-

The Thanksgiving holiday-shortened week, next-to-no supply and few economic data releases should keep munis steady.

November 19 -

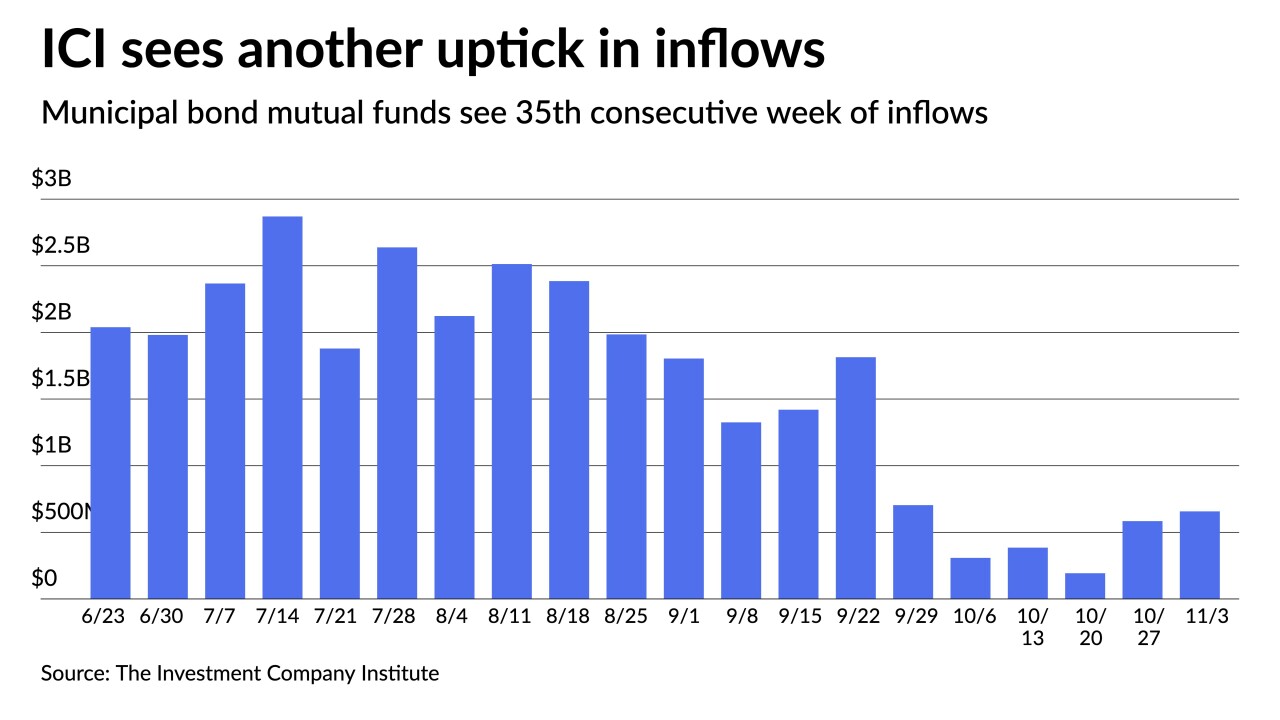

The Investment Company Institute reported $657 million of inflows into municipal bond mutual funds while ETFs saw $828 million of inflows, a massive increase over the $43 million reported a week prior.

November 10 -

Triple-A benchmarks have fallen double digits since Nov. 1, with the largest moves out long. California, the District of Columbia, Wisconsin and other issuers part of a $6 billion new-issue calendar priced.

November 9 -

This Fixed-Income Pricing and Valuation (FIPV) Division will use BDA resources to represent professionals who price and value securities portfolios.

