Municipals were slightly firmer in spots Thursday, while U.S. Treasuries extended their rally once more and equities ended up.

The two-year muni-UST ratio was at 65%, the three-year at 66%, the five-year at 68%, the 10-year at 69% and the 30-year at 93%, according to Refinitiv MMD's 3 p.m. ET read. ICE Data Services had the two at 63%, three at 64%, the five at 64%, the 10 at 69% and the 30 at 94% at 4 p.m.

Federal Reserve Board Chairman Jerome Powell "remained on the inflation fighting path [Wednesday], despite recent bank failures and financial stability concerns," said José Torres, senior economist at Interactive Brokers.

The Federal Open Market Committee's 25-basis point rate hike "was accompanied by Powell's stern warnings that a slider could be the next step required for striking out inflation because recent economic data has been hotter than expected," he said.

"Powell had to walk a fine line," Torres noted.

"Raising rates aggressively could have risked worsening the banking crisis, but taking a dovish approach could have had two drawbacks — it would have signaled that the Fed believes the banking system is too fragile to handle the stress of higher interest rates and it would allow strong inflation to continue," he said.

Powell warned "the Fed has to do more to contain inflation, a concern reinforced this morning when the jobless claims report for the week" ended March 18 showed initial claims fell to 191,000, below analysts' expectations of 197,000, according to Torres.

Despite Powell's hawkish tone, markets rallied Thursday "as investors believe the Fed is finished hiking rates and will begin cutting them as soon as July," he said. Equities are higher, erasing Wednesday's steep losses. The 2-year UST yield "is hovering at its lowest level since September," down 15 bps to 3.791% after falling roughly 25 bps the day prior. The 10-year UST is down six basis points to 3.384%, and the 30-year UST is essentially flat at 3.660%

Following the market volatility from the banking sector crisis, CreditSights strategist Pat Luby said the slowdown in the new-issue market has given muni investors a chance to catch their breath and survey market conditions a little.

Next week's calendar, he said, has some interesting deals, including $1.19 million of GOs from New York City, which will create more opportunities for investors to step in.

"If you take away the overlay of what's going on with the Fed, this time of year is slow," he said, adding technicals are weak and there's not a lot of reinvestment demand. Luby said April 1 will provide a provide a little bit of support.

"If new-issue volume continues to tick up, there could be some spread widening and some opportunities for investors to pick up some good deals," he said. "I would expect that most investors will be paying careful attention next week. If the volatility means better yields and wider spreads, they'll draw some money in off the sidelines."

He said the SVB collapse and the continuing banking crisis does not appear to be systematic.

"However, it appears to have induced some behavioral change among investors to be more aware of counterparty risk," he said.

This is visible in what's happening with VRDOs, Luby said. The SIMFA rate on Wednesday was reset at 4.35%, which was up from 2.62%. He said that's the highest it's been in quite a while.

"That increase is way more than can be attributed to the change in the Fed funds target rate," he said, "The balance of the VRDOs that are on offer in the Street is well above average. So I think what's going on is a combination of holders are probably being more aware of diversifying their concentration in letter of credit providers and liquidity providers. Plus, we're coming into the very end of the first quarter of the year," Luby said. "And I wouldn't be surprised if some investors would actually rather hold actual cash than VRDOs, so that's kind of a change in the market."

Investors have to be aware of "how they're taking exposure," he said.

As the end of the first quarter approaches, Luby doesn't foresee any muni investors acting with urgency.

"If there are our deals that get priced to move, there's probably some opportunistic money," he said.

He expects long-duration bonds to underperform as there are fewer buyers for them and the unsettled expectations for inflation and Fed policy do not encourage investors to want to take on excess duration.

Redemptions in March were below those of February, and April redemptions will be even lower, he said.

"This is also the time of year ordinarily, we would expect new-issue volume to start ticking up," Luby said. But, he said, refunding issuance won't start picking up until the market is convinced Fed tightening is done.

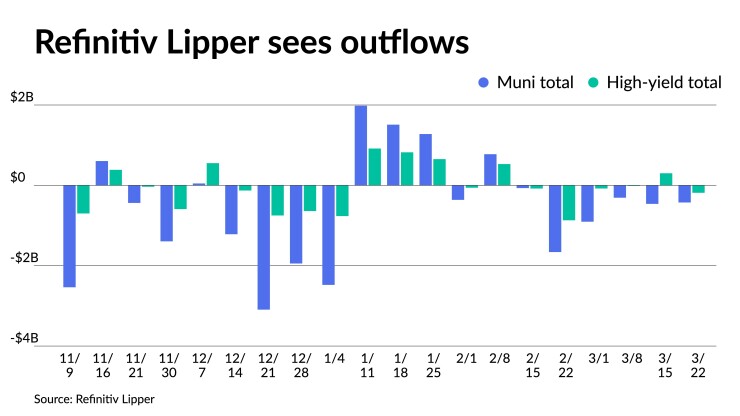

Outflows continued as Refinitiv Lipper reported $427.082 million was pulled from municipal bond mutual funds in the week that ended Wednesday after $461.123 million of outflows the week prior.

High-yield saw $184.920 million of outflows after $300.729 million of inflows the week prior, while ETFs saw inflows of $19.491 million after $83.364 million of outflows the previous week.

Secondary trading

Maryland 5s of 2024 at 2.60% versus 2.59% Wednesday. Minnesota 5s of 2024 at 2.56% versus 2.53%-2.50% on 3/17. North Carolina 5s of 2026 at 2.43%-2.45%.

DASNY 5s of 2028 at 2.30%-2.29%. Connecticut 4s of 2029 at 2.52% versus 2.61% Wednesday. Baltimore County, Maryland, 5s of 2029 at 2.35% versus 2.38% Wednesday and 2.60% original on 3/8.

