-

Seventeen months after Winter Storm Uri hit the Southwest, state-sanctioned securitizations are queuing up to mitigate a huge spike in energy costs for customers, with an Oklahoma deal the latest to price.

July 11 -

Personal income tax revenues rely upon taxpayers continuing to be taxpayers and remaining residents of New York, especially high-income earners.

July 11 -

Investors will see almost $11.5 billion of volume head their way in the largest new-issue week of the year. More participants expect municipals to improve in the second half of 2022.

July 8 -

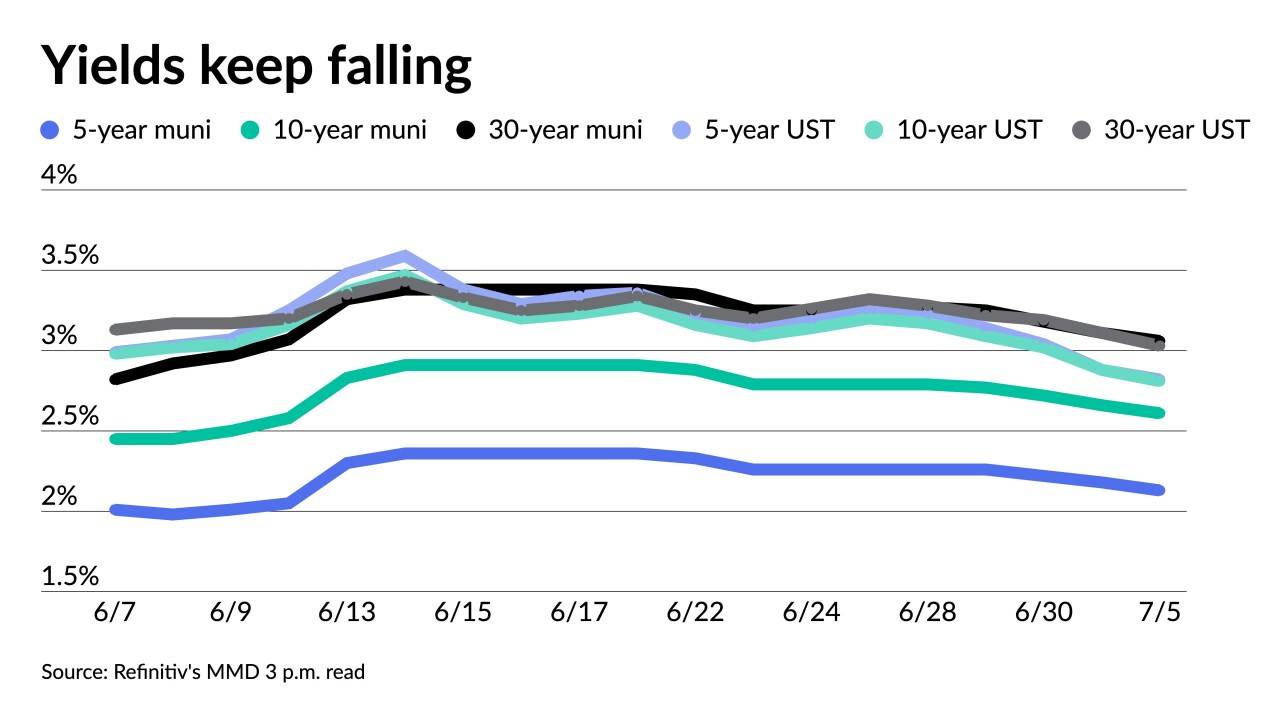

Despite rising U.S. Treasuries, municipals are making gains and are in the black to start July.

July 7 -

The Investment Company Institute reported investors pulled $1.372 billion from muni bond mutual funds in the week ending June 29.

July 6 -

The new credit received a triple-A from Fitch Ratings and a AA+ from S&P Global.

July 6 -

City and state will issue municipal bonds for the domed stadium while lowering taxpayer liabilities.

July 6 -

As investors shift the focus from inflation to recession concerns, fixed income markets, including munis, may regain some of the year's losses.

July 5 -

With the Fourth of July holiday shortening the week, investors will see a paltry $2.861 billion of new issues to kick off the second half of 2022.

July 1 -

Denver International Airport returns to the municipal market boosted by a rating upgrade as it recovers from passenger and revenue losses in the pandemic.

July 1 -

Elizabeth Funk is the new managing director of institutional sales and trading in the municipal underwriting group amid a wave of recent new additions. Natalie A. Brown has taken over as CEO.

July 1 -

Investors pulled more from municipal bond mutual funds, with Refinitiv Lipper reporting $1.3 billion of outflows, down from the $1.6 billion the week prior and bringing the total to $47 billion year-to-date.

June 30 -

For the first half of 2022, total issuance sits at $201.556 billion, down 14.5% from $235.836 billion in 2021. Taxables are down 46.8% to $31.024 billion from $58.338 billion.

June 30 -

The Investment Company Institute reported investors pulled $4.590 billion from muni bond mutual funds in the week ending June 22, down from $6.243 billion of outflows in the previous week.

June 29 -

Largely attributable to Fed interest rate increase-led volatility, outstanding municipal bonds lost $300 billion of market value in the first quart of 2022, a Municipal Securities Rulemaking Board report said.

June 29 -

A new-issue supply-focused buy-side had their sights on the $8 billion-plus flowing into the primary market this week, while municipal traders remained cautious, keeping an eye on bid-wanted lists in the secondary market.

June 28 -

A bearish market sentiment and elevated muni to UST ratios often represent a buy signal. Taxable equivalent yields are compelling for buy-and-hold investors, analysts say.

June 27 -

Municipals head into the final week of the first half of 2022 on more stable footing, but a cautious tone hangs over the market.

June 24 -

Cook County projects a surplus this year and a $18.2 million gap for fiscal 2023 while it readies two bond sales.

June 24 -

Refinitiv Lipper reported smaller outflows at $1.6 billion, down from the $5.6 billion the week prior. It brings the total outflows to $45.7 billion year-to-date.

June 23