Municipals were firmer in trading Wednesday as triple-A benchmark yields fell along with U.S. Treasuries after the consumer price index report showed inflation slowing. Equities ended down after the Federal Reserve Open Market Committee signaled another rate hike is likely at its May meeting.

The two-year muni-Treasury ratio was at 55%, the three-year at 56%, the five-year at 59%, the 10-year at 61% and the 30-year at 87%, according to Refinitiv MMD's 3 p.m. ET read. ICE Data Services had the two-year at 56%, three-year at 55%, the five-year at 56%, the 10-year at 60% and the 30-year at 88% at 4 p.m.

Strong demand in the primary market is leading to the oversubscription of many new issues as brisk activity continues to drive the municipal market — despite continued expectations of additional tightening by the Federal Reserve Board, according to a New York municipal underwriter.

"Deals that we have been involved in have seen good demand — especially through the short end," the underwriter said Wednesday afternoon.

Rhode Island Health & Educational Building Corp.'s $113 million of higher education facility revenue bonds for Providence College was among the deals doing exceptionally well this week, in addition to a $463 California Public Works lease revenue bond offering for various capital projects, the underwriter said.

He said the preference for short paper is a result of Wednesday's release of consumer price index data, which showed consumer prices rose at the slowest pace since May 2021, as inflation showed further signs of easing in March, according to the new data from the Bureau of Labor Statistics released Wednesday morning.

The CPI print, which saw inflation rise 5% year-over-year, was "a little cooler than what folks expected but not so substantial, that it's going to take a potential Fed hike off the table," said Tom Kozlik, head of strategy and credit at HilltopSecurities. Kozlik said the print has not changed market participants' opinions of additional rate hikes at the May Federal Open Market Committee meeting.

"There were still folks who are waiting to see if they're going to start to put maybe more money to work or take advantage of opportunities out there and or in the market," Kozlik said.

He said the most important thing for the market in the coming weeks is what happens at the next FOMC meeting.

"There's going to be readings [market participants] will have pay attention; they're going to look at those as the road signs on the way to May 3, but the upcoming FOMC meeting is the big next indicator," Kozlik said.

"I think people are anticipating a 25 basis point adjustment at the next meeting on May 2 and 3, but also a pause and easing in the latter part of the year, obviously after we get through inflation," the underwriter said.

Longer out on the curve, the underwriter is still seeing good pockets of interest through 15 years for 4% coupons at a discount when and if they are available, but there is a shift toward 5% coupons in the event 4%s are tough to find.

Overall, he said municipals seem to be "hanging in there," he said.

"The CPI number indicates that maybe the Fed could be pausing here and that inflation is starting to take the right trend," the underwriter added.

He said the market will also be looking at the producer price index data to be released on Thursday.

Ahead of any further Fed action, the underwriter expects to see an open window of opportunity for issuers and investors.

"The next two weeks will be active just because people want to get deals in the market ahead of the Fed, so I expect a robust primary calendar," he said.

Kozlik has said he was optimistic about munis in the near term but not overly so.

Munis are "not overly attractive, but they're very investable at the point," he said.

Over the past month, he said most investors looked at munis as a "quality option."

When there was the flight-to-quality in wake of the banking sector crisis, he said investors were not fleeing munis but rather moving toward them.

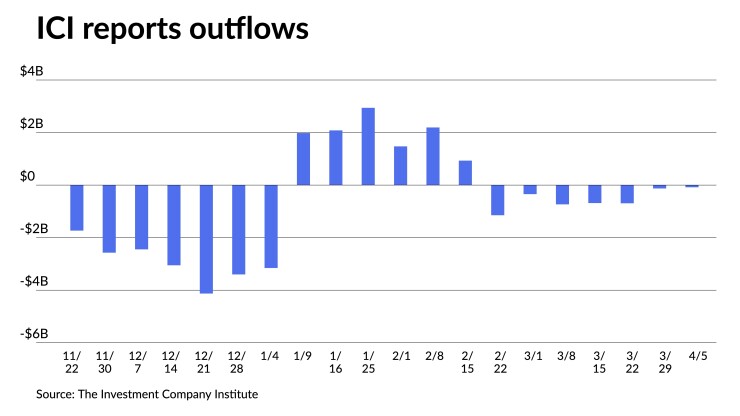

While investors have continued to pull money from muni mutual funds, outflows have lessened over the past several weeks.

