Municipals were mixed to start the week as participants await a $7 billion-plus new-issue calendar, while U.S. Treasuries were firmer and equities were mixed.

The two-year muni-Treasury ratio Monday was at 62%, the three-year at 64%, the five-year at 65%, the 10-year at 67% and the 30-year at 91%, according to Refinitiv MMD's 3 p.m. ET read. ICE Data Services had the two-year at 64%, three-year at 65%, the five-year at 64%, the 10-year at 66% and the 30-year at 91% at 4 p.m.

Last week, muni yields rose for the first time in seven weeks with yields on 10-year notes rising by 24.3 basis points to end the week at 2.34%, said Jason Wong, vice president of municipals at AmeriVet Securities.

With yields backing up this past week, ratios ticked "higher this past week with the 10-ratio now yielding 65.74% of Treasuries, compared to 59.78% a week earlier."

Ratios, he noted, "are still rich out 15 years as investors are still continuing to favor tax-exempts in the front end." The muni curve "flattened by 9.2 basis points in the past week to 87 basis points," Wong said.

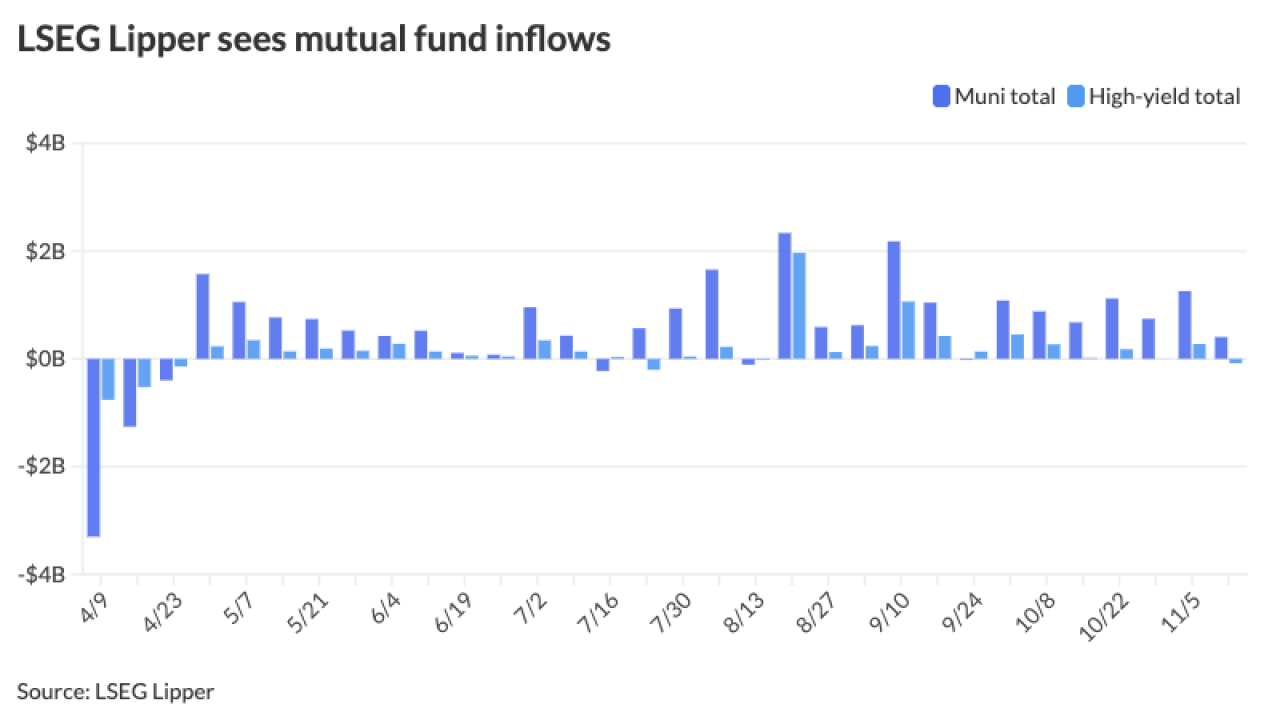

Outflows intensified last week, as muni mutual funds saw their largest outflows year-to-date. Refinitiv Lipper reported investors pulled about $2.87 billion out of muni bonds funds, the majority of which "were in long-term muni funds with about $2.3 billion of outflows," he said.

