-

The competition is open to nonprofit financing institutions and the funding will target clean technology projects in underserved areas of the country.

July 18 -

Amid bankruptcy proceedings, the project's owner and bondholders agreed to a plan to re-issue most of the defaulted debt.

July 18 -

The rule amendments would create an exemption for previously qualified municipal advisors to forego requalification after a lapse in working for a municipal advisor.

July 18 -

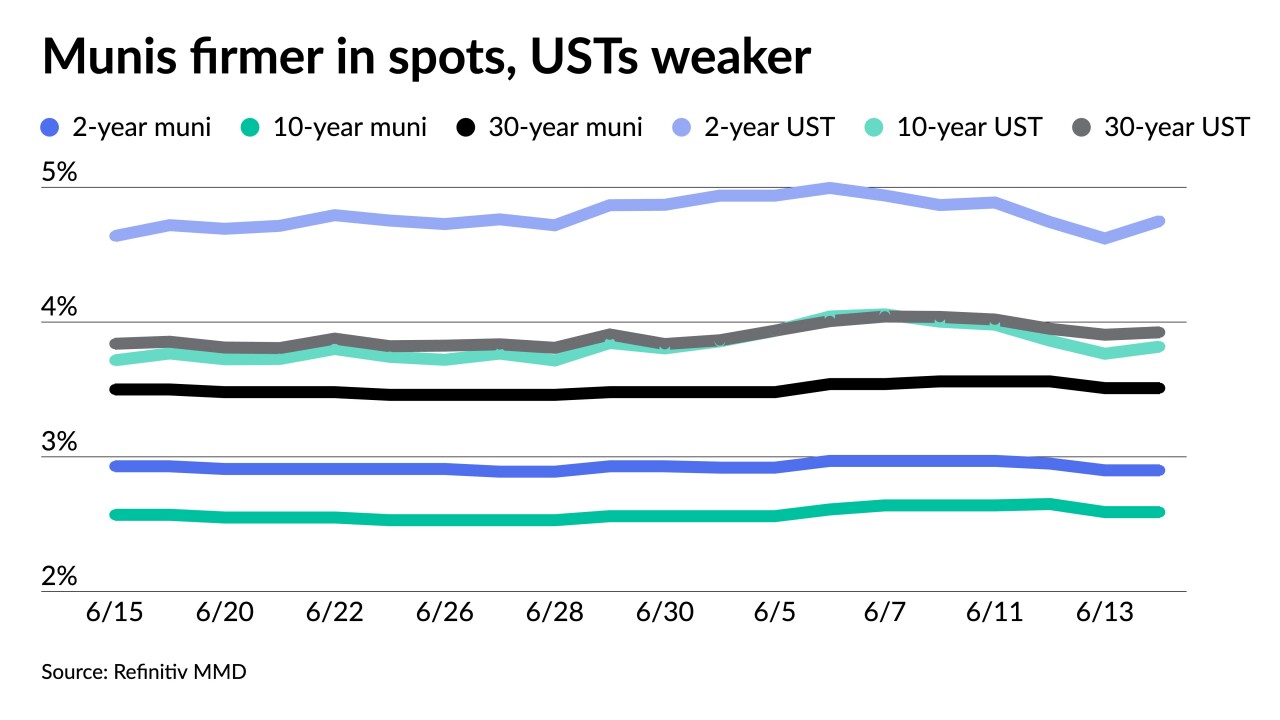

Long-duration and shorter-coupon munis saw ample demand last week. Investors, believing rates will fall as early as the first part of next year, continue to lock in long-bond yields, Nuveen strategists said.

July 17 -

The group of banks would pay $68 million to settle the lawsuit, which originally estimated damages at $340 million.

July 17 -

The FOMB needs to return to its "deal mindset" so that we can end the bankruptcy at PREPA. While gaps remain between the FOMB's and bondholders' affordability analyses, they are not insurmountable.

July 17 Puerto Rico Financial Oversight and Management Board

Puerto Rico Financial Oversight and Management Board -

Nonprofit assisted living and nursing home bonds continue to be under stress, with defaults and impairments on the rise.

July 17 -

Moody's boost to Aa1 to the Desert Community College District affects more than half a billion dollars of general obligation debt.

July 17 -

The airport's bond ratings were raised a notch to A-plus by S&P and to AA by KBRA.

July 17 -

The IFA and CWA launched a tender offer June 23 that closed Friday. The IFA and Citizens' tender invited holders of some bonds sold in 2014, 2016, and 2018 to tender their bonds as part of the water refunding.

