-

The consumer price index number further complicates market expectations of Fed rate cuts and muni investors may want "to keep their powder dry" until they have a better idea of the Fed's timing, said CreditSights' Pat Luby.

February 13 -

The December consumer price index came in slightly stronger than expected, perhaps eliminating the possibility of a rate cut in March, analysts said.

January 11 -

Large reserves will insulate states against downgrades in the near future, one rating agency says.

November 2 -

The state managed to grow revenues above forecast for the first two months of the fiscal year despite the delayed tax filing deadline.

September 19 -

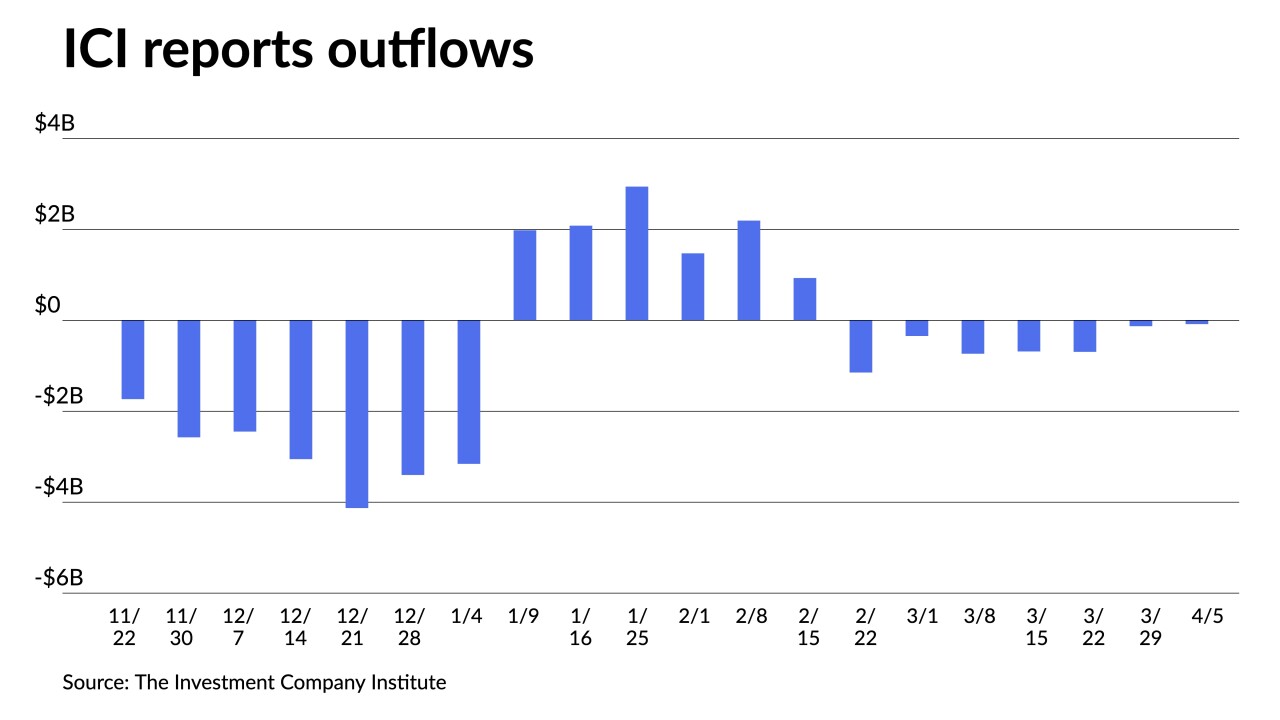

There hasn't been a huge return of capital in the muni market so far this year, with fund flows being rather anemic, said Chad Farrington, co-head of municipal bond strategy at DWS Group.

September 13 -

Despite this, August saw the largest monthly volume of 2023, helped by several billion-dollar deals and multiple Texas school district deals.

August 31 -

Tracey Manzi, senior investment strategist at Raymond James, talks with Chip Barnett about the fixed income markets today and how munis and Treasuries are doing. She says the number one issue clients are asking about is inflation. (20 minutes)

August 22 -

Another day of mixed inflation data led Treasury yields to rise but munis mostly stayed put after underperforming a UST rally earlier in the week. The market is also focused on the $9 billion of redemption flows coming on Tuesday.

August 11 -

Refinitiv Lipper reported $278.559 million of inflows into municipal bond mutual funds for the week ending Wednesday, led by exchange-traded funds.

August 10 -

Eric Merlis, managing director and co-head of global markets at Citizens Bank, talks with Chip Barnett about the economy and financial markets and what the Federal Reserve might do. He also discusses possible near- and long-term economic scenarios. (15 minutes)

July 25 -

Municipal bond mutual fund outflows continued as Refinitiv Lipper reported investors pulled $136.174 million from the funds for the week ending Wednesday following $855.719 million of outflows the week prior.

July 13 -

Escalating costs, particularly for wages, could strain budgets or drain reserves, the rating agency said.

July 12 -

While "munis are set up for better performance, perhaps modest single-digit returns, the near-term outlook for fund flows will make for a challenging read," Oppenheimer's Jeff Lipton said.

June 13 -

Bond traders have overestimated month-over-month headline inflation heading into four of the last seven Consumer Price Index releases, says strategist Raghav Datla.

June 12 -

Inflation joined supply chain struggles, wage pressures, and the labor shortage — most acutely felt with nursing staff — dragging down the sector's margins.

May 23 -

Amid rising construction costs and supply chain shortfalls, some California school bond projects are being redesigned, accelerated or delayed.

May 18 -

The secondary was quiet and the sole deal of size came from a $400 million-plus competitive water and sewer loan from Portland, Oregon. The recent rise in yields makes for more compelling levels.

May 3 -

Strong demand in the primary market is leading to the oversubscription of many new issues. Municipals and USTs were better again as macroeconomic concerns pressure equities.

April 12 -

Members of the Fed learned the wrong lesson from bizarrely focusing on the 1970s when they said "If history has taught us anything, it's to not let up too soon on inflation."

March 21 Sit Fixed Income

Sit Fixed Income -

Disruptions and dislocations associated with more volatile business cycles have already created opportunities for active fixed income management, as the dramatic interest rate increase of 2022 illustrates.

March 8 Schroder Investment Management

Schroder Investment Management