Municipals were firmer in secondary trading and moved in lockstep with U.S. Treasuries while an active primary led by a large income tax revenue bond offering from the District of Columbia took focus. Equities ended in the red.

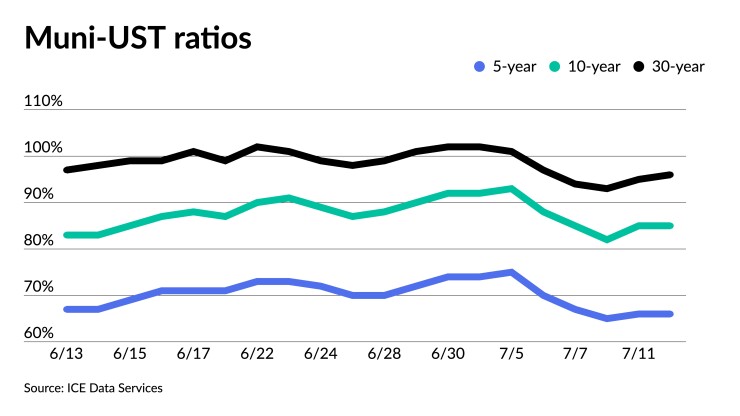

Triple-A curves saw yields fall three to five basis points while UST moved three to six basis points lower. Triple-A 30-year muni yields dipped below 3% Tuesday, the first time since early June. Muni to UST ratios on Tuesday were at 66% in five years, 83% in 10 years and 95% in 30 years, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 66%, the 10 at 85% and the 30 at 97% at a 3:30 p.m. read.

In the primary market Tuesday, BofA Securities priced for the District of Columbia $1.429 billion of income tax-secured revenue bonds. The first tranche, $651.575 million of tax-exempts, Series 2022A, saw 5s of 7/2031 at 2.69%, 5s of 2032 at 2.77%, 5s of 2037 at 3.11%, 5s of 2042 at 3.35%, 5s of 2047 at 3.48% and 5.5s of 2047 at 3.35%, callable 7/1/2032.

The second tranche, $139.395 million of taxables, Series 2022B, saw all bonds price at par: 3.419s of 7/2026, 3.499s of 2027 and 3.863s of 2031.

The final series, $638.45 million of forward-delivery tax-exempt refunding revenue bonds, Series 2022C, saw 5s of 12/2023 at 1.80%, 5s of 2027 at 2.36%, 5s of 2032 at 2.88%, 5s of 2037 at 3.21%, callable 12/1/2032. Forward delivery on 9/7/2022.

Jefferies priced for the Cities of Dallas and Fort Worth, Texas, (A1/A+/A+/AA/) $556.750 million of Dallas Fort Worth International Airport joint revenue non-AMT refunding bonds, Series 2022B, with 5s of 11/2023 at 1.68%, 5s of 2027 at 2.29%, 5s of 2032 at 2.90%, 5s of 2037 at 3.46%, 4s of 2042 at 4.05% and 5s of 2050 at 3.84%, callable 11/01/2032.

Raymond James & Associates priced for the San Antonio Independent School District, Texas, (Aa2//AA/) $287.895 million of unlimited tax school building bonds, Series 2022, with 5s of 8/2023 at 1.54%, 5s of 2027 at 2.16%, 5s of 2032 at 2.70%, 5s of 2037 at 3.11%, 5s of 2042 at 3.34%, 5s of 2047 at 3.39% and 5s of 2052 at 3.49%, callable 8/15/2032.

Citigroup Global Markets priced for the Trinity River Authority of Texas (/AAA/AAA/) $132.590 million of regional wastewater system revenue bonds, Series 2022, with 5s of 8/2024 at 1.90%, 5s of 2027 at 2.24%, 5s of 2032 at 2.79%, 3.5s of 2037 at 3.59% and 3.5s of 2042 at 3.875%, callable in 8/1/2032.

J.P. Morgan Securities priced for the City of Phoenix Civic Improvement Corporation (Aa2/AAA/AA+/) $131.650 million of subordinated excise tax revenue bonds, Series 2022, with 5s of 7/2025 at 1.85%, 5s of 2027 at 2.02%, 5s of 2032 at 2.60%, 5s of 2037 at 3.07%, 5s of 2042 at 3.40% and 5s of 2047 at 3.51%, callable 7/1/2032.

UBS Financial Services priced for the Massachusetts Port Authority (Aa2/AA/AA/) $121.595 million of AMT green revenue bonds, Series 2022-A, with 5s of 7/2028 at 2.78%, 5s of 2032 at 3.23%, 5s of 2037 at 3.63% and 5s of 2042 at 3.75%, callable 7/1/2032.

