Municipals were steady to weaker in spots as the primary market picked up, while U.S. Treasuries were a little better and equities sold off.

Muni-UST ratios were at 69% in five years, 87% in 10 years and 99% in 30, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 70%, the 10 at 88% and the 30 at 99% at a 4 p.m. read.

A new-issue supply-focused buy-side had their sights on the $8 billion-plus expected to enter the primary market this week, while municipal traders remained cautious, keeping an eye on bid-wanted lists in the secondary market, tax-exempt professionals said.

“A constructive market tone seems to be carrying over from last week where we saw bumps and good levels of participation,” Shaun Burgess, portfolio manager and fixed income analyst at Cumberland Advisors said.

“Levels definitely reached a threshold to entice some buyers back into the space, with the pace of outflows decreasing dramatically."

Burgess said he expects the upcoming large primary market calendar to be well received, however, there will be a slightly quiet undertone to the market toward week’s end as the approaching July 4th holiday nears.

In the primary Tuesday, Morgan Stanley & Co. priced for the California Community Choice Financing Authority (A1///) $833.820 million of green Clean Energy Project revenue bonds, Series 2022A, with 4s of 2/2024 at 2.92%, 4s of 2/2027 at 3.54%, 4s of 8/2027 at 3.58% and 4s of 5/2053 at 3.83%, callable in 5/1/2028.

Loop Capital Markets priced for the Sacramento City Unified School District, California, (A3/AA//AA/) $280.220 million. The first tranche, $225 million of Election of 2022 (Measure H) general obligation, 2022 Series A, saw 5s of 08/2023 at 1.93%, 5s of 2030 at 3.20%, 5s of 2032 at 3.44%, 5s of 2037 at 3.92%, 4s of 2042 at 4.39%, 5.5s of 2047 at 4.06% and 5.5s of 2052 at 4.13%, callable in 8/1/2030. The second tranche, $55.220 million of 2022 general obligation refunding bonds, saw 5s of 07/2023 at 1.90%, 5s of 2027 at 2.69% and 5s of 2031 at 3.31%, noncall.

BofA Securities priced for the University of Maine System (/AA-//) $120.915 million of revenue bonds, Series 2022, with 5s of 03/2023 at 1.64%, 5s of 2027 at 2.45%, 5s of 2032 at 3.10%, 5s of 2037 at 3.60%, 5s of 2042 at 3.91%, 5s of 2047 at 4.05%, 5.5s of 2052 at 4.05%, 5.5s of 2057 at 4.15%, 5.5s of 2062 at 4.25%, callable in 3/1/2032.

In the competitive, Seattle, Washington, (Aa2/AA//) sold $257.715 million of municipal light and power improvement and refunding revenue bonds, Series 2022, to Morgan Stanley & Co., with 5s of 7/2023 at 1.65%, 5s of 2027 at 2.34%, 5s of 2032 at 2.91%, 5s of 2037 at 3.35%, 5s of 2042 at 3.56%, 5s of 2047 at 3.70% and 5s of 2052 at 3.80%, callable in 7/1/2032.

Denton, Texas, (/AA+/AA+/) sold $112.155 million of certificates of obligation, Series 2022, to Citigroup Global Markets, with 5s of 2/2023 at 1.60%, 5s of 2027 at 2.37%, 5s of 2032 at 3.11%, 5s of 2037 at 3.52%, 4s of 2042 at 4.06%, 4.125s of 2048 at 4.20% and 4.25s of 2052 at 4.30%, callable in 2/15/2031.

The city also sold $71.620 million of general obligation refunding and improvement bonds, Series 2022, to Citigroup Global Markets, with 5s of 2/2023 at 1.60%, 5s of 2027 at 2.37%, 5s of 2032 at 3.11%, 5s of 2037 at 3.52% and 4s of 2042 at 4.06%, callable in 2/15/2031.

Jeff Lipton, head of municipal credit and market strategy and municipal capital markets at Oppenheimer & Co. Inc., said if "sentiment and conviction" can hold course, "we suspect that interest will be strong, with orderly deal placement benefitting from long-awaited strengthening momentum."

