-

"Florida may have the statutory authority to abrogate an agreement, but what does that say for things going forward?" asks Joseph Krist, publisher of Muni Credit News. "Why couldn't an anti-development administration do the same thing in reverse to somewhere like the Villages?"

April 19 -

The Oversight Board, the Fiscal Agency and Financial Advisory Authority, and fuel line lenders filed separate objections to the bondholders' request, arguing it would further complicate PREPA's plan of adjustment.

April 18 -

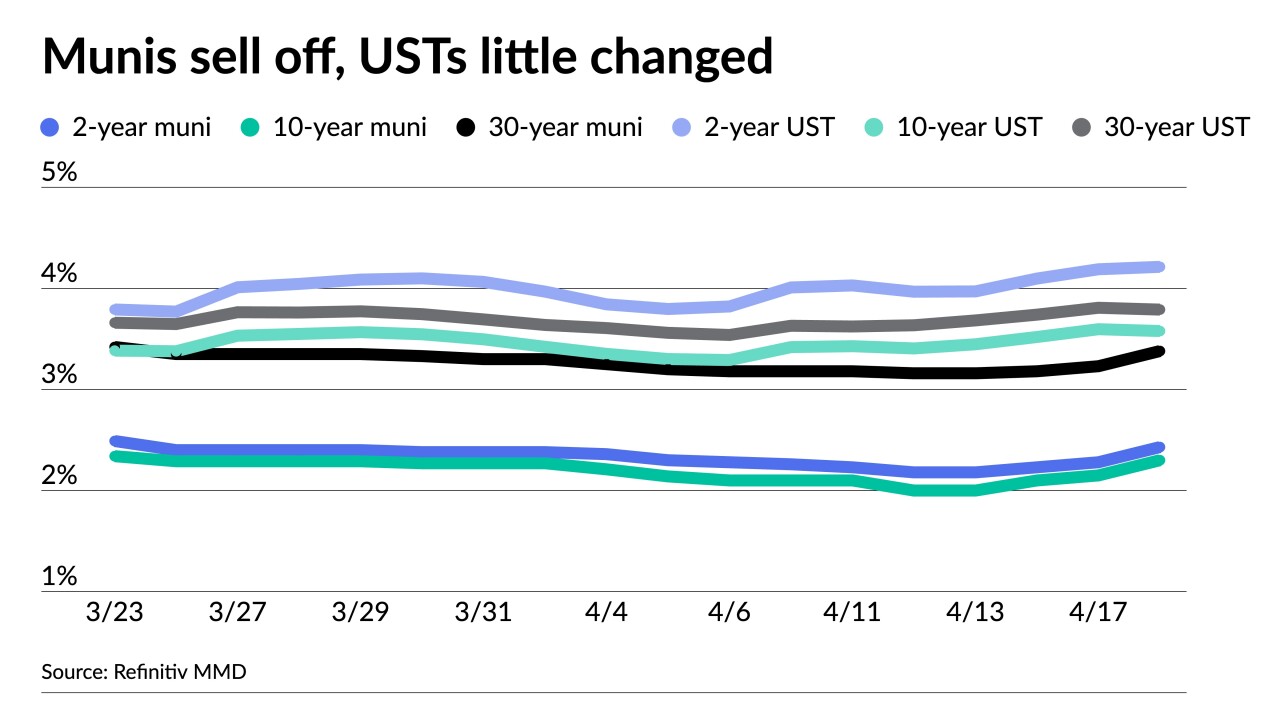

Municipal outperformance to UST ended Tuesday as triple-A yields rose 12 to 20 basis points as several new issues began pricing.

April 18 -

A heated hearing was preceded by letters to the House Financial Services Committee that gave muni advocates a chance to weigh in on regulatory concerns.

April 18 -

The amount of time governments took to produce audited financials has increased by double-digits during an 11-year period.

April 18 -

It's unrealistic to ask transit agencies, even financially stables ones, to solve larger social problems like homelessness or inequity, says an expert.

April 18 -

Dueling analyses out this week found the mixed-use development will either underperform or outperform in generating revenue for Tempe.

April 18 -

Illinois' $2.45 billion GO sale should attract a wider investor audience with the higher ratings as the state seeks to raise new money for capital projects, fund ongoing pension buyout programs, and refund some debt for present value savings.

April 18 -

Neal Pandozzi, a partner at the law firm of Bowditch & Dewey, talks with Chip Barnett about what environmental social and governance really means for public finance, separating politics from policy, polemics from principles. (34 minutes)

April 18 -

Muni yields were cut four to eight basis points, depending on the scale, while UST yields rose seven to nine basis points. Muni outperformance and rich ratios continue.

April 17 -

Two ratings agencies expect AES Puerto Rico to default on Puerto Rico municipal conduit bonds.

April 17 -

Participants in the Texas municipal market raised concerns over bills that would constrain debt issuance.

April 17 -

S&P raised Massachusetts' general obligation long-term credit rating to AA-plus from AA.

April 14 -

For long-term muni bonds, BofA strategists noted that macro market and supply/demand conditions "are dominating the picture, pushing the high-grade muni market to a relatively rich valuation versus Treasuries."

April 14 -

Federal Reserve Governor Christopher Waller said he favored more monetary policy tightening to reduce persistently high inflation, although he said he was prepared to adjust his stance if needed if credit tightens more than expected.

April 14 -

Swain set a deadline ahead of what was requested by the Oversight Board.

April 14 -

Attorney General Rob Bonta faces criticism for restrictions that caused the collapse of a proposed buyout of a troubled Central Valley hospital.

April 14 -

Texas, Virginia, Idaho, Mississippi, Montana, Nebraska, New Hampshire, South Dakota and Utah, have all signed briefs urging the Court to take on the case.

April 14 -

"I think there is a certain amount of anxiety for New York — and many other states — as federal pandemic funds run out and questions about the potential for a recession emerge," said Evercore's Howard Cure.

April 14 -

A John Miller-less speculative bond market may mean more diversification and price transparency, say some investors.

April 14