With munis selling off, the asset class was "pushed into negative territory for the month with munis down by 0.34% for the month of April bringing year-to-date returns to 2.43%," he said.

"Heavier bids-wanted coupled with large outflows in muni bond funds which pushed yields higher by an average of 24.2 basis points across the curve last week," contributed to the sell-off, he said.

CreditSights strategists Pat Luby and Sam Berzok "expect the weakness in the secondary market to carry over into this week, which may lead to higher yields and wider spreads in the primary market."

The main reason for munis' weakness, they said, is the

With tax-exempt yields "mostly too rich to appeal to institutional investors subject to the 21% federal corporate income tax, demand for the bonds to be sold will have to come from direct or indirect demand from individual investors," they said.

The recent trend of outflows from muni mutual funds suggests "that there is limited enthusiasm for individual high-tax-bracket investors to add money to the muni market," according to CreditSights strategists.

"Add in the pending supply of low-coupon rate bonds in the secondary market, and yields have to cheapen further to have a hope of enticing income-focused investors to invest" in bonds with 1%, 2% or 3% coupons, instead of those with 4% or 5%, they said.

If tax-exempts continue to underperform corporates, they said "munis could get cheap enough to create an opportunity for banks, insurance companies and other "21%'ers" to add munis at yields that would be competitive with the after-tax yields on comparably rated corporates."

By the end of Friday, "single-A tax-exempt benchmark yields hit parity with corporate ATYs beginning around 15-years, but double-A muni yields were still mostly out of the money," they said.

While market weakness will continue this week, CreditSights strategists expect that "an inflection point for the muni market is close at hand, thanks to the $24.3 billion of principal that is scheduled to be returned to investors in May, of which $13.5 billion will be paid out on May 1."

Secondary trading

California 5s of 2024 at 2.87% versus 2.31% on 4/14 and 2.40% on 4/11. Maryland Stadium Authority 5s of 2025 at 2.91% versus 2.99% original on Friday. DASNY 5s of 2025 at 2.73%.

Maryland 5s of 2028 at 2.43%-2.42%. Triborough Bridge and Tunnel Authority 5s of 2028 at 2.47% versus 2.45%-2.44% on 4/18. DASNY 5s of 2030 at 2.49% versus 2.13% on 4/13.

Baltimore County, Maryland, 5s of 2033 at 2.43%. Winston-Salem, North Carolina, 5s of 2034 at 2.43%. Anne Arundel County, Maryland, 5s of 2035 at 2.63%.

Ohio Water Development Authority 5s of 2042 at 3.33% versus 3.36% on 4/18. NY Metropolitan Transportation Authority 5s of 2045 at 3.74%-3.71%.

AAA scales

Refinitiv MMD's scale was cut five basis points at one-year: The one-year was at 2.85% (+5) and 2.56% (unch) in two years. The five-year was at 2.36% (unch), the 10-year at 2.36% (unch) and the 30-year at 3.40% (unch) at 3 p.m.

The ICE AAA yield curve was firmer five years and out: 2.91% (+5) in 2024 and 2.65% (flat) in 2025. The five-year was at 2.35% (-1), the 10-year was at 2.32% (-2) and the 30-year was at 3.41% (-2) at 4 p.m.

The IHS Markit municipal curve was cut at the one-year: 2.83% (+5) in 2024 and 2.56% (unch) in 2025. The five-year was at 2.36% (unch), the 10-year was at 2.35% (unch) and the 30-year yield was at 3.40% (unch), according to a 4 p.m. read.