The Investment Company Institute reported investors pulled $83 million from mutual funds in the week ending April 5, after $128 million of outflows the previous week. Meanwhile, Exchange-traded funds saw inflows of $854 million after $184 million of inflows the week prior, per ICI data.

"We haven't seen anything close to a negative billion number, whereas last year at this time, it was billions of dollars that was flowing out on a weekly basis," he said.

Kozlik said the market could be nearing the end of negative fund flows, but he wants to wait until "we get on the other side of tax time and see what happens for a week or two after that before I finally say that the worst is over."

In the primary Wednesday, Citigroup Global Markets priced for the Idaho Housing and Finance Association (Aa1/NR/AA+/NR/) $349.705 million of Transportation Expansion and Congestion Mitigation Fund bonds, Series 2023A, with 5s of 8/2024 at 2.41%, 5s of 2028 at 2.16%, 5s of 2033 at 2.32%, 5s of 2038 at 3.02%, 5s of 2043 at 3.44%, 5.25s of 2048 at 3.58% and 4s of 2048 at 4.05%, callable 8/15/2033.

Citigroup Global Markets priced for the Rhode Island Health and Educational Building Corp. (A2/A/NR/NR/) $112.875 million of Providence College Issue higher education facility revenue bonds, Series 2023, with 5s of 11/2025 at 2.38%, 5s of 2028 at 2.36%, 5s of 2033 at 2.66%, 5s of 2038 at 3.38%, 5s of 2043 at 3.73%, 5s of 2047 at 3.90% and 5s of 2053 at 4.00%, callable 11/1/2033.

In the competitive, Anne Arundel County, Maryland (Aaa/AAA//) sold $132.555 million of consolidated general improvement bonds, Series 2023, to Morgan Stanley, with 5s of 10/2023 at 2.40%, 5s of 2028 at 2.01%, 5s of 2033 at 2.09%, 5s of 2038 at 2.77%, 5s of 2043 at 3.08%, 5s of 2047 at 3.25% and 4s of 2052 at 3.90%, callable 4/1/2033.

The county also sold $63.670 million of GOs — consisting of $41.405 million of refunding consolidated general improvement bonds, Series 2023, and $22.265 million of refunding consolidated water and sewer bonds, Series 2023 — to Wells Fargo Bank, with 5s of 4/2024 at 2.36%, 5s of 2028 at 2.03%, 5s of 2033 at 2.08%, 5s of 2038 at 2.72% and 5s of 2043 at 3.01%, callable 4/1/2033.

Secondary trading

Connecticut 5s of 2024 at 2.27%. DC 5s of 2024 at 2.37% versus 2.41% Monday and 2.58%-2.56% on 3/30. Georgia 5s of 2025 at 2.23% versus 2.29% Tuesday. NYC 5s of 2025 at 2.27%-2.25% versus 2.32% Tuesday.

Triborough Bridge and Tunnel Authority 5s of 2027 at 2.14% versus 2.19% Tuesday. Florida 5s of 2029 at 2.06% versus 2.10% Monday. Oregon 5s of 2030 at 2.06%-2.03% versus 2.09% Monday.

Tampa waters, Florida, 5s of 2033 at 2.09% versus 2.13% Tuesday. California 5s of 2033 at 2.20%-2.18% versus 2.32%-2.17% original on 4/6. Maryland 5s of 2036 at 2.44% versus 2.68%-2.67% on 3/31.

California 5s of 2045 at 3.42% versus 3.23%-3.25% Tuesday and 3.41%-3.30% original on 4/6. California State Infrastructure and Economic Development Bank 4s of 2047 at 3.80%-3.81%. NYC TFA 4s of 2051 at 4.04% versus 4.02% on 4/6 and 4.14% on 4/4.

AAA scales

Refinitiv MMD's scale was bumped two to five basis points. The one-year was at 2.31% (-5) and 2.18% (-5) in two years. The five-year was at 2.03% (-3), the 10-year at 2.08% (-2) and the 30-year at 3.16% (-2) at 3 p.m.

The ICE AAA yield curve was bumped two to five basis points: 2.40% (-5) in 2024 and 2.29% (-3) in 2025. The five-year was at 2.00% (-3), the 10-year was at 2.05% (-3) and the 30-year was at 3.19% (-2) at 4 p.m.

