-

The new-issue market saw deals from Houston, the Illinois Finance Authority and the City and County of San Francisco, Calif., hit the screens.

September 17 -

Duane McAllister and Lyle Fitterer of Baird talk with Chip Barnett about low rates and credit quality. They discuss the best scenarios for investors and issuers in these challenging times. (20 minutes)

September 17 -

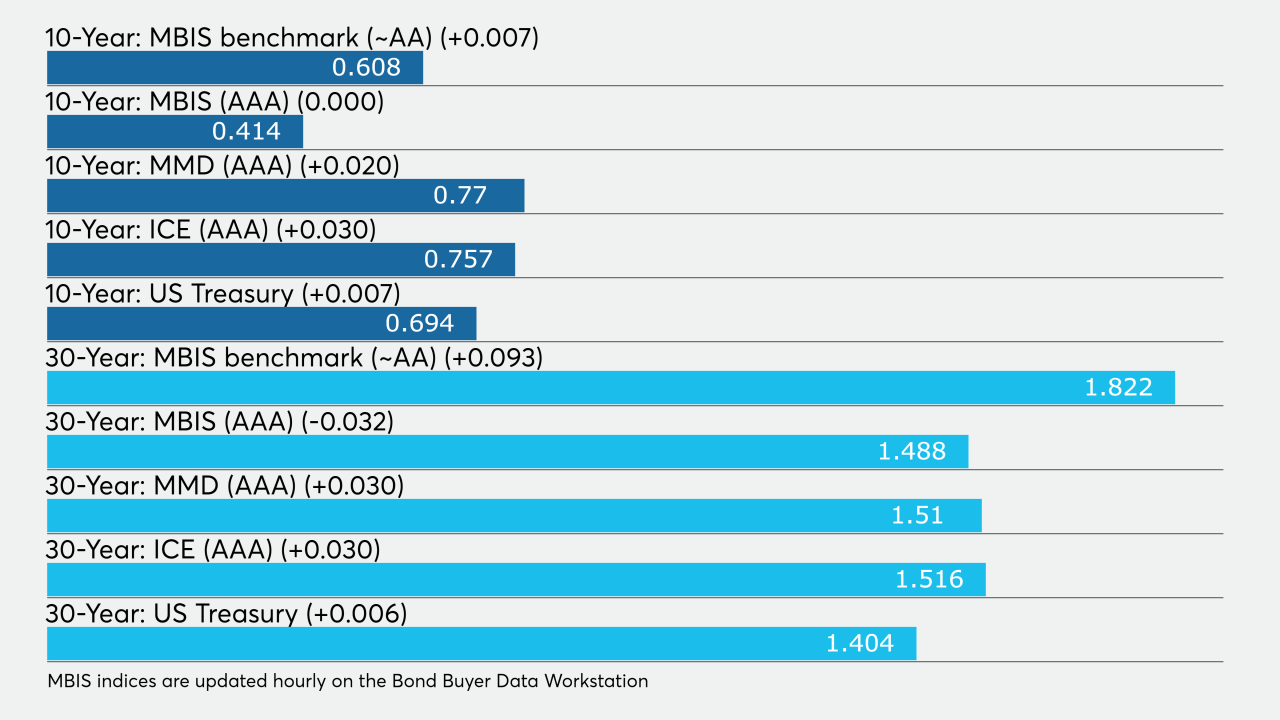

Longer-dated municipals strengthened Thursday as transportation deals from Oregon, Texas and Atlanta issuers came to market.

September 10 -

Muni yields fell a basis point on some AAA curves Wednesday as deals from Maryland and California hit the screens.

