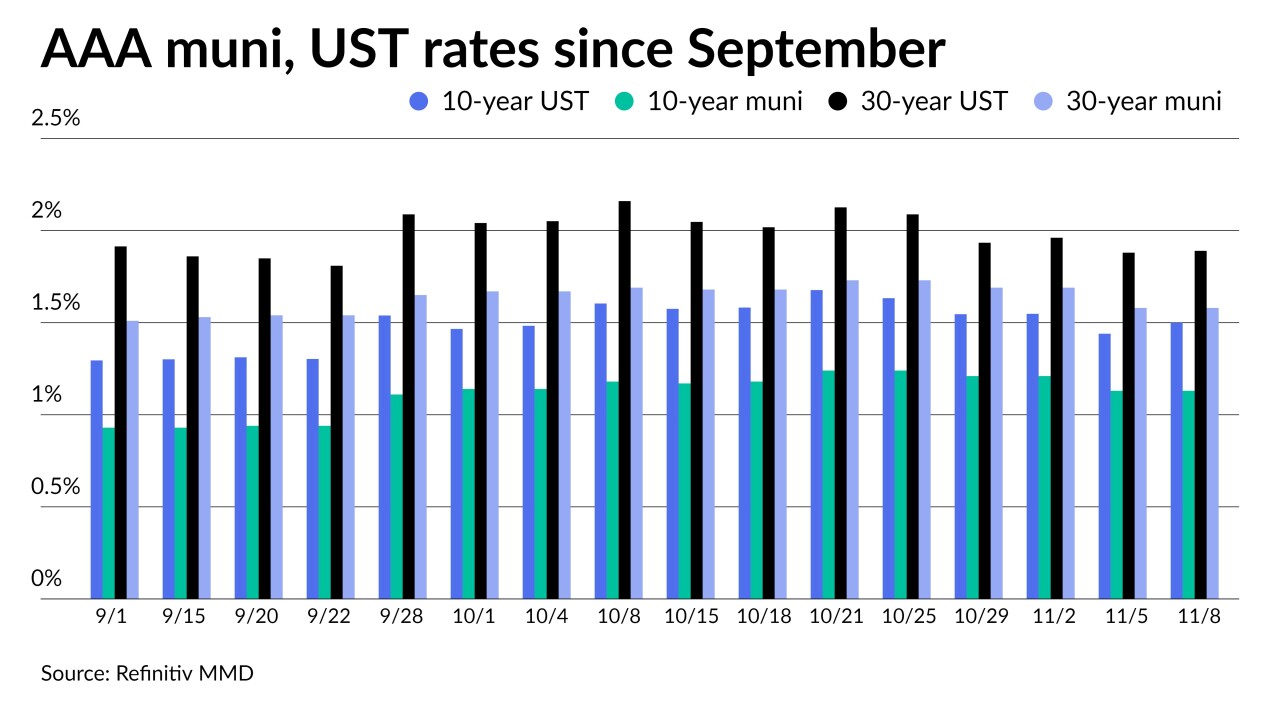

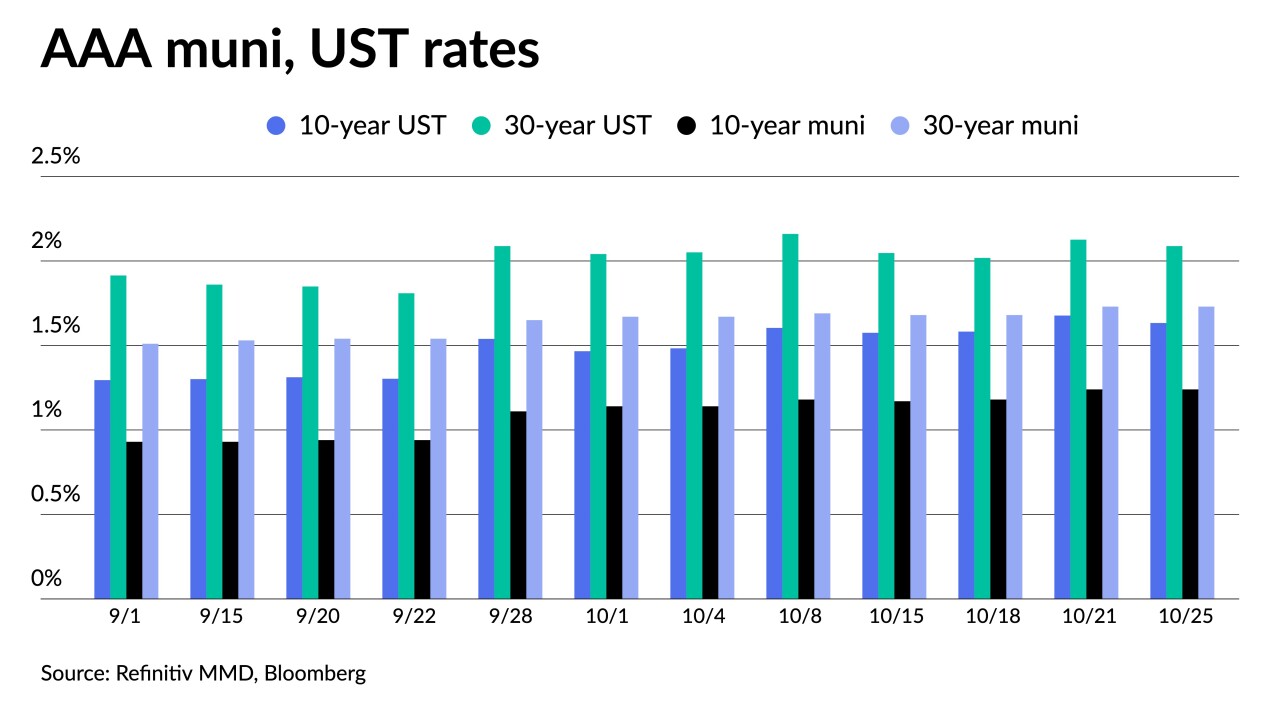

After the FOMC made taper official, high-grade benchmark yields ended the day one to three basis points better while USTs ended the day higher after an up-and-down trading session that moved the 30-year back above 2%.

November 3 -

The FOMC will likely take the opportunity to profess its reliance on data to decide liftoff and reiterate the threshold for a rate hike remains higher than for taper.