Bloomberg BVAL was unchanged: 2.68% in 2024 and 2.57% in 2025. The five-year at 2.30%, the 10-year at 2.33% and the 30-year at 3.40% at 4 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.144% (-4), the three-year was at 3.832% (-6), the five-year at 3.601% (-6), the seven-year at 3.554% (-7), the 10-year at 3.512% (-6), the 20-year at 3.849% (-6) and the 30-year Treasury was yielding 3.721% (-6) at 3:30 p.m.

Primary to come

The Providence St. Joseph Health Obligated Group (A2/A/A/) is set to price Wednesday $585 million of taxable corporate CUSIPs, Series 2023. Morgan Stanley.

Columbus, Ohio, (Aaa/AAA/AAA/) is set to price Thursday $441.760 million of tax-exempt and taxable GOs, consisting of $320.215 million of Series 2023A, serials 2024-2043; $25.125 million of Series 2023B, serials 2024-2038; $23.960 million of Series 2023C, serials 2024-2041; $51.750 million of Series 2023D, serials 2024-2038; $5.325 million of Series 23-1, serials 2025, 2029; and $15.385 million of Series 23-2, serials 2024, 2026-2029. BofA Securities.

The Ohio Water Development Authority (Aaa/AAA//) is set to price Wednesday $339.030 million of Ohio Water Pollution Control Loan Fund refunding revenue bonds, Series 2023A, serials 2024-2032. Ramirez & Co.

The Virginia Port Authority (Aa1/AA+/AA+/) is set to price Wednesday $201.465 million of non-AMT Commonwealth Port Fund revenue bonds, consisting of $149.145 million of new bonds, Series 2023A, serials 2032-2048, and $52.320 million of refunding bonds, Series 2023B, serials 2028-2036. Wells Fargo Bank.

Norfolk, Virginia, (Aa2/AAA//) is set to price Tuesday $183.350 million, consisting of $168.270 million of general obligation capital improvement and refunding bonds, Series 2023A, and $15.080 million of general obligation capital improvement bonds, Series 2023B. Morgan Stanley & Co.

The Greater Asheville Regional Airport Authority (Baa2///A+/) is set to price Thursday $175 million of AMT airport system revenue bonds, Series 2023, serials 2027-2043, terms 2048, 2053. Siebert Williams Shank & Co.

The New York State Environmental Facilities Corporation (Aaa/AAA/AAA/) is set to price Tuesday $149.125 million of green 2010 Master Financing Program state revolving funds revenue bonds, Series 2023A, serials 2023-2036, 2043, terms 2037-2042. Loop Capital Markets.

The Oregon Department Of Administrative Services (Aa2/AAA//AAA/) is set to price Tuesday $148.100 of tax-exempt Oregon State Lottery revenue bonds, 2023 Series A, serials 2024-2025, 2033-2043. Citigroup Global Markets.

Hartford, Connecticut, (Aa3/AA-//) is set to price Wednesday $124.090 million of special obligation refunding bonds, Series 2023, serials 2024-2033. Siebert Williams Shank & Co.

The Albuquerque Municipal School District No. 12, New Mexico, (/AA//) is set to price Wednesday $117 million, consisting of $70 million of Series A and $47 million of Series B. Stifel, Nicolaus & Co.

Nassau County, New York, (Aa3/AA-/A+/) is set to price Tuesday $114.860 million of general obligation refunding general improvement bonds, 2023 Series B. J.P. Morgan Securities.

Competitive

Union County, North Carolina (Aaa/AAA/AAA/) is set to sell $134.405 million of general obligation school bonds at 11 a.m. eastern Tuesday.

Delaware (/AAA//) is set to see $362.84 million of general obligation bonds at 11 a.m. eastern and $34.115 million of GOs at 11:30 a.m.

Washington (Aaa/AA+/AA+/) is set to sell $1.332 billion Wednesday: $206.325 million of various purpose general obligation refunding bonds at 11:15 a.m. eastern; $289.26 million of various purpose GO refunding bonds at 10:45 a.m. eastern; $327.32 million of various purpose GO refunding bonds at 10:15 a.m. eastern and $509.68 million of motor vehicle fuel tax and vehicle-related fees general obligation refunding bonds at 11:45 a.m. eastern.