July 14 -

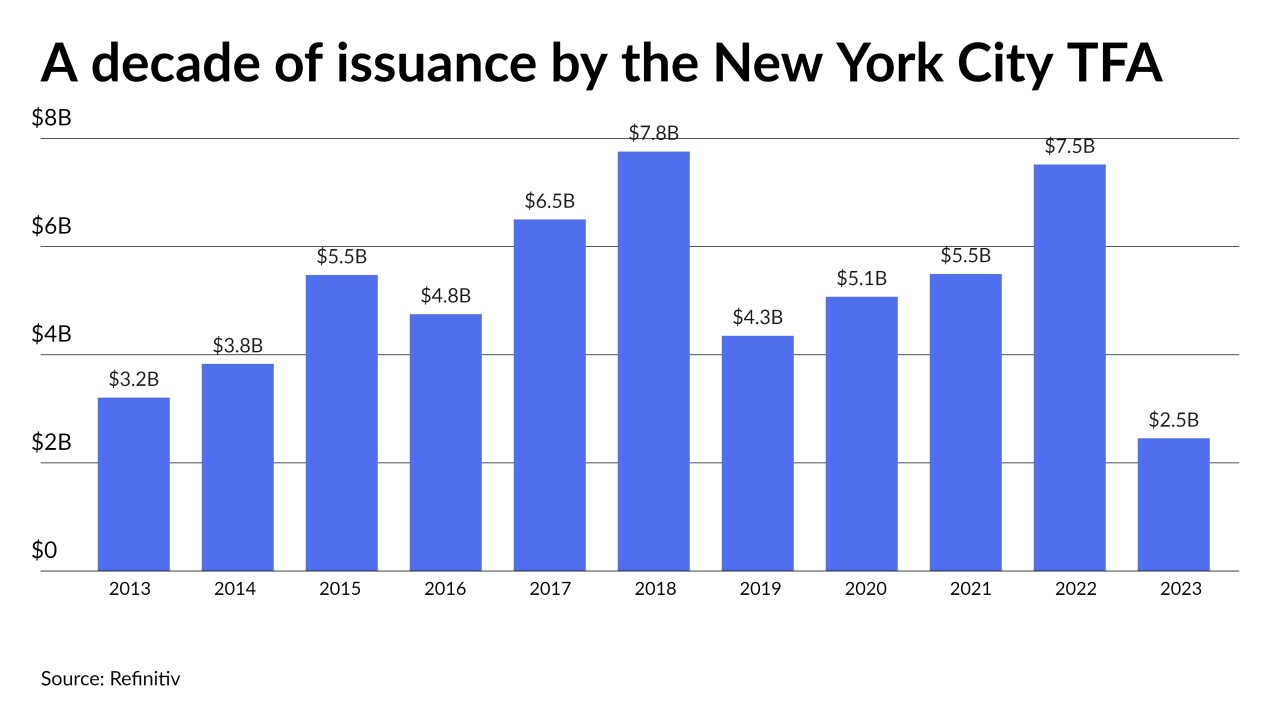

Bond Buyer 30-day visible supply climbs to $13.42 billion while the new-issue calendar is led by a $1 billion-plus New York City Transitional Finance Authority future tax-secured subordinate deal.

July 14 -

The preliminary approval was granted in a New Jersey federal court.

July 14 -

Proceeds from the sale will be used to fund infrastructure projects in the city's $164.8 billion 10-year capital plan.

July 14 -

As the Oklahoma Supreme Court nears a decision on the validity of initial bonds for the turnpike's $5 billion project, property owners again raised objections.

July 14 -

Mr. Wolfe worked at Goldman Sachs, Prudential Securities, E-Bond Trade.com, Merrill Lynch and ButcherMark Financial Advisors. He also led the Illinois Health Facilities Authority and had advisory roles for the city of Phoenix, New York City Health and Hospitals Corp. and Dartmouth College.

July 13 -

Municipal bond mutual fund outflows continued as Refinitiv Lipper reported investors pulled $136.174 million from the funds for the week ending Wednesday following $855.719 million of outflows the week prior.

July 13 -

Transactions announced for the second quarter rose to 20 involving $13.3 billion of revenues from 15 in the first quarter and hit a milestone in more closely resembling pre-COVID-19 mergers and acquisition activity, according to Kaufman Hall's quarterly review.

July 13 -

Transit capital investment grants would be funded at the lowest level in decades under the House GOP 2024 draft bill.

July 13 -

The bond measure was approved by the Senate in late May but is on pause while negotiations are under way between the Senate, Assembly and the governor's team.

July 13 -

The SEC has adopted amendments that will increase minimum liquidity requirements, among other features but will only affect the muni market on the margins.

July 13