November 2 -

The Illinois State Toll Highway Authority plans $600 million of borrowing next month and $500 million next year as its 15-year-old capital program remains in full speed ahead mode.

November 2 -

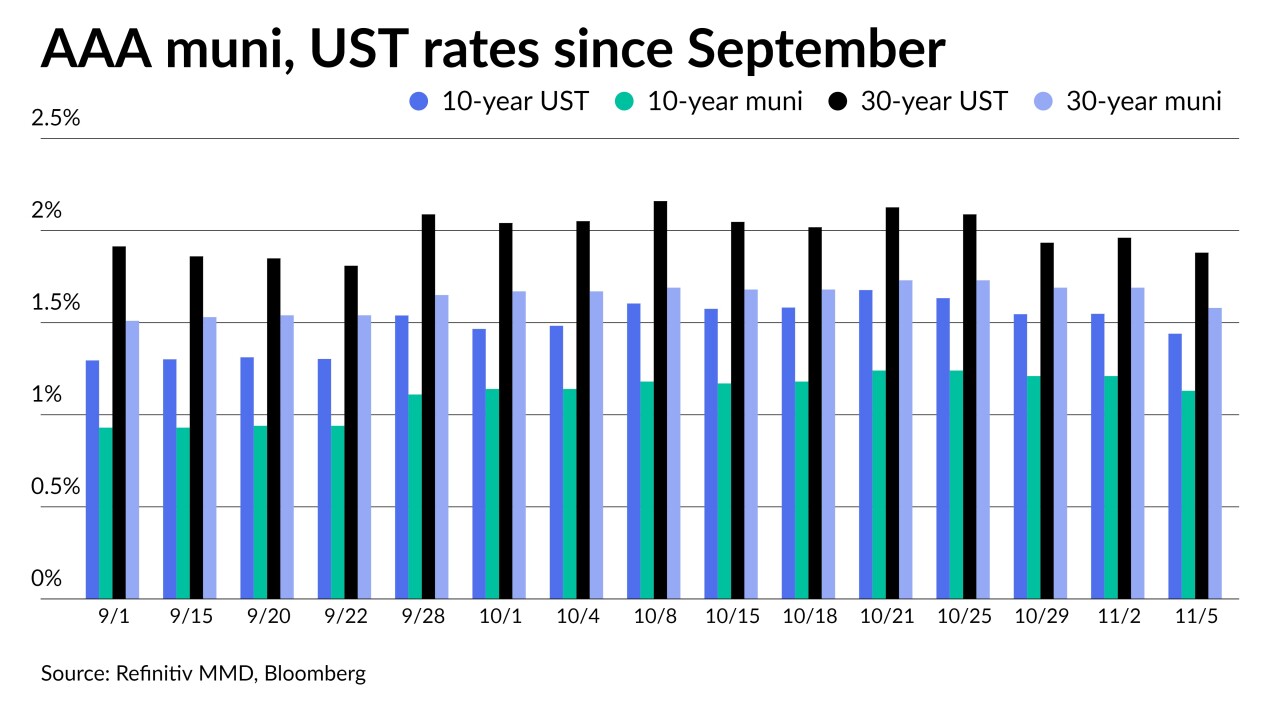

Though monetary policy has been in the forefront, at mid-month the tone changed with global inflation outlooks and federal infrastructure and social package in flux.

