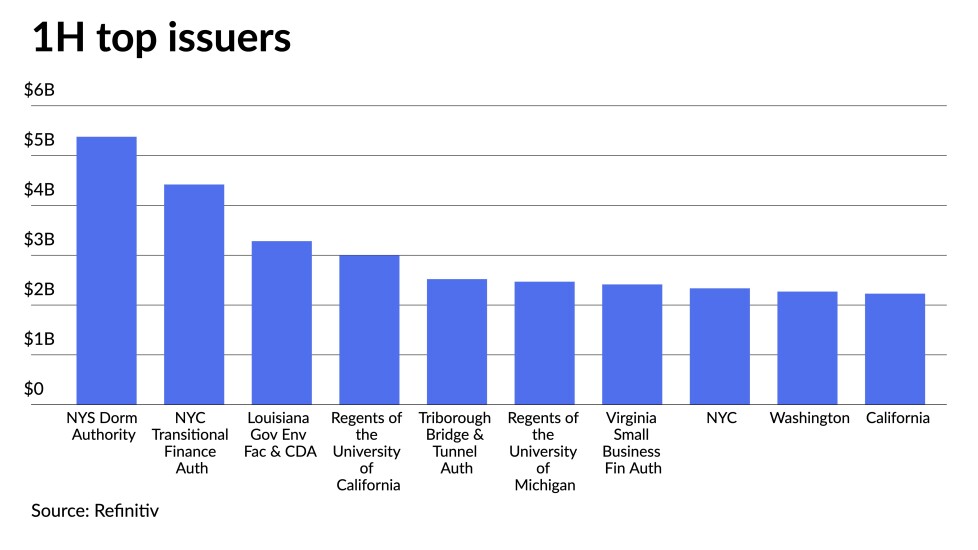

The Dormitory Authority of the State of New York headlined the top 10 issuers of the first half of 2022, almost all of which outperformed their par amounts year-over-year.

Five new issuers entered the top 10, two of which did not sell debt in the first half of 2021. The five issuers who fell out of the top 10 — the state of Connecticut, the New York City Housing Development Corporation, the Port Authority of New York and New Jersey, the California Statewide Communities Development Authority Community Improvement Authority and the New Jersey Transportation Trust Fund Authority — are no longer among the top 20 issuers.

Most top 10 issuers for 1H are from New York and California, with four from New York and two from California.