-

“Many states are reporting revenue surpluses and rebounding economies, in part as a result of federal aid to state governments.”

March 7 -

Oklahoma is not alone in struggling to fund repairs for aging dams, a $20 billion problem nationwide according to a 2019 study.

March 7 -

Market volatility has risen significantly, particularly in the last several weeks, with daily Treasury yield swings of 10 basis points or more becoming the norm with municipals struggling to stabilize.

March 4 -

The teachers are trying to prevent enactment on March 15.

March 4 -

The low-interest federal loans will complete financing packages for Virginia's express lane extension outside Washington D.C. and Maryland’s Purple Line light rail project.

March 4 -

Forty-one of the state's 115 school districts are floating bond measures or seeking tax levy increases.

March 4 -

The City Council on Wednesday began the first of a series of hearings on Mayor Eric Adams' $98.5 billion preliminary fiscal 2023 budget.

March 4 -

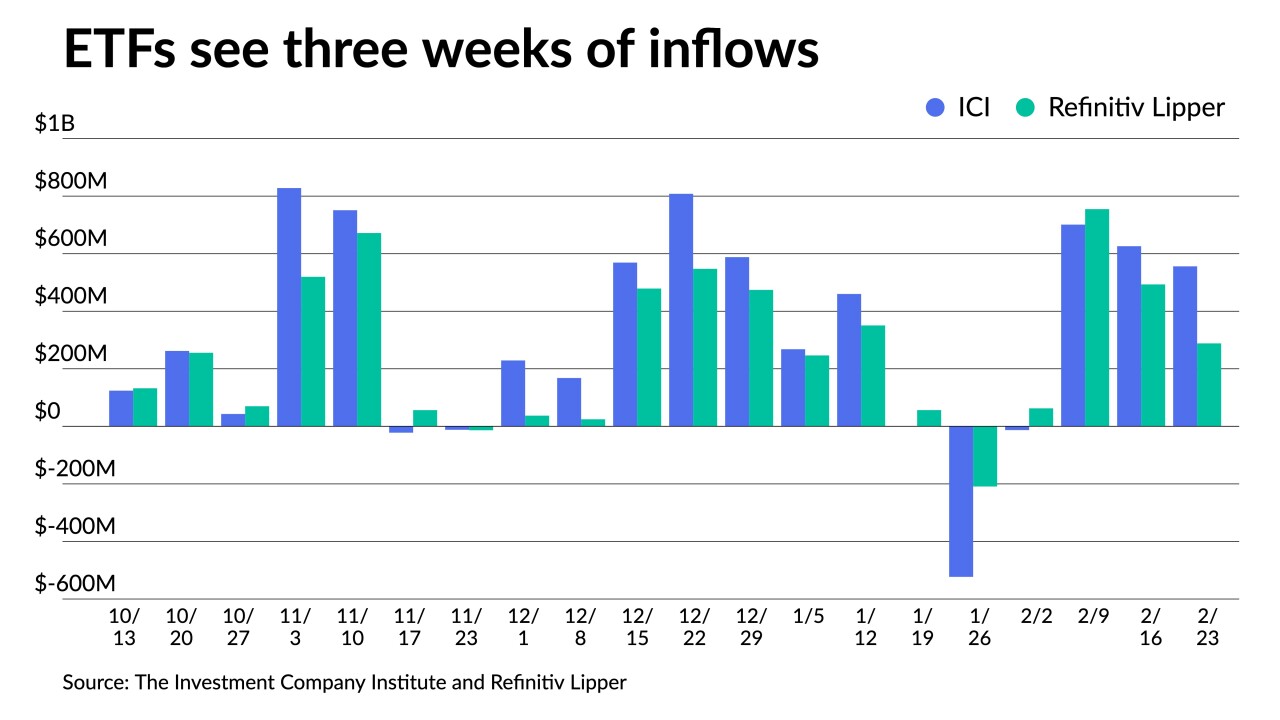

ETFs pulled in just more than $2 billion in February while muni mutual funds saw $8.5 billion of outflows.

March 4 -

Green bond issuance may offer no pricing benefit to issuers, but observers have noticed that the process of issuing a green bond often leads to an expanded investor base.