Wisconsin DOT 5s of 2032 at 2.40% versus 2.57% original on 3/15. Maryland 5s of 2034 at 2.47%-2.46% versus 2.548% original on 3/16. St. Paul water, Minnesota, 5s of 2034 at 2.60%.

Washington 5s of 2048 at 3.71%-3.70% versus 2.64%-3.65% on 3/15 and 3.78% on 3/10. San Diego County Water Authority 5s of 2052 at 3.62% versus 3.62% Wednesday and 3.65% Monday.

AAA scales

Refinitiv MMD's scale was bumped up to two basis points. The one-year was at 2.58% (unch) and 2.49% (-2) in two years. The five-year was at 2.33% (-2), the 10-year at 2.36% (-2) and the 30-year at 3.42% (unch) at 3 p.m.

The ICE AAA yield curve was firmer two years and out: 2.61% (+3) in 2024 and 2.52% (-1) in 2025. The five-year was at 2.31% (-3), the 10-year was at 2.36% (-4) and the 30-year yield was at 3.44% (-3) at 4 p.m.

The IHS Markit municipal curve was bumped up to two basis points: 2.58% (unch) in 2024 and 2.49% (-2) in 2025. The five-year was at 2.32% (-2), the 10-year was at 2.36% (-2) and the 30-year yield was at 3.40% (unch) at a 4 p.m. read.

Bloomberg BVAL was little changed: 2.54% (-1) in 2024 and 2.49% (unch) in 2025. The five-year at 2.32% (-1), the 10-year at 2.37% (unch) and the 30-year at 3.41% (+1).

Treasuries rallied.

The two-year UST was yielding 3.791% (-15), the three-year was at 3.586% (-15), the five-year at 3.396% (-13), the seven-year at 3.406% (-9), the 10-year at 3.384% (-6), the 20-year at 3.795% (-1) and the 30-year Treasury was yielding 3.660% (+1) at 4 p.m.

FOMC continued

Analysis of the Federal Open Market Committee meeting continued.

The dot plot suggesting the same year-end rate as the previous one "is notable given Chair [Jerome] Powell, in testimony before Congress just days before the failure of Silicon Valley Bank, suggested the Fed would be open to a 50 bp rate hike and that the terminal rate would likely need to rise above the level the Fed had signaled in its December SEP (5.1%)," said Mickey Levy, chief economist for Americas and Asia at Berenberg Capital Markets, a member of the Shadow Open Market Committee

This reflects, in part, "the Fed's caution amid heightened stresses within the banking sector, but is also an acknowledgment that tightening credit conditions are analogous to rate hikes, albeit with wide bands of uncertainty around the ultimate effects," he said.

"No one believed Powell's comment that 'If we need to raise rates higher, we will,'" said Edward Moya, senior market analyst for the Americas at OANDA. "The outlook is not looking good as credit is tightening, banks are going to be hesitant to lend, and banking stress won't be easily solved."

Powell's defense of the banking industry also drew comment.

"The only time anyone feels the need to say that the banking system is 'sound and resilient' is if it's not," said Bryce Doty, senior vice president at Sit Investment Associates.

But the Fed statement appears contradictory, as it then says, "recent developments are likely to result in tighter credit conditions for households and businesses to weigh on economic activity, hiring, and inflation," he noted.

The Fed appears to be happy "to welcome in an era of credit crunch which we know will lead to a very hard landing," according to Doty.

The main takeaway from Powell's press conference for Jason Brady, president & CEO of Thornburg Investment Management, was: "when Chair Powell reiterated that there are real costs to bringing down inflation and higher costs for failing to bring down inflation."

Powell's statement, he said, "was a downbeat and somber tune that the economy appears challenged while inflation and unemployment remain too hot."

The Fed leaves no uncertainty it "will tip the economy into recession if that's what it takes," Brady said.

The March SEP "reinforces the notion that the Fed expects the economy will veer dangerously close to recession," Levy said.

"The dispersion around the median policy rate projection in the SEP also increased," he said, with several "FOMC participants signaling further aggressive rate hikes would be required, with four participants projecting a terminal rate above 5.5%. This compares to two participants in December."

With Powell "continuing to emphasize the Fed's data dependence, should the effect of tightening credit on economic activity turn out to be more moderate than the Fed currently expects, and if labor markets remain resilient and inflation fails to subside, there is still considerable support among the ranks of the FOMC for additional policy tightening," Levy noted.

"The Fed's job is not yet done on inflation, and Chair Powell was clear to state that rate cuts are 'not in our base case' for this year," said Robert Bayston, head of U.S. government and mortgage portfolios at Insight Investment. "Despite dramatic repricing of market expectations for rate cuts later in the year, we currently believe they remain an unlikely prospect given sticky inflation pressures."

"A bullish pivot likely doesn't await investors, but by delivering a 25-basis point rate hike, the Fed may have decreased the chance of a policy error that could send bond yields markedly higher," said Jason England, global bonds portfolio manager at Janus Henderson Investors.

Mutual fund details

Refinitiv Lipper reported $427.082 million of municipal bond mutual fund outflows for the week that ended Wednesday following $461.123 million of outflows the previous week.

Exchange-traded muni funds reported inflows of $19.491 million after outflows of $83.364 million in the previous week. Ex-ETFs, muni funds saw outflows of $446.574 million after outflows of $377.759 million in the prior week.

Long-term muni bond funds had outflows of $104.390 million in the latest week after inflows of $162.139 million in the previous week. Intermediate-term funds had outflows of $78.792 million after outflows of $171.955 million in the prior week.

National funds had outflows of $365.933 million after outflows of $440.843 million the previous week while high-yield muni funds reported outflows of $184.920 million after inflows of $300.729 million the week prior.