November 9 -

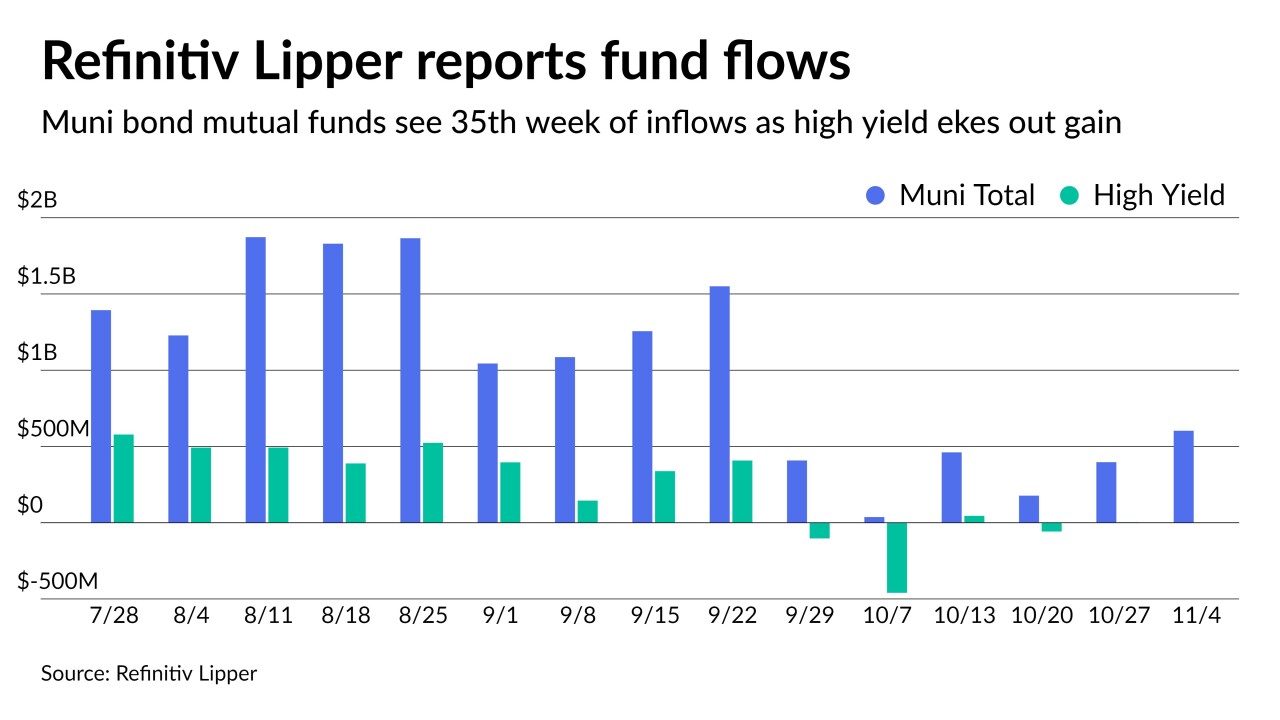

For 35 weeks in a row, investors have put cash into municipal bond funds as Refinitiv Lipper reported $603 million of inflows while high-yield funds eked out a gain of slightly more than $1 million.

November 4 -

The Treasury Department, for the first time in more than five years, will likely unveil a scaling down of its behemoth quarterly sale of longer-term securities.

