-

In a Bond Buyer survey, 57% of participants believe issuance will be less than $475 billion. Additionally, 47% said ESG would have the greatest impact on the public finance industry in 2022.

March 2 -

The Connecticut treasurer also extolled "baby bonds" as a way to improve “racial equity,” narrow the state's gap between rich and poor, and promote economic growth.

March 2 -

The president touted the benefits of last year's Bipartisan Infrastructure Law and American Rescue Plan Act during his first State of the Union address.

March 2 -

The Russian invasion of Ukraine could slow interest rate hikes and has led the market to pull back on the chances of a 50-basis-point liftoff.

March 1 -

Income taxes — despite losses due to remote work — and internet gambling revenue are on the rise, giving the Motor City's general fund a boost.

March 1 -

Recent federal laws have provided municipalities with record levels of funding, but may only have a marginal increase in the number of issuances.

March 1 -

“I want to break ground next year,” Kentucky Gov. Andy Beshear said.

March 1 -

North Carolina Treasurer Dale Folwell talks with The Bond Buyer's Chip Barnett about how the state's economy has remained in financially good health despite dealing with the COVID-19 pandemic as well how the state deals with troubled municipalities. As chair of the debt affordability commission, he chats about bond issuance. He also discusses the ways to reform healthcare and increase transparency. (15 minutes)

March 1 -

The U.S. and European Commission moved Saturday to disconnect Russia from a global financial system.

February 28 -

All markets, but particularly municipals, are in uncharted territory once again, with volatility amplified by the crisis in Ukraine and a still somewhat uncertain path for the Federal Reserve and inflation.

February 28 -

A Michigan House Republican plan would direct $1.15 billion of grants to local municipal pensions that agree to abide by certain conditions.

February 28 -

February volume was $26.481 billion in 594 deals versus $37.052 billion in 981 issues a year earlier, bringing total volume for the first two months of the year to $51.426 billion, or 20% less than 2021.

February 28 -

The governor wants the current deal revised and to be able to participate in any mediation talks. Bond insurers, the Unsecured Creditors Committee and authority’s fuel line lenders also want to be included.

February 28 -

SIFMA had argued that the SEC's temporary exemption order for municipal advisors was arbitrary and capricious.

February 28 -

The new-issue calendar is $5.45 billion while 30-day visible supply sits at $11.14 billion. The largest deal of the week comes from the New York City Municipal Water Finance Authority with $793.83 million.

February 25 -

The city's current trajectory could drive per-unit costs to $1 million, according to the audit by City Controller Ron Galperin.

February 25 -

Lawmakers are being asked to put off a deadline to consolidate suburban Chicago and downstate police pension assets and extend the deadline for funds to reach a 90% funded ratio by 10 years.

February 25 -

The board also says the bondholders' proposed deadlines for completing a restructuring are too tight.

February 25 -

Municipal bond issuance in the region was down 11.7% year-over-year in 2021, as new money, refunding, taxable and tax-exempt volume all slipped.

February 25 -

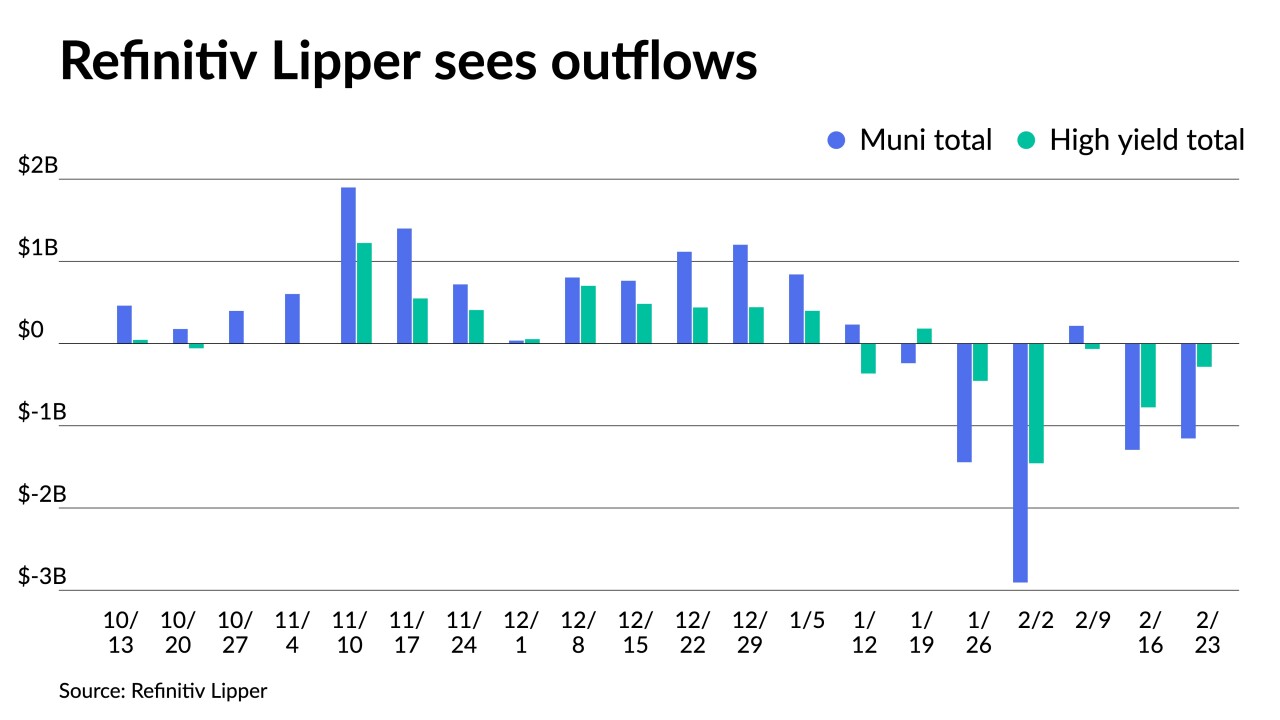

Investors yanked $1.154 billion out of municipal bond mutual funds in the latest week, Refinitiv Lipper reported.

February 24