Treasuries sold off by nine and eight basis points respectively on the 10- and 30-year Tuesday, pushing muni yields higher, but the asset class continues outperforming its taxable counterpart with only a two basis point cut in triple-A benchmarks.

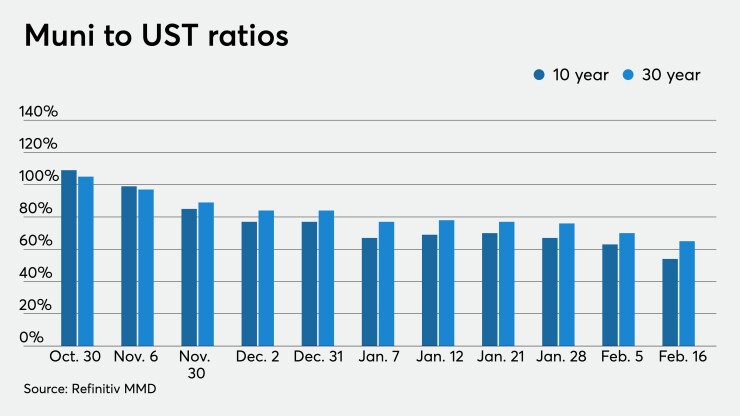

Rising U.S. Treasuries moved municipal to UST ratios even lower again. They fell four basis points to 54% in 10 years and two basis points to 65% in 30 years, according to Refinitiv MMD. ICE Data Services showed ratios fell two basis points to 54% in 10 years and fell two basis points to 66% in 30. BVAL showed 10-year ratios fall two basis points to 56% and three basis points lower at 70% in 30 years.

Roberto Roffo, managing director and portfolio manager at SWBC Investment Company, noted that UST weakness did not move municipals much, because strong technicals remain in the market. Munis are “still very strong as cash inflows continue to flood the market and funds are reluctant to raise cash positions,” which bodes well for the market ahead, Roffo said.

The excess cash will continue to chase the upcoming deals this week, despite their lack of size, he noted.

Besides the continued outperformance to Treasuries, robust inflows and modest new issuance will be present as the holiday-shortened week brings with it an estimated $5.8 billion.

“The acute supply-demand imbalance continues to compress absolute tax-exempt yields, spreads, and muni/Treasury ratios to historically low levels,” Peter Block, managing director of credit research at Ramirez & Co., wrote in a weekly municipal market report on Tuesday.

Last week’s primary market welcomed about $9.2 billion of new issuance, while deals arriving this week include an estimated $5.8 billion, including the $819 million Regional Transportation District of Colorado tax-exempt and taxable sales tax revenue green bond deal, $551 million from the Nashville-Davidson County Metro Government, Tennessee, and $295.3 million Wisconsin taxable general obligation bonds.

The 30-day visible net supply is negative-$12.7 billion, which includes $7.2 billion of announced supply compared with $19.9 billion of maturities and/or calls, Block noted.

Year-to-date taxable issuance of $13.8 billion, or 31.7% of the total, is exacerbating the tax-exempt supply shortage, according to Block. The scenario is not that much better in the secondary market, he noted.

“Secondary trading flow and bid-wanted par accelerated slightly from prior weeks, although was about 10% below average, Block added.

Economic indicators

The manufacturing sector in New York “grew modestly,” the February Empire State Manufacturing Survey suggested, as the general business conditions index climbed to 12.1 from 3.5 in January.

The 12.1 was the index’s highest read since July, and above the 6.2 level predicted by economists polled by IFR Markets.

The new orders index rose to 10.8 from 6.6, while the shipments index fell to 4.0 from 7.3 and unfilled orders reversed to positive 2.6 from negative 5.5. The delivery time index increased to 9.1 from 5.5, inventories jumped to positive 6.5 from negative 0.7, prices paid grew to 57.8 from 45.5, prices received gained to 23.4 from 15.2, the number of employees index rose to 12.2 from 11.2, and the average employee workweek climbed to 9.0 from 6.3.

In the forward-looking indexes, the general business conditions index crept to 34.9 from 31.9, the new orders index rose to 35.6 from 34.8, shipments declined to 35.1 from 37.6, unfilled orders grew to 15.6 from 6.2, the delivery times index jumped to 11.0 from 3.4, inventories increased to 14.9 from 9.0, prices paid climbed to 55.8 from 49.0, prices received grew to 32.5 from 23.4, the number of employees index slid to 16.6 from 23.0, while the average employee workweek gained to 14.3 from 11.7, the capital expenditures index soared to 28.6 from 17.9, and the technology spending index rose to 23.4 from 13.1.

The biggest downside economic risk for credit would be a quantitative easing “taper scare,” according to the BNP Paribas credit strategy research team, headed by Viktor Hjort, “It’s not our base case but in terms of a risk that’s both reasonably possible within the next few months and would have high market impact it’s the one to be concerned about,” he said.

As the second quarter approached, the threat of a scare will rise, Hjort said, “not because the Federal Reserve/European Central Bank are ready to taper — they are not — but because by then the vaccination progress may have reduced uncertainty to such an extent that the market views policy tightening as a foregone conclusion.”