November 1 -

A lighter, $5 billion calendar, heavy on healthcare, kicks off November. Most participants agree volatility in U.S. Treasuries will be a leading factor for municipal market performance. Uncertainty in Washington also isn't helping the asset class.

October 29 -

Key institutional players like banks and insurance companies may have less incentive to buy tax-exempt munis if the provision becomes law.

October 29 -

Amid a flattening municipal yield curve and inversion of the Treasury market, new issues fared better than the secondary on Thursday as participants prepared for month end.

October 28 -

The lack of inclusion of the muni market's priorities in the reconciliation framework sends a strong signal they're unlikely to be included in the final legislation.

October 28 -

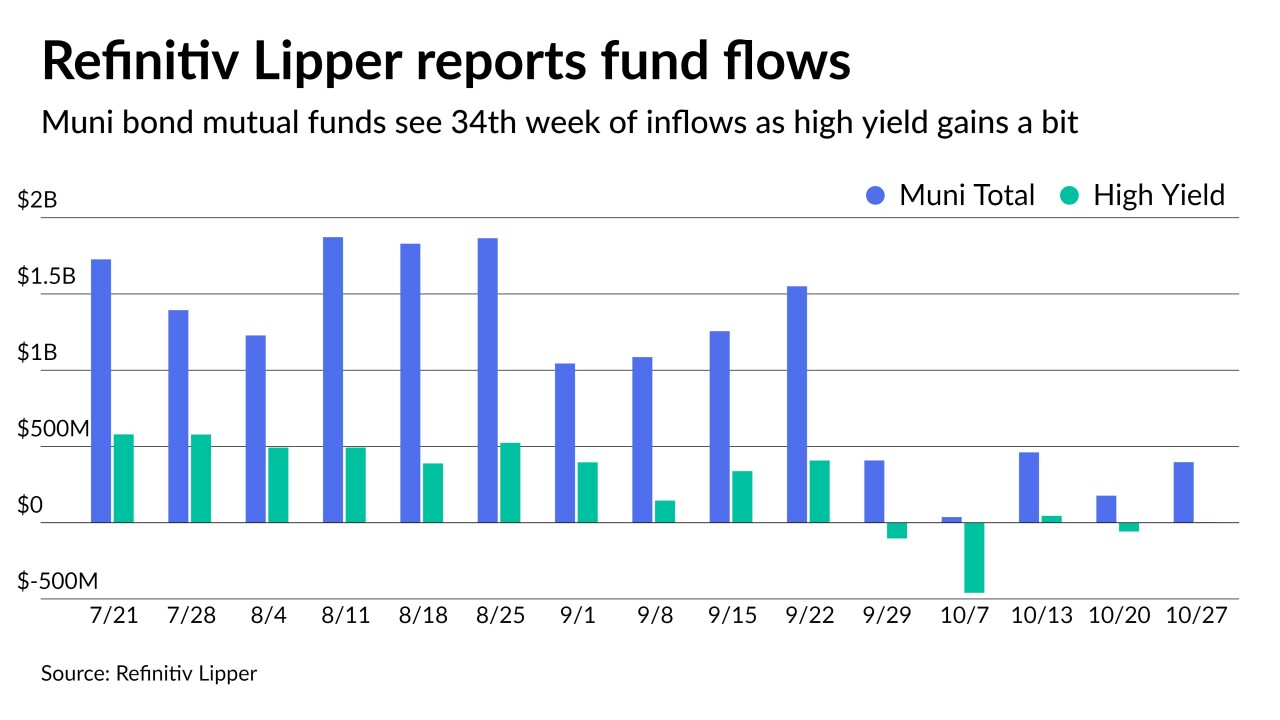

ICI reported the lowest inflows since outflows in March, while exchanged-traded funds saw an uptick.

October 27 -

As of now, returns for the month will very likely end in the red. The Bloomberg U.S. Municipal Index is at -0.40% for the month and +0.39% for the year.

October 26 -

S&P lifted its outlook to stable on Minneapolis' AAA rating and Fitch went positive on its AA-plus rating.

October 26 -

The $162 million tax-exempt new money deal is bolstered by two ratings upgrades and analysts say it will generate a lot of investor interest on Wednesday.

October 26 -

Despite a short-end U.S. Treasury rally, municipals face pressure on the one- and two-year as participants look to month-end positioning.

October 25 -

The fast pace of the Democratic negotiations may act in muni market's favor.

October 25 -

Volume falls slightly in the week of October 25 with total potential volume estimated at $7.408 billion: $6.036 billion of negotiated deals and $1.372 billion in the competitive market.

October 22