Brightline West said Thursday it has reached a tentative agreement with the majority of its bondholders for a debt exchange that would give the company time to secure fresh financing.

The announcement comes ahead of a

The company filed a

As part of the deal, Brightline West has committed to raise at least $400 million in equity by March 31, 2026. Of that, $250 million would be used to redeem Series 2025B Bonds and the remainder would be used to continue to advance the project, the company said in a separate press release.

"These transactions are designed to allow Brightline West adequate time to obtain the additional equity funding, debt financing and federal loans for the project while enabling construction to progress," Brightline said.

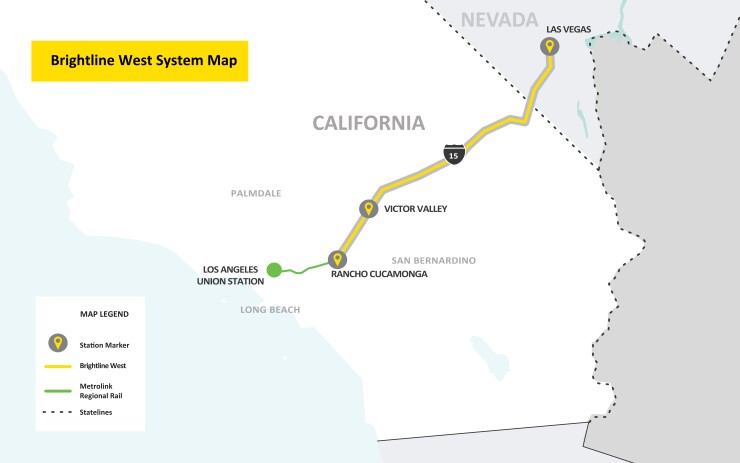

DesertXpress Enterprises LLC, which does business as Brightline West and is owned by Fortress Investment Group, aims to own and operate the nation's first privately owned, all-electric high-speed train, running a 218-mile route between Las Vegas and a suburb of Los Angeles. The project carries a price tag of $21.5 billion.

Brightline West

The deal also called for the company to nail down a $6 billion bank facility and $1 billion of equity. In October, Brightline

A similar strain faced its companion project in Florida, which in August

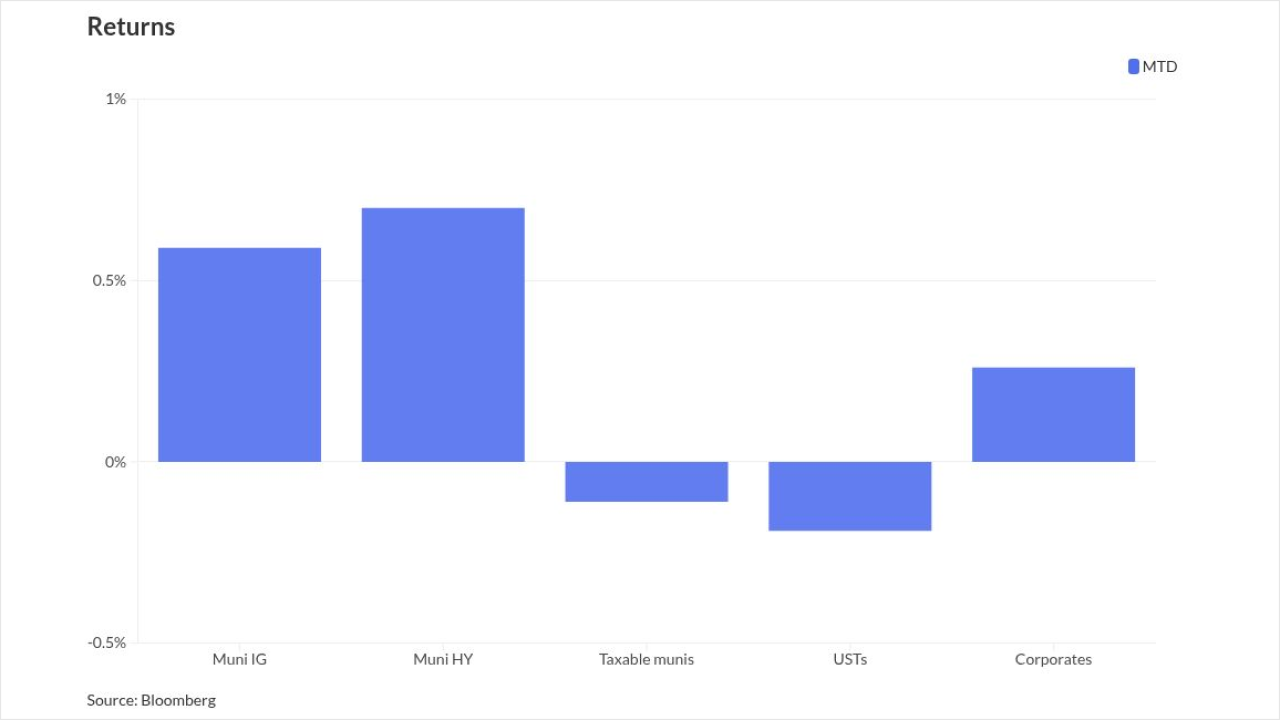

The financing challenges facing both Brightline projects, which represent some of the most liquid and prominent names in the high-yield municipal market, have translated into falling bond prices over the last several months. In a Friday note, Barclays said that Brightline West bonds "increased slightly due to the exchange announcement," and have "rallied more than 6-7pts from the mid-October lows."

On Friday, $4 million of senior subordinate bonds issued through the California Infrastructure and Economic Development Bank with a 9.5% coupon due in 2065 traded at 86. That's up from 79 on Nov. 17.

Barclays said the debt swap "removes a major overhang for the muni HY market," adding that Brightline represents just over 2.5% of the high-yield index. "Brightline will be challenged in the next 12-24 months, and we cannot dismiss the probability of a credit event and debt restructuring next year," the bank said.

Herbert Smith Freehills Kramer LLP is representing the majority bondholders. First Eagle Investments, BlackRock, Invesco and Alliance Bernstein are large Brightline West holders.