-

"We're in a market right now where there's heightened volatility in prices, inconsistent pace of supply, and for investors who need to put money to work, muni ETFs continued to play that role," CreditSights' Pat Luby said.

April 26 -

One underwriter called it a "violent inversion," given that the short end of the municipal and Treasury yield curves were so dislocated.

April 25 -

While the system took a hit during the COVID-19 pandemic, total traffic hit 94% of pre-pandemic levels in 2022. Traffic for the first two months of 2023 was 99% of levels in the same period of 2019.

April 25 -

"We know this cliff is coming," said state Sen. Ram Villivalam, head of the state Senate transportation committee. "What structural reforms are we looking at implementing? What innovation can we pursue?"

April 25 -

The parties haven't been engaging in mediation, angering Judge Swain.

April 25 -

A default would halt federal payments and could delay key infrastructure projects

April 25 -

A bill that advanced last week in the Texas Legislature would force a citywide vote on bonds for the Project Connect plan to build light rail.

April 25 -

While Nuveen is a storied and well-respected institution in our business, it did not define John Miller.

April 25 Consultant

Consultant -

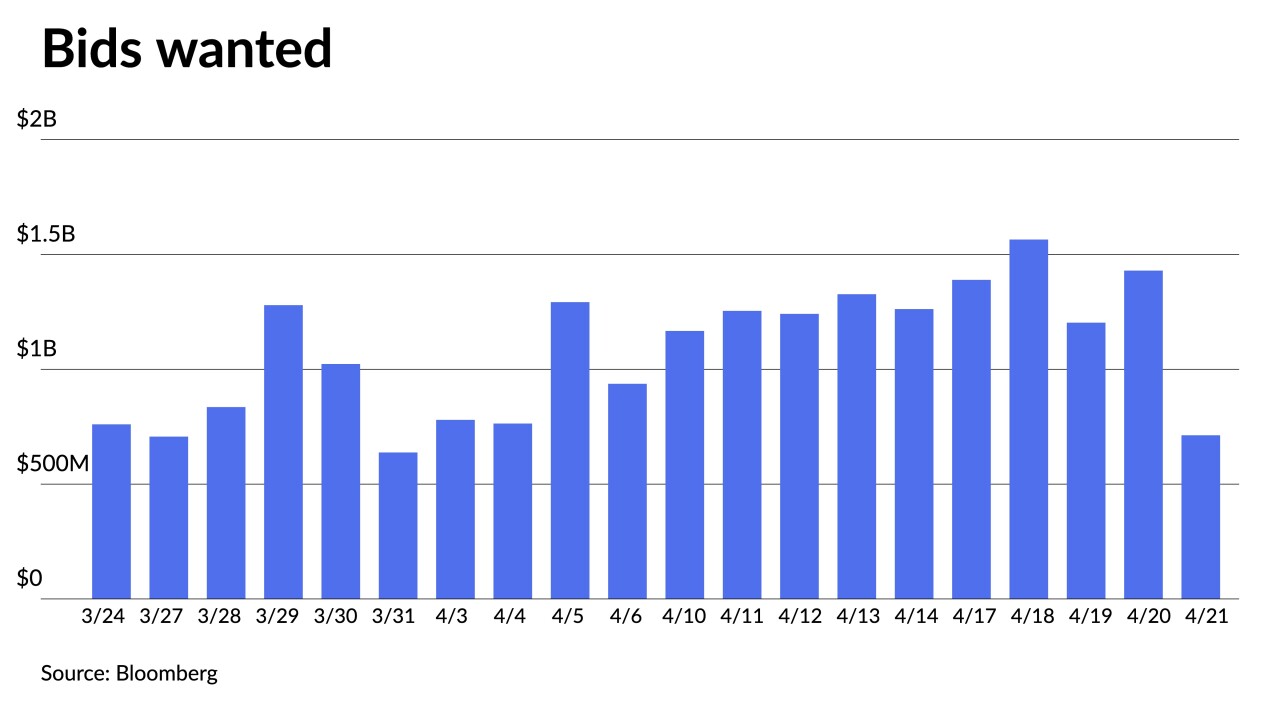

The "weakness in the secondary market will carry over into this week, which may lead to higher yields and wider spreads in the primary market," said CreditSights strategists Pat Luby and Sam Berzok.

April 24 -

Except for the riskiest sectors, high-yield credit fundamentals appear to be strong, but rising interest rates and fund outflows are dampening primary and secondary market activity.

April 24 -

Still no clarity as the banking crisis adds to the difficulty of predicting an economy still feeling COVID impacts and uncertainty about the prospects for a recession.

April 24 -

A bill to prevent developers from buying bonds issued by their metropolitan districts died, but another measure limiting interest rates in such cases was enacted.

April 24 -

How $5.7 billion will be divided among creditors remains to be figured out.

April 21 -

Investors will be greeted Monday with a new-issue calendar estimated at $7.208 billion, led by $1.3 billion of GOs from bellwether Washington.

April 21 -

Chicago outgoing mayor offered a parting shot against pending state legislation that stands to add to city pension costs, but sponsors say the fix was promised and is needed to avoid violating federal rules.

April 21 -

Photos from The Bond Buyer's Texas Public Finance conference.

April 21 -

Nassau County is set to issue $269.54 million of general obligation bonds in two separate sales in the upcoming week.

April 21 -

Proceeds will be used to refund some bonds that had been issued to finance or refinance eligible clean water and drinking water projects in the state.

April 21 -

Even though yields have moved to higher ground, some participants say that even cheaper levels are needed to bring about more retail conviction. Muni-to-UST ratios are still rich.

April 20 -

The Florida Legislature has passed a law that bans the issuance of municipal bonds, such as green bonds that use environmental, social or governance criteria. The bill now heads to Gov. Ron DeSantis for his signature.

April 20