-

The City Council will vote Tuesday night on whether to approve bonds for the formerly stalled project.

March 27 -

Municipals' strong fundamentals and high credit quality combined with market inefficiencies and dislocations present opportunities.

March 27 -

Yields on top-rated municipal bonds fell as much as nine basis points on Friday as bank contagion fears resurfaced and investors looked to safe-haven securities. The primary calendar is rebounding, with volume rising to an estimated $5.4 billion in the week ahead.

March 24 -

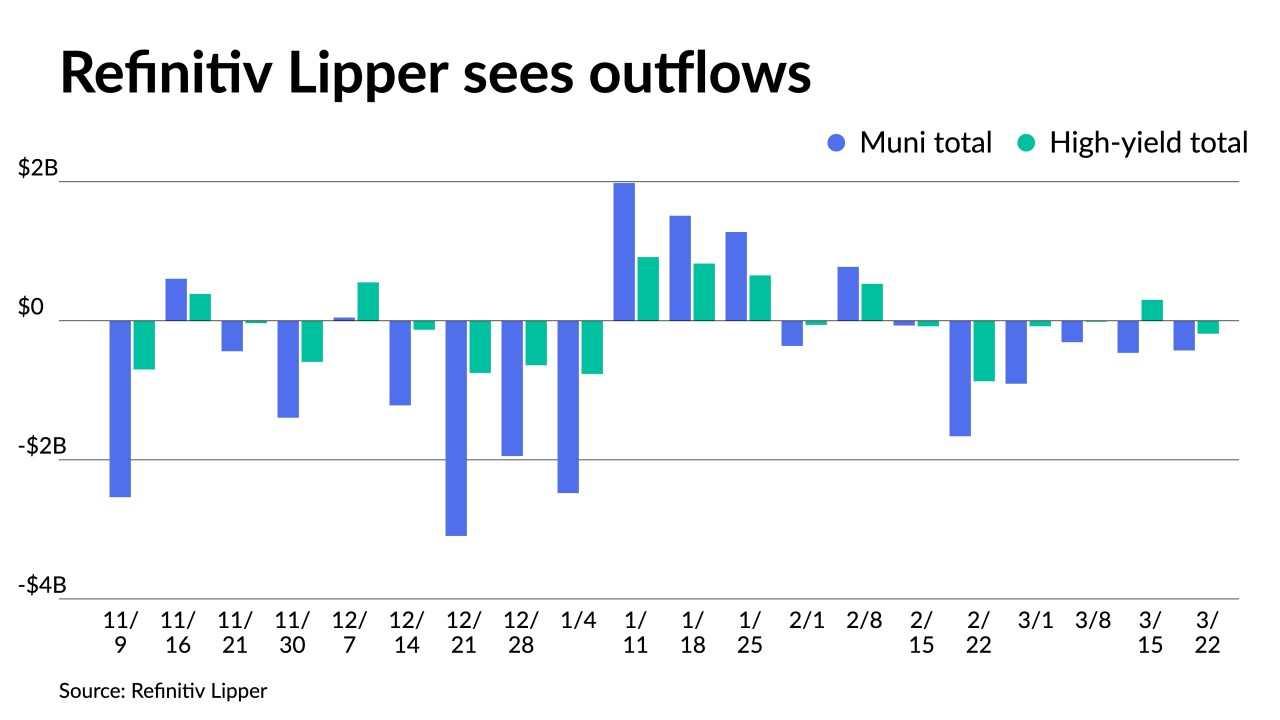

Outflows continued as Refinitiv Lipper reported $427.082 million was pulled from municipal bond mutual funds in the week that ended Wednesday after $461.123 million of outflows the week prior.

March 23 -

"In short, it appears that the end of the current tightening cycle is coming into view," said Wells Fargo Securities Chief Economist Jay Bryson.

March 22 -

After a tumultuous week, expect another ahead, said Matt Fabian, a partner at Municipal Market Analytics.

March 21 -

The state plans to enter the market before the fiscal year closes June 30th with eyes turned to Fitch and whether it will follow Moody's and S&P with an upgrade.

March 21 -

The banking sector crisis caused a flight-to-quality bid in USTs last week.

March 20 -

Investors will be greeted Monday with a new-issue calendar estimated at $4.064 billion.

March 17 -

The collapse of Silicon Valley Bank and Signature Bank clouds the economic landscape and complicates monetary policy decisions but it's a long way off from the troubles banks and broker-dealers faced in the 2008 financial crisis.

