-

Build America Mutual insured the majority of the maturities in the West Contra Costa Unified School District GO deal.

October 25 -

Geography is playing a role in financial health as debt issuance rises.

October 24 -

The state lacks the money to widen the traffic-clogged highway on its own, officials said.

October 24 -

Up to $475 million of unrated revenue bonds will be sold to purchase, expand, and renovate the Stanley Hotel, which inspired Stephen King's The Shining.

October 24 -

The Chicago City Council this week approved a plan to refinance $1.5 billion of the city's debt. The city expects to issue the bonds in the fourth quarter.

October 24 -

Despite studies showing questionable financials, municipalities continue to build

October 24 -

Market participants warned of the law's potential harm to a market that's famously bespoke and self-regulated.

October 23 -

The top five bond financings came in above $7 billion.

October 22 -

The public-private partnership that took over four Puerto Rico toll roads following the territory's bankruptcy is gearing up to sell municipal bonds.

October 18 -

The city faces no monetary penalty or monitorship in the final judgment in what those involved are calling an unprecedented move for SEC litigation.

October 17 -

After the school board resigned, the rating agency put Chicago Public Schools on notice that it will watch how its tricky financial situation is handled.

October 17 -

The groups are taking advantage of the Committee's invitation to address tax teams.

October 16 - Negotiated Bond Sales

Intermountain Power Agency's bond sale comes after Utah lawmakers tweaked a state law to address concerns about its impact on the agency's outstanding debt.

October 16 -

The board has requested comment on additional disclosures that state and local governments would need to provide in financial statements but faces a long timeline for implementation.

October 15 -

-

-

-

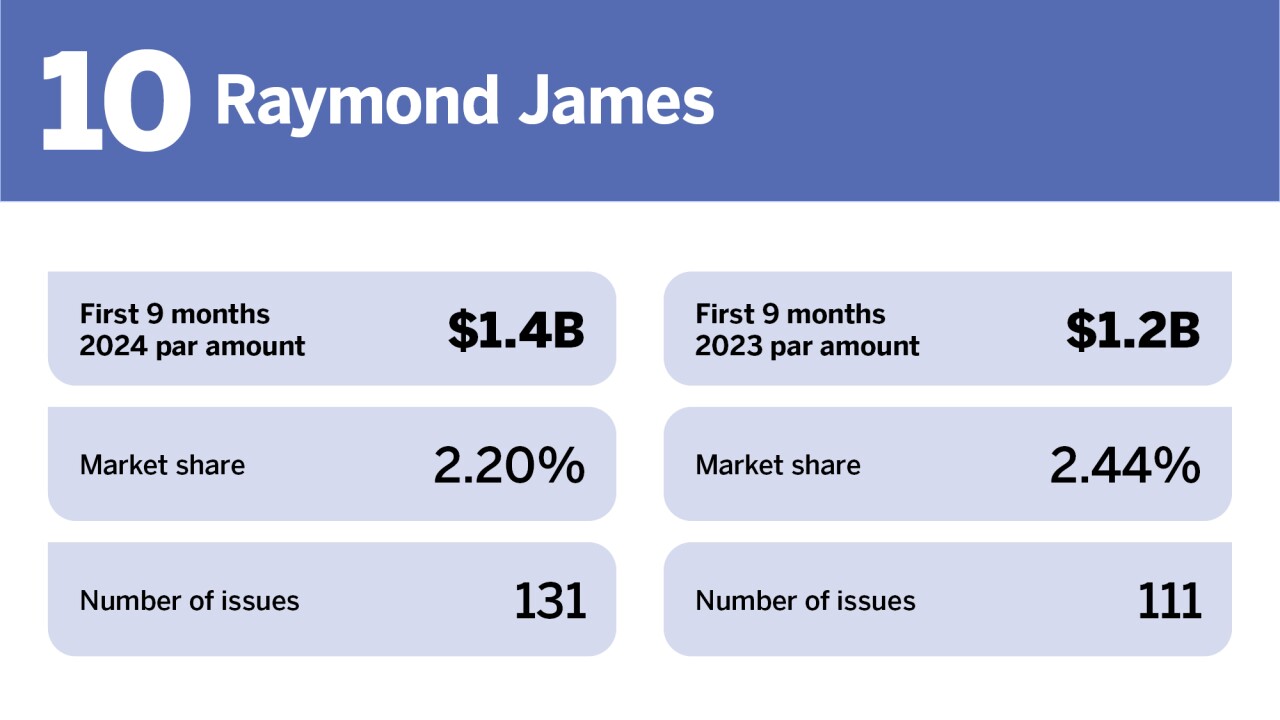

As the underwriter landscape changes, so does the competitive market.

October 15 -

Municipal triple-A yield curves played catch up to USTs Friday to close out a week of more mixed economic data that has economists constantly reevaluating their Federal Reserve policy expectations with little consensus.

October 11 -

Municipal bond insurers wrapped $28.921 billion in the first three quarters 2024, a 26.8% increase from the $22.814 billion insured in the first three quarters of 2023, according to LSEG data.

October 11