In the competitive market, Colorado sold $295 million of education loan program tax and revenue anticipation notes, Series 2022A, to Wells Fargo Bank with 5s of 6/2023 at 1.49%, noncall.

The Miami-Dade County Public Schools, Florida, (Aa3/AA//) sold $270.800 million of general obligation school bonds, Series 2022A, to BofA Securities, with 5s of 3/2023 at 1.45%, 5s of 2027 at 2.16%, 5s of 2032 at 2.75%, 5s of 2042 at 3.37%, 5s of 2047 at 3.53% and 5s of 2052 at 3.61%, callable in 2/15/2032.

Tax-exempt municipals “rallied well last week despite consistent losses by USTs Wednesday to Thursday, a strong June employment reading and Fed minutes that show the Federal Open Market Committee’s willingness to continue with aggressive rate hikes in the near term,” said Matt Fabian, a partner at Municipal Market Analytics in their weekly Outlook report.

Munis were instead focused on internal supply issues, he said, “with a holiday-shortened primary calendar skimpy versus whatever July 1 reinvestment demand that had not yet been put to work."

Further, June’s 40 to 50 basis point back-up in nominal benchmark triple-A benchmark yields “had justifiably been seen as creating value for medium- and long-term income buyers, value that, in a world of chronically scarce product cannot be counted on to persist.”

And it hasn’t, he said. Between the last few weeks of June and the first week of July, he noted “60-80% of early June losses have been reversed,” leaving triple-A benchmark yields only 10 to 20 basis points away from second quarter lows, according to Fabian.

“This may show amplified volatility, especially for [triple-A] curves evaluations that, since 2016 depend more on jittery 2% and 3% coupons in a less-dealer-intermediated market," he said. “But it could also be highlighting a market support level (at 3.5%) created by the many non-fund buyers with cash or temporary short-term/ETF positions that need a more permanent allocation.”

Last week’s gains came amid another weekly fund outflow and just after primary dealers had ended the second quarter of 2022 with their smallest inventories in a year.

This week things may get more difficult, with relative value ratios and MMA’s valuation metrics showing munis “as overbought versus recent averages, with the 30-day supply calendar hitting a lofty $17 billion and with the expected headlines about state and local pension funding challenges now emerging,” he said.

Munis have somewhat underperformed relative to USTs and ratios have lagged a little bit, said Craig Brothers, senior portfolio manager and co-head of fixed income at Bel Air Investment Advisors.

Munis have been steady to firmer in spots over the past few trading sessions, something he credits to the July effect, with almost $50 billion of cash coming in from redemptions and coupons, and the Treasury market rally.

Those factors are giving munis some stability, but the market isn’t ready to rally more than a couple of basis points, Brothers said. It’s a function of the whipsaw nature of USTs and believes there needs to be an “even bigger” UST rally before issuers “would be able to mark their stuff up step-for-step with the Treasury market."

“It feels a bit like munis are trading a little bit more in their own world because of the amount of cash that's come in and the reduction and redemptions by the mutual funds,” he said.

Upcoming economic indicators this week could move yields, though Brothers thinks the way the UST market has been trading, the market has seen highs in yields.

“That's not to say that you can still see outlier prints that question whether the Fed has been aggressive enough, but the flattening of the curve, tells you we're getting close to the market pricing in inflation,” he said.

“So the Fed is an outlier being hawkish, but there are limits to their hawkishness, as you're seeing a flattening of the yield curve. Inflation will probably be north of the [Fed’s] target," Brothers said. "Unless they push the economy into a recession, they're not going to be able to hike enough to make inflation go back to where they wanted to sort of doing, being way more aggressive than the market expects.”

Muni CUSIP requests rise

Municipal request volume rose in June, following an increase in May, according to CUSIP Global Services. For muni bonds specifically, there was an increase of 1.1% month-over-month, though requests are down 17.5% year-over-year.

The aggregate total of identifier requests for new municipal securities, including municipal bonds, long-term and short-term notes, and commercial paper, climbed 10.6% versus May totals. On a year-over-year basis, overall municipal volumes were down 16.3%.

Secondary trading

Delaware 5s of 2023 at 1.31%-0.97% versus 1.35%-1.33% Monday. Maryland 5s of 2023 at 1.31% versus 1.36%-1.33% Monday. Washington 5s of 2024 at 1.72% versus 1.74% Monday. California 5s of 2025 at 1.85%-1.86% versus 1.88%-1.89% Monday and 1.94%-1.93% on 7/7.