March 17 -

Outflows continued as Refinitiv Lipper reported $461.123 million was pulled from municipal bond mutual funds in the week that ended Wednesday after $307.815 million of outflows the week prior.

March 16 -

"The main question for investors recently has been: will we see bank selling of municipals that exerts pressure on the market, and what kind of market effects could occur," Barclays strategists said.

March 15 -

"The muni market is no different than others, where fear and greed drive the trends," said Peter Delahunt, StoneX's managing director.

March 14 -

The transportation revenue bond sale comes as legislative work on a new budget package is ramping up with the GOP expected to craft its own operating and capital spending plans.

March 13 -

Triple-A benchmarks have fallen five to 10 basis points, depending on the scale.

March 13 -

Investors will be greeted Monday with a new-issue calendar estimated at $6.041 billion.

March 10 -

A $3.52 billion Texas Natural Gas Securitization Finance Corp. deal includes a make-whole redemption over three years to call bonds if the state appropriates funds to pay them off.

March 10 -

Outflows continued as Refinitiv Lipper reported $307.815 million was pulled from municipal bond mutual funds in the week that ended Wednesday after $905.030 million of outflows the week prior.

March 9 -

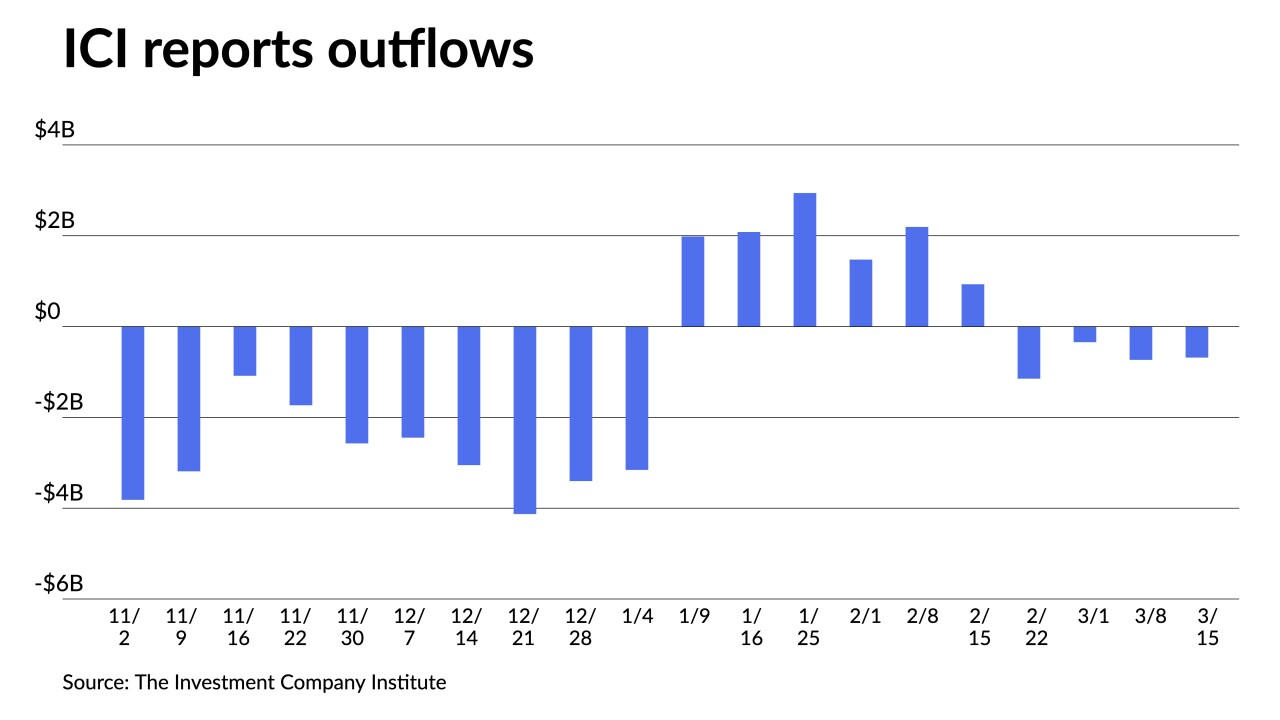

Outflows lessened, with the Investment Company Institute reporting investors pulled $344 million from mutual funds in the week ending March 1, after $1.148 billion of outflows the previous week.

March 8 -

The two-year UST is now a full point above the 10-year UST, something that hasn't happened since 1981.

March 7