The IHS Markit municipal curve was bumped three to eight basis points: 2.29% (-8) in 2024 and 2.21% (-3) in 2025. The five-year was at 2.02% (-3), the 10-year was at 2.03% (-3) and the 30-year yield was at 3.14% (-3), according to a 4 p.m. read.

Bloomberg BVAL was bumped two to five basis points: 2.30% (-5) in 2024 and 2.22% (-5) in 2025. The five-year at 2.02% (-3), the 10-year at 2.06% (-3) and the 30-year at 3.15% (-2) at 4 p.m.

Treasuries were firmer.

The two-year UST was yielding 3.967% (-9), the three-year was at 3.700% (-10), the five-year at 3.468% (-8), the seven-year at 3.434% (-6), the 10-year at 3.406% (-3), the 20-year at 3.746% (flat) and the 30-year Treasury was yielding 3.635% (+1) at 4 p.m.

CPI report

"CPI inflation from a year ago slowed to 5.0%, a full percentage point improvement from the 6.0% reading in February," noted Scott Anderson, chief economist and executive vice president at Bank of the West.

"This print shows that core inflation continues to be high, but lower than expected, particularly the much talked about core services excluding shelter," said Olu Sonola, head of U.S. regional economics at Fitch Ratings.

"However, the start of the Ukraine war last year pushed prices higher last March, making the year-on-year inflation rate look a bit better today than it probably would be otherwise," Anderson said.

"For the inflation optimists out there, the March CPI report delivered good news with total prices rising by the smallest amount in nine months and hints that core services inflation is starting to moderate," said Wells Fargo economists Sarah House and Michael Pugliese. "However, for the inflation pessimists, the latest CPI report shows the recent underlying trend in price growth remains far too high, with the core CPI increasing at more than a 5% annualized pace the past three months."

They noted core consumer prices keeps growing faster than the Fed's target but "believe slower inflation is coming in the months ahead as the economy cools and finds better balance in a post-pandemic world."

"Despite the moderation in headline consumer prices, core consumer price inflation remains stubbornly high," at a 0.4% increase in March, he said.

Despite the 0.4% gain in the core inflation figure, Alexandra Wilson-Elizondo, co-head of portfolio management for Multi Asset Solutions at Goldman Sachs Asset Management said Wednesday's data "will most likely be perceived as welcome news because headline was marginally light of expectations and core was in-line."

"Headline inflation cooled in March, but it's not time to celebrate just yet," said Morning Consult chief economist John Leer.

"Topline inflation was driven lower primarily by falling energy prices, which tend to be volatile from month to month," he said. "Core inflation remains stickier and more persistent than the Fed would like, and combined with the

"A slight slowdown in core inflation with significant deceleration on core services should be a positive signal for the Fed. Shelter inflation still has to show more signs of turning decisively," according to Morgan Stanley Research strategists. "However, the large increase in airfares in the CPI will not feed through to PCE, pointing to less upside pressure in the Fed's preferred inflation gauge."

U.S. inflation slowed to 5% from 6% year-over-year, but James Knightley, ING's chief international economist, said "the monthly increases in non-food and energy prices continue to run hotter than desired, giving the Fed justification to hike interest rates again in May."

Nonetheless, he said that "higher borrowing costs and reduced credit availability mean the risks of a hard landing are on the rise and this will get inflation down quickly."

As the May FOMC meeting approaches, Sonola said the "Fed will clearly be happy with the direction of inflation, but still unhappy with the level, which relative to their 2% target, remains too high."

March's CPI print does not "materially changes the outlook for U.S. monetary policy," according to Wells Fargo economists, with House and Pugliese still expecting a 25 bps rate hike at the May FOMC meeting.

"Past May, the outlook is increasingly uncertain, but we think the most likely outcome is for the FOMC to keep the federal funds rate steady for an extended period of time," they said.

"While the Fed will be encouraged by the moderation in headline inflation and signs that shelter inflation is peaking, robust price growth across services components, upside risks to used vehicle prices, and ongoing labor market strength will likely push the Fed to opt for a 25bp rate hike at its May 2-3 meeting," said Mickey Levy and Mahmoud Abu Ghzalah of Berenberg Capital Markets.

Wilson-Elizondo said "the continued strength in the core figure is not consistent with the Federal Reserve's 2% long-term target and will keep a 25-bps hike on the table for the May meeting."

However, she noted the March CPI print "does not yet reflect post-banking stress information and the subsequent tightening of credit conditions."

