-

Total October volume was $24.951 billion in 510 deals versus $41.811 billion in 1,068 issues a year earlier, according to Refinitiv data.

October 31 -

The upcoming Federal Open Market Committee meeting on Tuesday and Wednesday has led to a lighter new-issue calendar with $2.72 billion on tap.

October 28 -

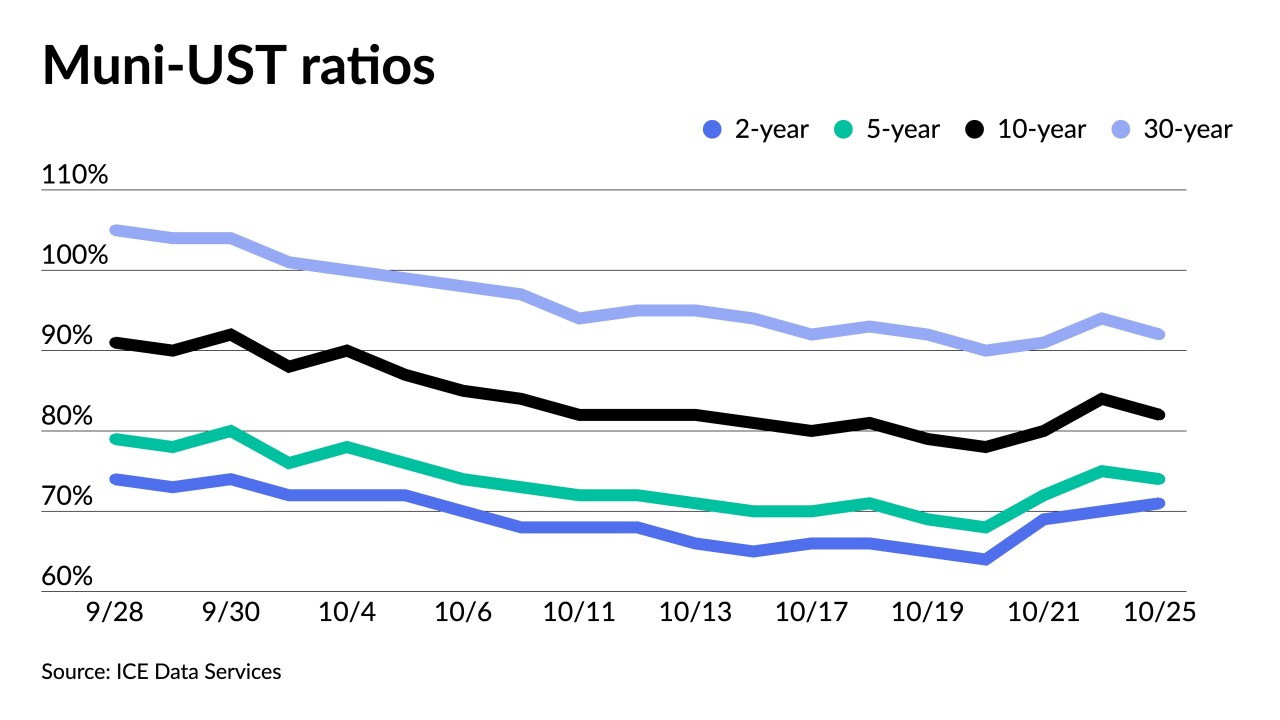

Municipal to UST ratios have risen this week with the 10-year approaching 90% and the 30-year topping 100%.