September 9 -

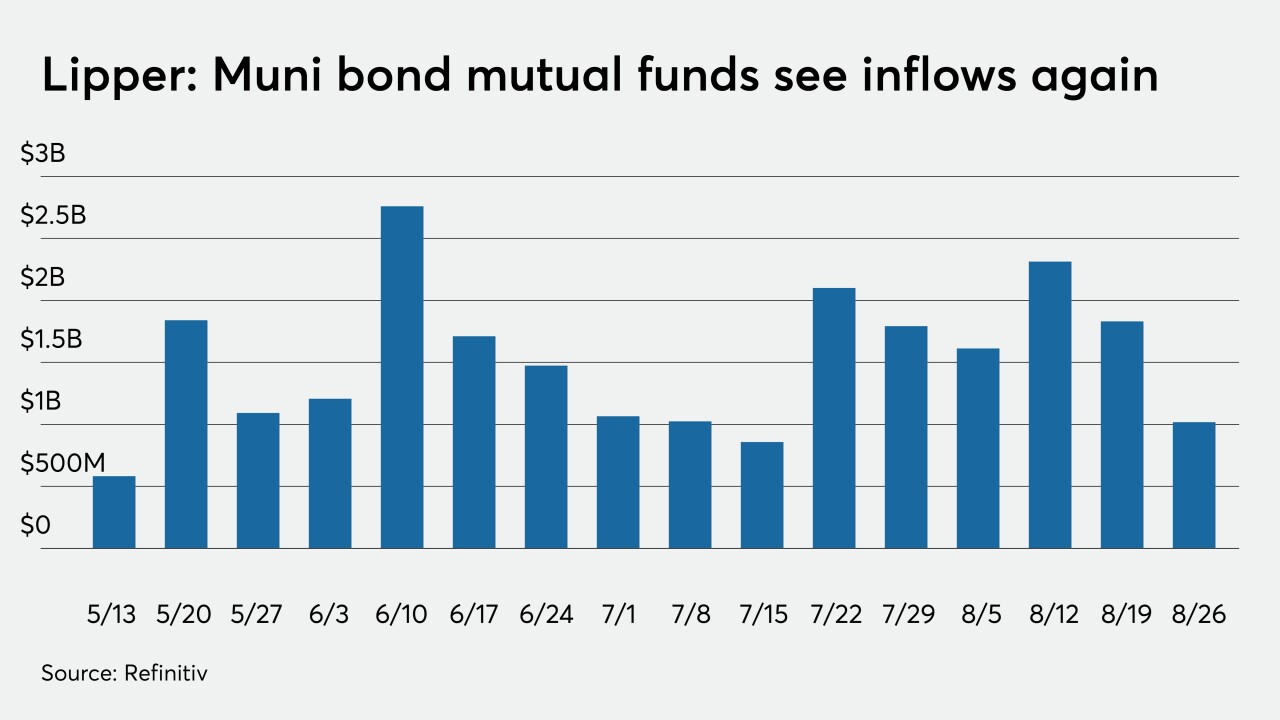

Refinitiv Lipper reported $139.364 million of muni fund inflows, the 17th week in a row of positive results, but the lowest gain since July.

September 3 -

The Florida State Board of Administration Finance Corp. deal was upsized by $1 billion on a day that gave muni buyers a wide variety of paper to choose from.

September 2 -

More supply sold Thursday as the Chicago Transit Authority, the Austin ISD, Texas and Kern HSD, Calif., all came to market.

August 27 -

Ashton Goodfield, head of municipal bonds at DWS Group, talks with Chip Barnett about how the municipal bond market has been coping with the effects of the COVID-19 pandemic and what's in store for the rest of the year. (22 minutes)

August 27 -

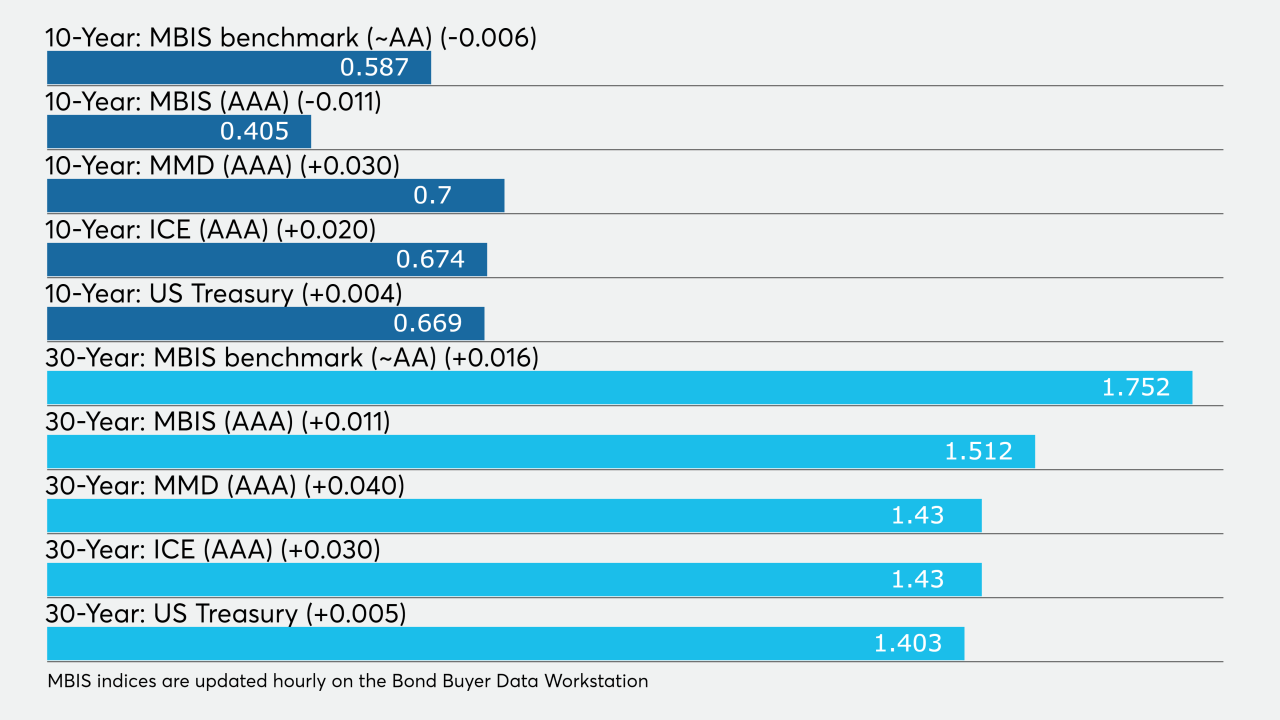

Munis continued to weaken with yields on the AAA scales rising by as much as three basis points.

August 26 -

The muni market steadied Wednesday as a strong dose of supply hit the screens.

August 19