Municipals, according to Lipton, have the potential to recover, barring any obstacles.

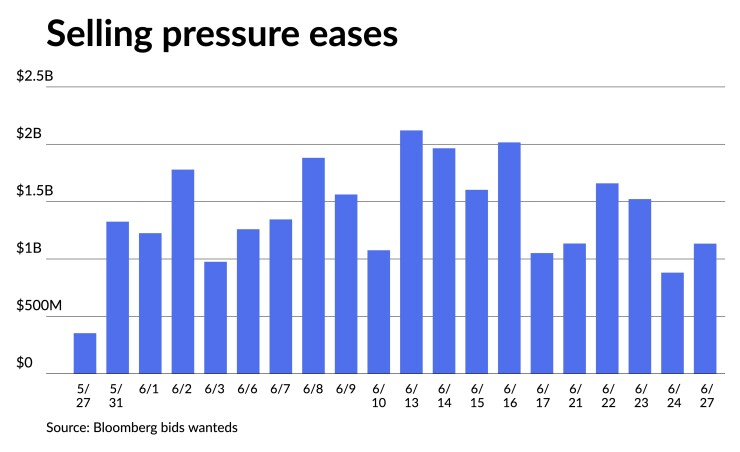

“We suspect that some of the hardest hit areas can be standouts along the way, such as lower coupon structures, longer-duration bonds, and select high-yield securities,” Lipton suggested. “Any sustained containment of bid-wanted activity may very well be a telling sign that the market has altered both sentiment and perception, potentially catalyzing a brighter outlook for the second half of 2022.”

Matt Fabian, a partner at Municipal Market Analytics, also noted that there has been limited demand for lower coupon structures of late.

“Customers’ selling prices for such held at deeply de minimus distressed levels last week,” he said.

“This dynamic likely followed continued outflows by the mutual funds, which “are the prime supporters of lower coupons and similar volatility trades,” Fabian said. Mutual funds have lost $45.7 billion in asset under management since the start of the year, according to Refinitiv Lipper.

Lipton said withdrawals could subside and even turn positive should a cyclical shift emerge from a sustained bond market rally in general as well as municipal momentum driven by the technicals of lower supply and active reinvestment needs.

“We are at or near cyclical highs in long-term muni yields, a likely reflection of oversold conditions, and so the rate environment portends a nearing conclusion to the extended period of negative flows,” he added.

Fabian noted that demand seems to have favored higher coupon and higher grade structures. He said this is “an appropriate trade as economic growth is increasingly likely to slow and many/most states have undermined their resilience to such via tax cuts.”

Lipton said the municipal backdrop is well-positioned to emerge in a better place by year-end.

“Fiscal austerity has been buoyed by more conservative assumptions, multiple infusions of fiscal stimulus, and outperforming revenue collections given the wholesale reopening of the U.S. economy,” he said.

Strong reserve balances could be used to offset revenue disruptions should the economy enter a contractionary period.

“Given that we have revised downward our quarterly growth forecasts, it makes sense to scale back our estimates for state and local tax receipts, yet we still assign a favorable outlook to overall revenue performance throughout the foreseeable future,” he wrote.

With the elevated yield levels and cheaper valuations, municipal credit spreads have widened from significantly tighter levels that were present throughout 2021, he noted.

“As the economy slows and overall growth ebbs, we would not be surprised to see more visible widening over the coming months,” Lipton said.

AAA scales

Refinitiv MMD’s scale were cut two basis points on the long end the 3 p.m. read: the one-year at 1.62% (unch) and 1.97% (unch) in two years. The five-year at 2.26% (unch), the 10-year at 2.79% (unch) and the 30-year at 3.27% (+2).

The ICE municipal yield curve was cut one to three basis points: 1.66% (+1) in 2023 and 1.98% (+1) in 2024. The five-year at 2.32% (+1), the 10-year was at 2.77% (+2) and the 30-year yield was at 3.28% (+3) at a 4 p.m. read.

The IHS Markit municipal curve saw cuts 10 years and out: 1.63% (unch) in 2023 and 1.97% (unch) in 2024. The five-year at 2.24% (unch), the 10-year was at 2.82% (+2) and the 30-year yield was at 3.28% (+2) at 4 p.m.

