-

Chicago's second tax-increment financing district for transit would provide up to $959 million of funding to leverage federal infrastructure grants.

December 13 -

The December Federal Open Market Committee meeting, combined with the release of inflation data, "will test the good cheer currently prevailing in the bond market," said MSCI Research strategists Andy Sparks, Tamas Hanis and Edina Szirma.

December 12 -

The island expects federal government funds to provide the lion's share of its resources in 2021-2025.

December 12 -

The Municipal Securities Rulemaking Board has announced its fifteen-member Compliance Advisory Group for the 2023 fiscal year, which includes eleven women and four men.

December 12 -

Projections for total bond volume in 2023 are at a high of $500 billion and a low of $302 billion, continuing 2022's lackluster growth.

December 12 -

Investors will be greeted Monday with a new-issue calendar estimated at $3.214 billion, the majority of which is a nearly $1.9 billion private activity P3 bond deal from Pennsylvania.

December 9 -

The downgrade of Kaweah Delta Health Care District's revenue bonds to Ba1 affected $218 million of debt.

December 9 -

Arrick was formerly a managing director and healthcare group leader for S&P Global Ratings.

December 9 -

The borrowing, which will be backed by availability payments, will finance the first six of the state's nine-span Major Bridges P3 program.

December 9 -

Puerto Rico bankruptcy Judge Laura Taylor Swain approved the Oversight Board's request for five more days.

December 9 -

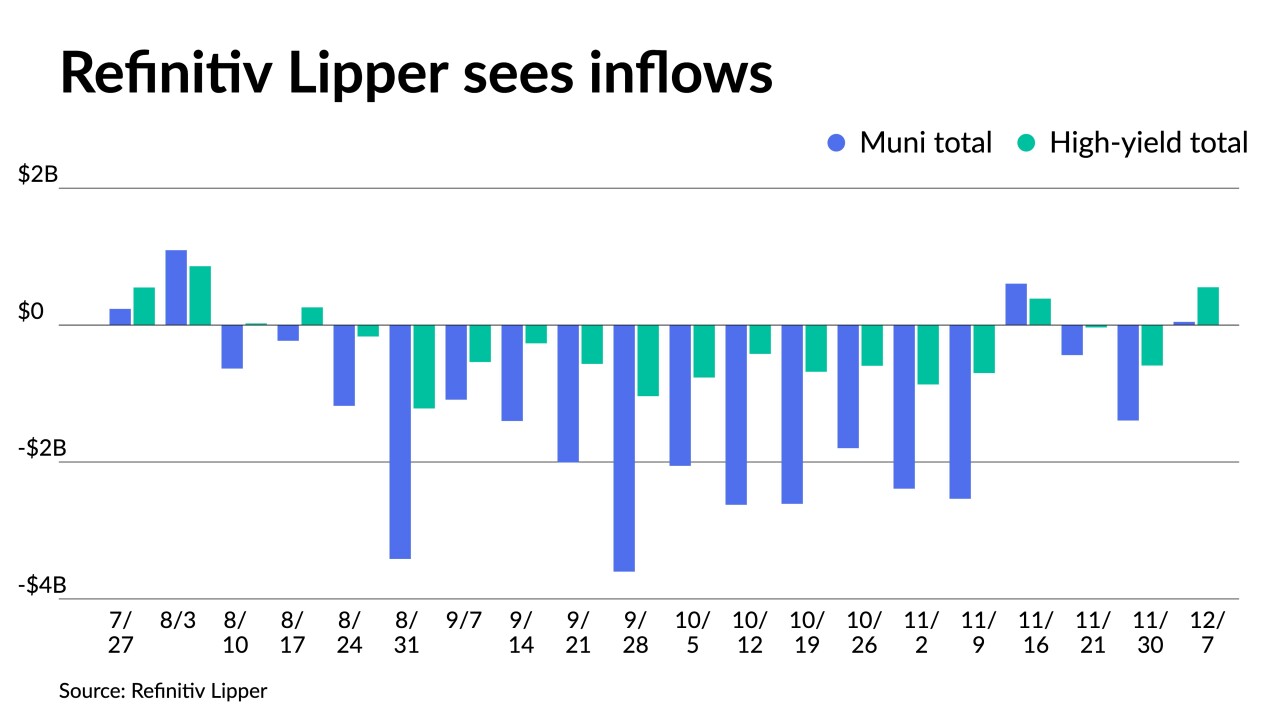

Refinitiv Lipper reported $46.912 million was added to municipal bond mutual funds for the week ending Wednesday after $1.394 billion of outflows the week prior.

December 8 -

Illinois' unfunded pension tab improved slightly in 2022 because 2021 returns still play a role in the actuarial assessment through smoothed investment returns.

December 8 -

The trade group is adding the operations group to boost fixed income expertise.

December 8 -

Washington's new measure to clean up Puget Sound would require billions in borrowing over the next decade, including up to $14 billion in King County alone.

December 8 -

While the MSRB's compliance resources are not a rule and it has not been filed with the SEC, one can infer that following the same will be beneficial should the SEC inquire.

December 8 SOLVE

SOLVE -

"Yield curve inversion deepens and nears a four-decade low which is clearly setting up this economy for a recession that won't be a mild one," OANDA's Edward Moya said.

December 7 -

The bond issuance was one step of several taking place Tuesday stemming from the court approval of the HTA plan of adjustment, which reduces HTA's $6.4 billion of total claims by more than 80%.

December 7 -

The provision shifts rulemaking and enforcement of the new disclosure standards to the SEC from the MSRB, which was charged with the task in an original version.

December 7 -

Despite the volatility in equities and Treasuries, the backdrop for munis is very positive.

December 6 -

The White House has asked for an additional $37.3 billion to send to states and communities that faced natural disasters last year, including $600 million to Jackson, Mississippi, for its water crisis.

December 6