October 27 -

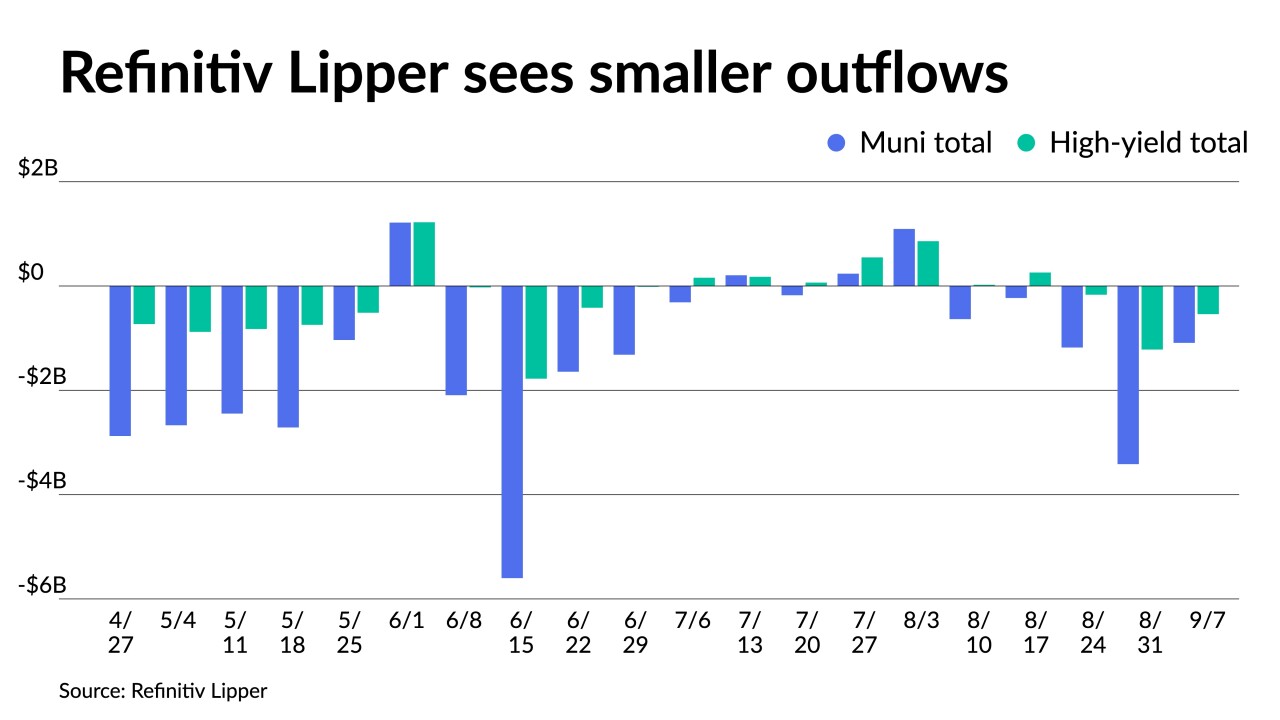

Outflows continued as investors pulled $3.876 billion from mutual funds in the week ending Oct. 19 after $4.532 billion of outflows the previous week, according to the Investment Company Institute.

October 26 -

The Metropolitan Pier and Exposition Authority will restructure a portion of fiscal 2023 debt service amid tax collections still recovering from the pandemic.

October 26 -

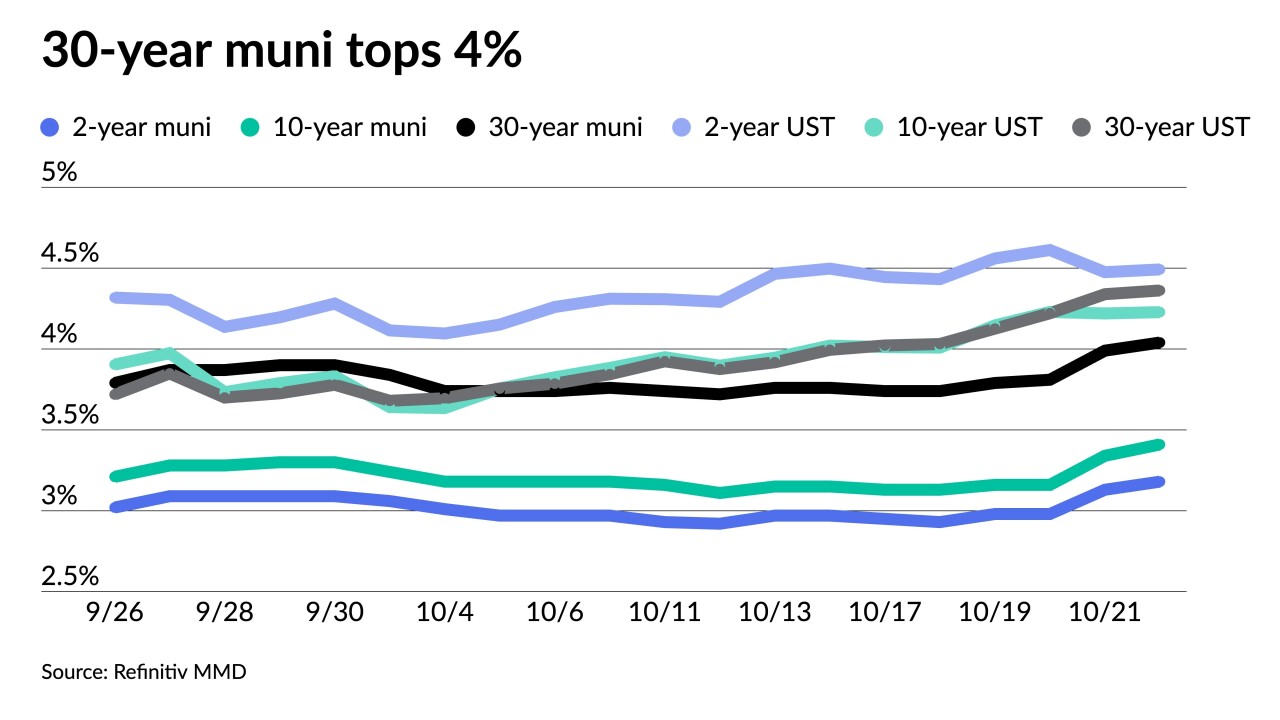

While muni performance has turned negative for October, "the asset class is significantly outperforming UST," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

October 25 -

As issuers push against a financial disclosure bill pending in the Senate, some buy-siders say standardized disclosure would attract more investors and boost liquidity.

October 25 -

"Municipal market performance has improved, but the bumpy road continues as investors remain uncertain about the interest rate environment," said Nuveen's Head of Municipals John Miller.

October 24 -

The zoo's parent received double-A-level ratings with the bonds rated one to two notches lower as a result of appropriation risks.

October 24 -

In its analysis of primary market data from 2019 to 2021, the MSRB showed that market participants fled competitive offerings during the COVID period and preferred private placements.

October 24