-

"It is important to remember that as long as the Fed's next move is to lower policy rates, bonds will do well," said Jack McIntyre, portfolio manager at Brandywine Global. "The employment market is in better balance, which is very important for the Fed — even more than inflation."

June 12 -

The bonds are part of a proposed settlement with the city's firefighters union that would need court approval.

June 12 -

Driven by ongoing capital expenditure funding and current refunding opportunities, airport issuance is estimated at $21 billion in 2024, with a slew of from June through September and more planned in December, according to Ramirez.

June 12 -

Milwaukee Public Schools is months late in submitting the annual financial audit reports amid turmoil that has seen its superintendent and comptroller depart.

June 12 -

"We will remain cautious until CPI and the FOMC are in the rear-view mirror and as long as these don't catalyze a sell-off (since that would trigger outflows) or catalyze a sharp rally (as municipals lag rates during a sharp rally and ratios can increase optically) ... " said Vikram Rai, head of municipal markets strategy at Wells Fargo.

June 11 -

The top five bond financings have an average dollar volume of more than $1.2 billion.

June 11 -

Darren Olson of the American Society of Civil Engineers joins to discuss the importance of resilient infrastructure and the impact of federal funding on America's future.

June 11 -

With no change in rates expected, analysts are interested in the dot plot and Fed Chair Jerome Powell's press conference.

June 11 -

Controversy over where to build a new jail has delayed further issuance of $260 million of voter-approved bonds after an initial $45 million sale.

June 11 -

Even after paring down the capital plan, the MTA will need to issue debt, and sooner than planned. It will be issued under the MTA's transportation revenue credit rather than its congestion pricing credit, so near-term debt service costs will be higher, CEO Janno Lieber said.

June 11 -

The use of unregistered municipal advisors in the public-private partnership sector can lead to unnecessarily expensive deals for cities and states, said SEC's Dave Sanchez.

June 11 -

Munis should see better performance this week as issuance falls to $5.2 billion this week and cash still needs to be reinvested, said Jason Wong, vice president of Municipals at AmeriVet Securities.

June 10 -

The Water and Power Authority got good financial news from the U.S. Federal Emergency Management Agency but bad financial news from a federal court in Puerto Rico.

June 10 -

The ratings agency cited growing enplanement counts, expectations of resilience during future economic downturns, and strong management for its upgrade to AA from AA-minus.

June 10 -

Her abrupt suspension of the tolling plan for Lower Manhattan leaves a $15 billion hole in the Metropolitan Transportation Authority's capital budget.

June 10 -

Cities and states should carefully review the joint federal proposal and flag anything that may create a market problem, said the SEC's Dave Sanchez.

June 10 -

The Canadian finance official says local governments in the U.S. and Canada face similar challenges but also can learn from each other.

June 10 -

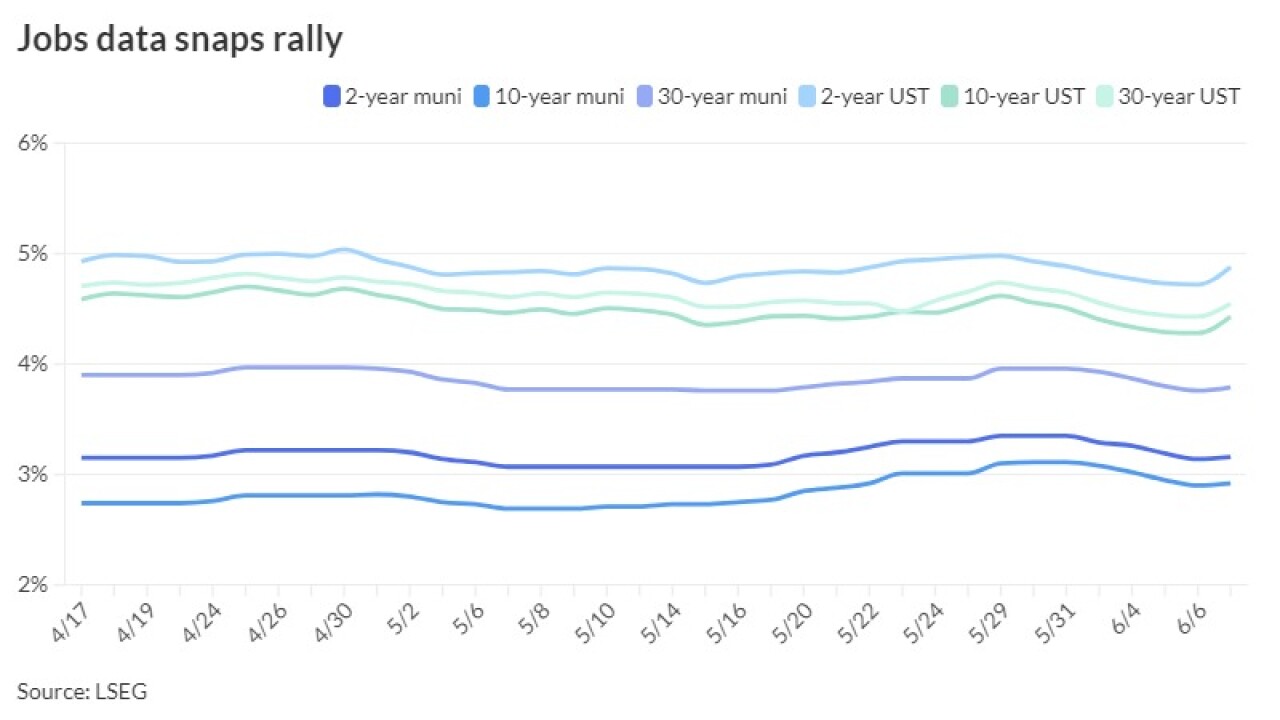

USTs spiked 17 basis points on the short end and 15 to 12 10-years and out following the release, while triple-A curves saw yields rise two to five basis points, depending on the yield curve, in a more muted and typical reaction for the asset class.

June 7 -

J.B. Pritzker on Wednesday signed Illinois' $53.1 billion fiscal year 2025 budget, which includes $198 million for the rainy day fund, among other things.

June 7 -

A $345 million taxable bond deal will support the public-private partnership arrangement that will upgrade the College Park campus district energy system.

June 7