March 4 -

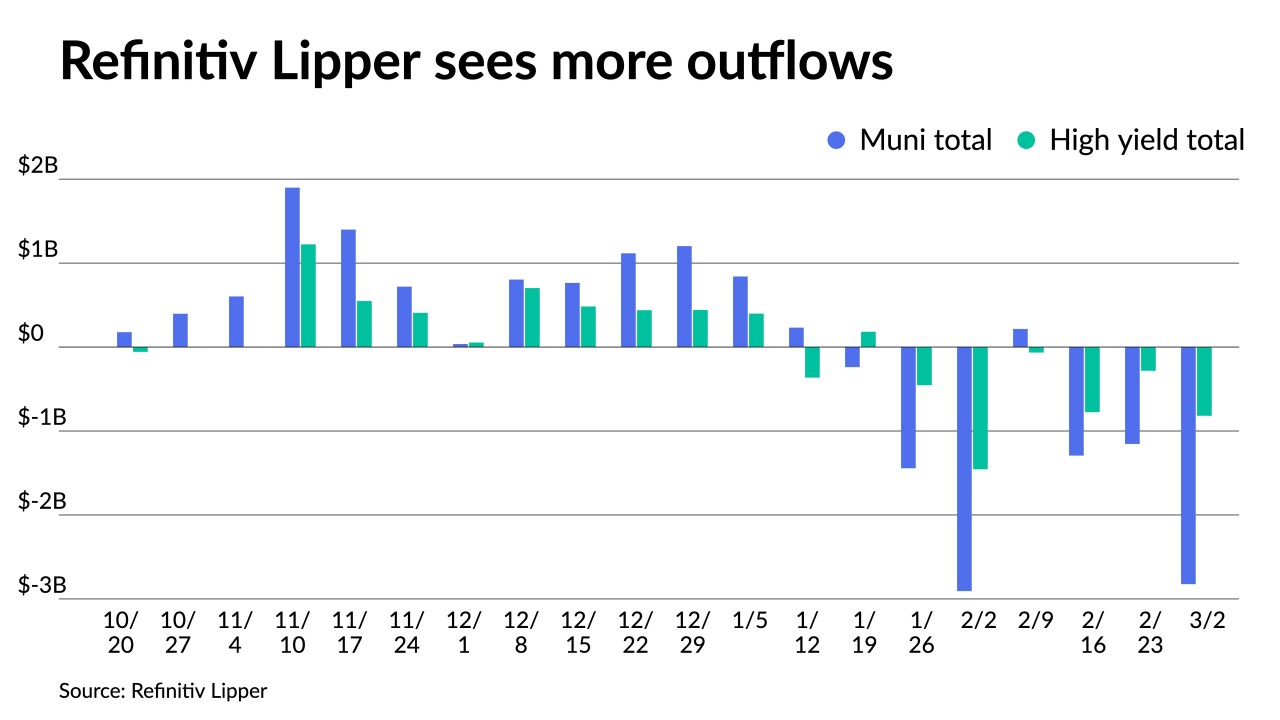

Ongoing turmoil in the Ukraine is roiling markets, municipals included. Refinitiv Lipper reported more outflows, with high-yield seeing $818.218 million pulled out in the latest week.

March 3 -

The MSRB’s annual fact book, released on Wednesday, shows that par amount trading volume was down 28% in 2021 when compared with 2020.

March 3 -

Puerto Rico teachers' associations are trying to delay the March 15 enactment of the Plan of Adjustment while they appeal it.

March 3 -

The Turnpike Authority is gearing up bond financing for a $5 billion capital plan, and will pick a team of underwriters and others later this year.

March 3 -

The University of Michigan follows Michigan State this month in joining the club of universities offering 100-year bond maturities.

March 3 -

A controversial tax on fuel exported to other states from Washington refineries was cut by the plan's author after neighboring governors cried foul.

March 3 -

The restructuring is on track to occur March 15, officials said.

March 3 -

The 18-member group will be headed by Eric Scroggins, co-head of debt advisory and restructuring, and Bill Reisner, head of public finance investment banking.

March 2 -

The Investment Company Institute on Wednesday reported $2.637 billion of outflows in the week ending Feb. 23, down from $3.120 billion of outflows in the previous week.

March 2 -

A federal memo on IIJA dollars outlines Biden administration priorities but doesn’t tie states’ hands when it comes to funding, the transportation secretary said.

March 2 -

A report from CreditSights says risks will increase for coastal issuers of municipal bonds with increased flooding at high tides and during storms.

March 2