Bloomberg BVAL was little changed: 1.66% (unch) in 2023 and 1.95% (unch) in 2024. The five-year at 2.28% (unch), the 10-year at 2.79% (unch) and the 30-year at 3.26% (+1) at a 4 p.m. read.

Treasuries were a tough firmer to close the session.

The two-year UST was yielding 3.112% (-1), the three-year was at 3.199% (-1), the five-year at 3.239% (-2), the seven-year 3.256% (-1), the 10-year yielding 3.182 (-2), the 20-year at 3.550 (-3) and the 30-year Treasury was yielding 3.287% (-3) at 4 p.m.

Primary to come:

The New York City Transitional Finance Authority (Aa1/AAA/AAA/) is set to price Wednesday $950 million of future tax-secured tax-exempt subordinate bonds, Fiscal 2023 Series A, Subseries A-1, serials 2024-2028. Siebert Williams Shank & Co.

The Alameda Corridor Transportation Authority, California, is set to price Thursday $273.500 million of lien revenue refunding bonds, consisting of tax-exempt senior capital appreciation bonds, Series 2022A (A3/A-/A/); taxable senior current interest bonds, Series 2022B (A3/A-/A/); and tax-exempt second convertible capital appreciation bonds, Series 2022C (Baa2/BBB+/BBB/). J.P. Morgan Securities.

The Sumter County Industrial Development Authority, Florida, (B1/B+/BB-/) is set to price Thursday $250 million of green exempt Enviva Inc. Project facilities revenue bonds, Series 2022, serial 2052. Citigroup Global Markets.

The San Diego Unified School District, California, is set to price Thursday $235 million of 2022-2023 tax and revenue anticipation notes, Series A, serial 2023. Citigroup Global Markets.

The New Hope Cultural Education Facilities Finance Corp., Texas, is set to price Wednesday $197.915 million of Outlook at Windhaven Project retirement facility revenue bonds, Series 2022, consisting of $109.715 million of Series 2022A, $19.755 million of Series 2022B-1, $25.640 million of Series 2022B-2, $41.465 million of Series 2022B-3 bonds and $1.340 million of Series 2022C. Ziegler.

The Dormitory of the State of New York (/BBB-//) is set to price Wednesday $148.815 million of Yeshiva University revenue bonds, Series 2022A. Goldman Sachs & Co.

The Alameda County Transportation Commission, California, (/AAA/AAA/) is set to price Wednesday $125.210 million of Measure BB limited tax senior sales tax revenue bonds, Series 2022, serials 2023-2041, term 2045. Citigroup Global Markets.

The Village Community Development District No. 14, Florida, is set to price next week $122.890 million of special assessment revenue bonds, Series 2022, terms 2027, 2032, 2037, 2042 and 2053. Jefferies.

The Barbers Hill Independent School District, Texas, (Aaa/AAA//) is set to price Wednesday $112.500 million of unlimited tax school building bonds, Series 2022, insured by Permanent School Fund Guarantee Program. Piper Sandler & Co.

The Nebraska Investment Finance Authority (/AA+//) is set to price Wednesday $106.980 million of non-AMT social single-family housing revenue bonds, 2022 Series D. J.P. Morgan Securities.

Competitive:

The Scott County School District Finance Corp., Kentucky, is set to sell $105.445 of school building revenue bonds, Series of 2022, at 11 a.m. eastern Wednesday.

The Clark County School District, Nevada, (A1/A+//) is set to sell $200 million of general obligation limited tax building bonds, Series 2022A, at 11:30 a.m. Wednesday.

Montgomery County, Pennsylvania, (Aaa///) is set to sell $155.220 million of general obligation bonds, Series of 2022, at 11 a.m. Wednesday.

Pueblo County, Colorado, is set to sell $126.355 million of Jail Project certificates of participation, Series 2022A, at 12 p.m. eastern Thursday.

The North Dakota Public Finance Authority is set to sell $320.800 million of taxable legacy fund infrastructure program bonds, Series 2022, at 10 a.m. Thursday.