November 1 -

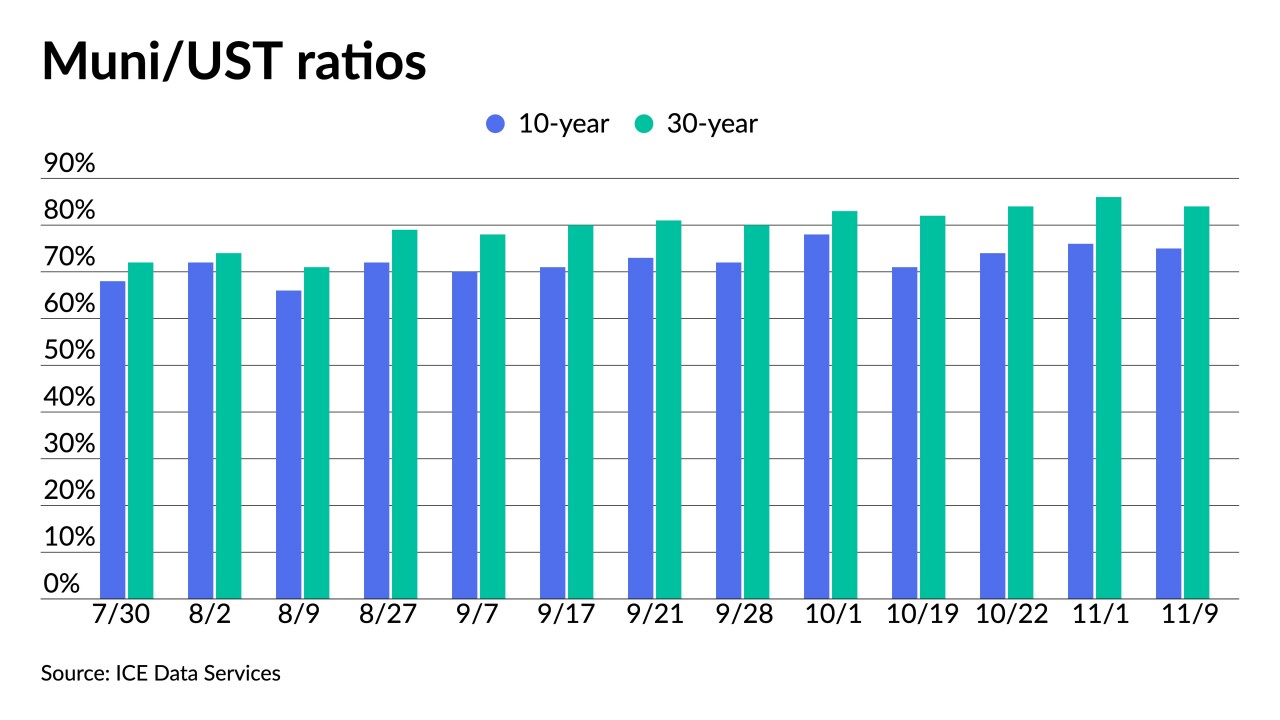

Without the primary in play and a mostly muted secondary, triple-A yield curves were little changed, coming nowhere near the moves in UST with the 10- and 30-year falling five and six basis points as equities saw their worst day since May.

September 20 -

Geithner and colleagues including five former central bank heads released a raft of recommendations to bolster the resilience of the market for Treasuries.

July 28 -

How the pandemic is accelerating trends in financial advice and changing the way Americans manage their money.

-

The U.S. Treasury kept its quarterly auction of long-term debt, planned for next week, at a record size to help fund the government’s continuing wave of stimulus spending.

May 5 -

The lineup of exclusively short-duration fixed-income products, taxable and municipal, still managed an overall gain.

April 21 -

Municipal bonds have a direct effect on the social and cultural character of cities, metropolitan areas, counties, and states. Munis and the initiatives they support such as public education, housing subsidies, public transit systems, and more, can often be linked to local or regional politics. Join Lynne Funk, Executive Editor at The Bond Buyer and Destin Jenkins, Neubauer Family Assistant Professor of History at the University of Chicago as they explore how municipal bond mismanagement can have contrasting influences on the different ethnic groups in our cities.

-

The top 20 performers nearly doubled the gains of their peers over the period.

April 15 -

Exactly one year after record billions were pulled from municipal bond mutual funds and the market was in free fall, municipals followed U.S. Treasuries this week as the markets continued to dismiss the Fed's outlook on inflation and rates.

March 19 -

The Treasury Department’s $60 billion sale of two-year notes on Tuesday broke one of the few remaining records of the low interest-rate era.

February 23 -

With the U.S. Treasury sell off, municipal to UST ratios fell below 55% in 10-years.

February 16 -

Robin Marshall, director of fixed income research at FTSE Russell, talks about what investors should be paying attention to during the coming year. He looks at inflation prospects, possible Central Bank actions and the continuing effects of the COVID-19 pandemic. Chip Barnett hosts. (15 minutes)

January 21 -

Muni yields have been in a nine-basis point range since the beginning of the year while UST yields have fluctuated more than 20 basis points. With so little supply, muni credit spreads continue to compress.

January 20 -

Tax-exempt performance is dependent on what supply looks like versus taxables. The 30-day visible supply shows more than 30% taxables on tap, though some analysts say the taxable increase makes exempts more attractive.

January 19 -

It was inevitable that muni yields would need to rise somewhat as the UST 10-year broke above 1%, however participants said the supply/demand imbalance will keep munis from rising as quickly as Treasuries. More than $1 billion inflows reported.

January 7