-

Most top 10 issuers for 1H are from New York and California, with four from New York and two from California.

July 19 -

Minor shuffling among the top municipal underwriters characterized the year-over-year differences, with Jefferies being the only newcomer to the top 10, replacing Robert W Baird & Co., which fell to 13th.

July 19 -

Munis are improving, but positive second-half municipal returns likely won’t be enough to offset the major losses of the first half of the year.

July 18 -

Massachusetts delayed the sale of $2.7 billion of taxable special obligation revenue bonds as state lawmakers consider a bill for their unemployment trust fund.

July 15 -

Investors will be greeted Monday with a new-issue calendar estimated at $7 billion. While issuance will likely come in above average this month, negative net issuance is still expected.

July 15 -

Investors added $206.127 million to municipal bond mutual funds, according to Refinitiv Lipper data.

July 14 -

Primary market takes focus for large revenue deals from the New York State Thruway Authority and the Colorado Health Facilities Authority.

July 13 -

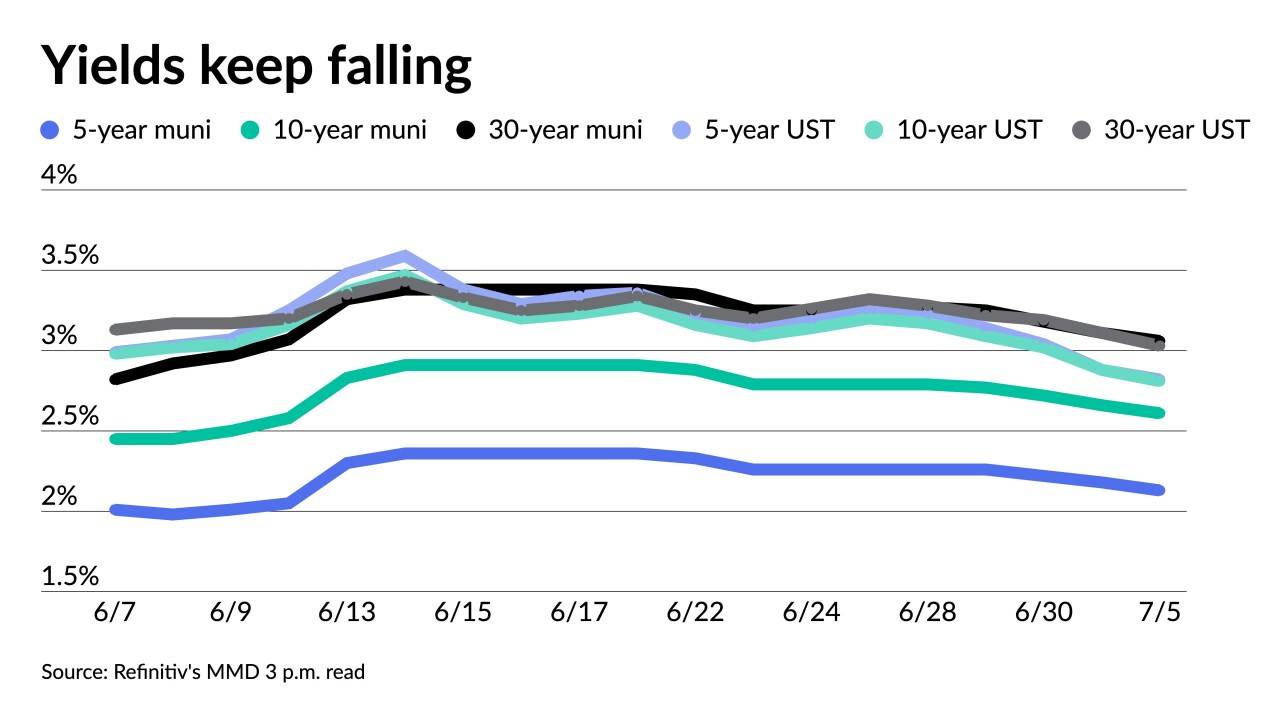

Munis have been steady to firmer in spots over the past few trading sessions as fundamentals have taken over. Triple-A 30-year munis dipped below 3% Tuesday, the first time since early June.

July 12 -

While small in size and population, D.C. is a wealthy area. If it were a state, it would rank 47th in population while its per-capita income leads all 50 states and it has a GDP greater than 17 states.

July 12 -

The $11-billion-plus calendar is the largest in eight weeks and includes two large high-grade issuers which may entice buyers into the market.

July 11 -

Seventeen months after Winter Storm Uri hit the Southwest, state-sanctioned securitizations are queuing up to mitigate a huge spike in energy costs for customers, with an Oklahoma deal the latest to price.

July 11 -

Personal income tax revenues rely upon taxpayers continuing to be taxpayers and remaining residents of New York, especially high-income earners.

July 11 -

Investors will see almost $11.5 billion of volume head their way in the largest new-issue week of the year. More participants expect municipals to improve in the second half of 2022.

July 8 -

Despite rising U.S. Treasuries, municipals are making gains and are in the black to start July.

July 7 -

The Investment Company Institute reported investors pulled $1.372 billion from muni bond mutual funds in the week ending June 29.

July 6 -

The new credit received a triple-A from Fitch Ratings and a AA+ from S&P Global.

July 6 -

City and state will issue municipal bonds for the domed stadium while lowering taxpayer liabilities.

July 6 -

As investors shift the focus from inflation to recession concerns, fixed income markets, including munis, may regain some of the year's losses.

July 5 -

With the Fourth of July holiday shortening the week, investors will see a paltry $2.861 billion of new issues to kick off the second half of 2022.

July 1 -

Denver International Airport returns to the municipal market boosted by a rating upgrade as it recovers from passenger and revenue losses in the pandemic.

July 1