Triborough Bridge and Tunnel Authority 5s of 2028 at 2.24% versus 2.25%-2.22% Monday and 2.26%-2.25% on 7/7. Georgia 5s of 2028 at 2.15%-2.17%. California 5s of 2029 at 2.27%-2.28%.

New York City 5s of 2032 at 2.90%-2.88%. Triborough Bridge and Tunnel Authority 5s of 2033 at 2.89%-2.87%. Montgomery County, Pennsylvania 5s of 2.67% versus 2.66% Monday.

NYC TFA 5s of 2037 at 3.26% versus 3.29%-3.31% on 7/6. LA DWP 5s of 2039 at 3.05%-3.01%.

LA DWP 5s of 2041 at 3.14%. Washington 5s of 2044 at 3.21% versus 3.26% Monday.

Illinois Finance Authority 5s of 2051 at 3.83% versus 3.84% on 7/6. LA DWP 5s of 2052 at 3.37% versus 3.31% Monday and 3.35% on 7/6.

AAA scales

Refinitiv MMD’s scale was bumped three to five basis points at the 3 p.m. read: the one-year at 1.44% (-3) and 1.74% (-5) in two years. The five-year at 2.00% (-5), the 10-year at 2.44% (-5) and the 30-year at 2.98% (-3).

The ICE municipal yield curve was firmer in spots 10 years and in: 1.44% (-3) in 2023 and 1.73% (-4) in 2024. The five-year at 1.96% (-4), the 10-year was at 2.48% (-2) and the 30-year yield was at 3.03% (+1) at a 4 p.m. read.

The IHS Markit municipal curve was unchanged: 1.44% (-3) in 2023 and 1.76% (-5) in 2024. The five-year at 2.00% (-5), the 10-year was at 2.44% (-5) and the 30-year yield was at 2.98% (-3) at a 3 p.m. read.

Bloomberg BVAL was four basis points: 1.45% (-4) in 2023 and 1.73% (-4) in 2024. The five-year at 2.03% (-4), the 10-year at 2.49% (-4) and the 30-year at 2.99% (-4) near the close.

Treasuries were firmer.

The two-year UST was yielding 3.046% (-3), the three-year was at 3.081% (-3), the five-year at 3.013% (-4), the seven-year 3.021% (-5), the 10-year yielding 2.953% (-4), the 20-year at 3.380% (-6) and the 30-year Treasury was yielding 3.134% (-4) at 3:30 p.m.

Primary to come:

The Colorado Health Facilities Authority (/AA+//) is set to price Wednesday $1.075 billion of revenue bonds, consisting of $478.945 million of bonds, Series 2022A; $197.860 million of long-term bonds, Series 2022B; $197.850 million of refunding long-term bonds, Series 2022C and $200 million of refunding floating rate notes, Series 2022D. J.P. Morgan Securities.

Harris County, Texas, (Aaa//AAA/) is set to price Wednesday $425.025 million, consisting of $102.725 million of tax and subordinate lien revenue refunding bonds, Series A; $233.220 million of unlimited tax road refunding bonds, Series B and $89.080 million of permanent improvement refunding bonds, Series C. Estrada Hinojosa & Co.

The Massachusetts Development Finance Agency (A1///) is set to price Thursday $361.510 million of Northeastern University issue revenue refunding bonds, Series 2022. Morgan Stanley & Co.

The Klein Independent School District, Texas, (Aaa/AAA//) is set to price Wednesday $145.340 million of unlimited tax schoolhouse bonds, Series 2022, serials 2023-2047, insured by the Permanent School Fund Guarantee Program. Ramirez & Co.

Competitive:

The New York State Thruway Authority is set to sell $154.225 million of taxable state personal income tax revenue bonds, Series 2022B, at 10 a.m. eastern Wednesday.

The New York State Thruway Authority is set to sell $360.365 million of state personal income tax revenue bonds, Series 2022A, Bidding Group 4, at 12 p.m. Wednesday.

The New York State Thruway Authority is set to sell $364.250 million of state personal income tax revenue bonds, Series 2022A, Bidding Group 5, at 12:30 p.m. Wednesday.

The New York State Thruway Authority is set to sell $428.870 million of state personal income tax revenue bonds, Series 2022A, Bidding Group 3, at 11:30 a.m. Wednesday.

The New York State Thruway Authority is set to sell $430.380 million of state personal income tax revenue bonds, Series 2022A, Bidding Group 1, at 10:30 a.m. Wednesday.

The New York State Thruway Authority s set to sell $455.885 million of state personal income tax revenue bonds, Series 2022A, Bidding Group 2, at 11 a.m. Wednesday.

Gabriel Rivera contributed to this report.