"As the Fed's mandate is both to promote maximum employment and stable prices, we believe half of the dual mandate suggests higher rates from here to reduce inflation, and the other half suggests lower rates to alleviate concerns over financial stability," Wilson-Elizondo said.

She believes "the hiking cycle is much closer to its end than its beginning" due to "financial stability has become a bigger concern and growth should continue to slow as credit conditions tighten."

FOMC minutes

Following the recent banking sector crisis, which started with the collapse of Silicon Valley Bank and continued as several other banks failed, Federal Reserve policymakers contemplated pausing their current rate hiking cycle in March, according to the most recent FOMC meeting minutes.

Since the March FOMC meeting, "policymakers have described the deliberation to hike or hold as a close call that came down to the wire," said Morgan Stanley strategists.

"Ultimately, it was evidence of relative stability in the banking sector that led the Fed to deliver a 25 bp hike, but the March FOMC minutes revealed that participants were highly attentive to risks around the financial and economic outlook as a result of recent banking-sector developments and cumulative tightening of previous monetary policy actions," they said.

"Whether it was due to the banking sector stresses or the fact that the Fed had already done an unprecedented amount of aggressive hikes over the past year, so was nearing the end of this campaign, the FOMC minutes finally showed some signs of a difference of opinions on the path forward for monetary policy," said Jason England, global bonds portfolio manager at Janus Henderson Investors.

All participants agreed to a 25 basis point rate hike at the March meeting, but he notes that "'several participants' … considered whether it would be appropriate to hold rates at this meeting and 'some participants' considered a 50bps rate hike given persistently high inflation and the strength of recent data."

Prior to the onset of the banking-sector stresses, Morgan Stanley said "any participants remarked that the incoming data before the had led them to see the appropriate path for the federal funds rate as somewhat higher than their assessment at the time of the December meeting, and a 50bp hike was in consideration."

However, "after incorporating the banking-sector developments, participants indicated that their policy rate projections were about unchanged from December."

Morgan Stanley strategists noted there was some discussion "to hold rates steady while assessing the impact of the banking sector, but given the backdrop of high inflation, economy activity, and hiring, all participants agreed it was appropriate to raise the federal funds rate target by 25 bp to 4.75%-5.00%."

In the end, England said, "the debate between price stability (inflation still well above the Fed longer-run target) and financial stability (banking sector stresses) the Fed's continued resolve to bring inflation back to their 2% target won out at this meeting."

The Fed acknowledged "that the banking sector stresses will likely lead to some tightening of credit conditions, but it is uncertain to what extent so that along with lag effects to hikes already done over the past year, the Fed will now be even more data dependent at each meeting," according to England.

The Fed will implement more hikes, If additional policy firming is needed, but he said "it appears like they are much closer to a pause than we thought prior to the bank turmoil in early March."

"The minutes of the March meeting leave the door open to no 25 bp follow-up in May, but participants were leaning more towards another hike, while spending good deal of time worrying about stresses in the banking sector," according to Morgan Stanley. They expect the "Fed to hike 25bp in May to a peak rate of 5.1%, then hold for an extended period before cutting in 1Q24."

Primary to come

The Modesto Irrigation District Financing Authority, California (/A+/AA-/) is set to price Thursday $174.575 million of electric system revenue bonds, consisting of $126.575 million of new-money bonds, Series 2023A, and $48 million of refunding bonds, Series 2023B. Goldman Sachs.

Raleigh, North Carolina, is set to price Thursday $150.565 million of GOs, consisting of $145.835 million of public improvement bonds, Series 2023A, serials 2024-2043, and $4.730 million of taxable housing bonds, Series 2023B, serials 2024-2043. PNC Capital Markets.

The Ventura Unified School District, California (A1///), is set to price Thursday $113.000 of Election of 2022 GOs, Series A, serials 2024-2025 and 2032-2043, terms 2048 and 2052. RBC Capital Markets.

Competitive

Louisiana (Aa2/AA-//) is set to sell $251.105 million of GOs, Series 2023-A, at 10:15 a.m. eastern Thursday.

New Mexico is set to sell $233.320 million of capital projects GOs, Series 2023, at 10 a.m. Thursday.

Portland Public Schools, Oregon (Aa1/AA+//), is set to sell $230.775 million of GOs, Series 2023, Bidding Group 1, at 11 a.m. Thursday.

The school system is also set to sell $189.225 million of GOs, Series 2023, Bidding Group 2, at 11:15 a.m. Thursday.