Separately, the Treasury Department’s announcement that it expects the cash balance to decline, could have an impact on short-term munis, according to Gary Pzegeo, head of fixed income at CIBC Private Wealth, US.

“The Treasury’s plan to unwind a large portion of its cash balance held at the Fed should lead to a reshuffling of liabilities and an increase in banking system reserves,” he said. “This could lead to volatility in short-term Treasury funding markets with potential secondary effects for short-term munis.”

Of course, the Fed could respond “with tweaks to the interest rate paid on excess reserves (IOER), which could indirectly lead to similar movements in other short-term muni benchmarks like the SIFMA swap index.”

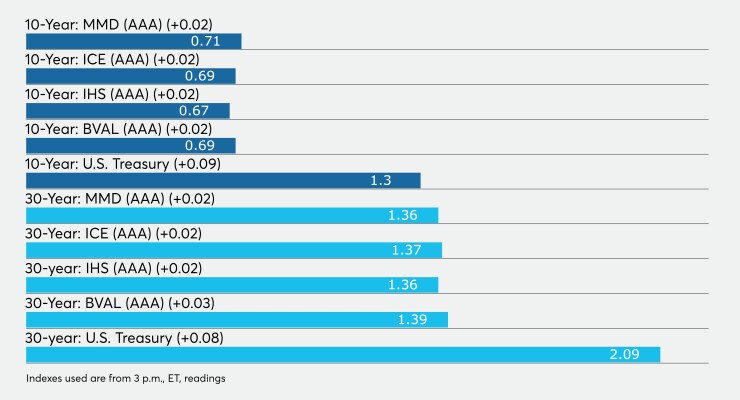

Secondary market

High-grade municipals were weaker by two basis points on bonds outside of 2024, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were at 0.06% in 2022 and 0.08% in 2023. The 10-year rose to 0.71% and the 30-year to 1.36%.

The ICE AAA municipal yield curve showed short maturities at 0.08% in 2022 and 0.10% in 2023. The 10-year rose to 0.69% while the 30-year yield rose to 1.37%.

The IHS Markit municipal analytics AAA curve showed yields at 0.08% in 2022 and 0.09% in 2023 while the 10-year was at 0.67% and to 30-year at 1.36%.

The Bloomberg BVAL AAA curve showed yields at 0.06% in 2022 and 0.08% in 2023, while the 10-year rose two basis points to 0.69%, and the 30-year yield rose three basis points to 1.39%.

The three-month Treasury note was yielding 0.09%, the 10-year Treasury was yielding 1.30% and the 30-year Treasury was yielding 2.09% near the close. Equities were mixed with the Dow up 89 points, the S&P 500 rose 0.06% and the Nasdaq fell 0.23%.

Muni primary market

The deal from Colorado's RTD (Aa2/AA-/AA/) has two pieces. The first, $519 million of taxable sales tax revenue refunding bonds (FasTracks Project) climate bond certified green bonds are expected Thursday. Goldman Sachs & Co. LLC is head underwriter.

Goldman will also run the books on $298 million of tax-exempt sales tax revenue refunding bonds (FasTracks Project) climate bond certified green bonds on Thursday.

Tucson, Arizona, (A1/AA-/A+/) is set to price $658 million of taxable certificates of participation on Tuesday. Serials 2022-2036, term 2047. Assured Guaranty insured. FHN Financial Capital Markets is lead underwriter.

Wisconsin (Aa1/AA//AA+) is set to price $295 million of taxable general obligation refunding bonds, serials 2022-2028, on Wednesday. BofA Securities is lead underwriter.

Gahanna-Jefferson City School District, Ohio, (Aa3/AA//) is set to price $205.6 million of Franklin County, Ohio, school facilities construction and improvement unlimited tax general obligation bonds, serials 2021-2041, terms 2043, 2046, 2051 and 2057, Assured Guaranty insured, on Wednesday. KeyBanc Capital Markets is head underwriter.

The CSCDA Community Improvement Authority (NR/NR/NR/NR) is set to price $193 million of essential housing revenue bonds (social bonds). Goldman Sachs & Co. LLC will run the books.

The Pennsylvania Housing Finance Agency (Aa2/AA+//) is set to price $157.9 million of single family mortgage AMT and non-AMT revenue bonds on Wednesday. $122 million Series A, serials 2027-2033, terms 2036, 2041, 2043, 2049 and $35.8 million of Series B, serials 2021-2027. Jefferies LLC is senior manager.

The Florida Housing Finance Corp. (Aaa///) is set to price $125 million of homeowner mortgage revenue social bonds (non-AMT), serials 2022-2033, terms 2036, 2041, 2051 and 2052. Citigroup Global Markets Inc. is bookrunner.

The San Diego Unified School District (Aa2//AAA/AAA) is set to price $113.7 million of dedicated unlimited ad valorem property tax general obligation refunding bonds on Thursday. Goldman Sachs & Co. LLC is head underwriter.

The Clear Creek Independent School District, Texas, (Aaa//AAA/) is set to price $108.7 million of unlimited tax school building bonds, PSF, on Wednesday. Piper Sandler & Co. is lead underwriter.

The Sierra Joint Community College District, Placer, El Dorado and Sacramento Counties California (Aa1/AA//) is set to price $97 million of general obligation bonds on Thursday. Piper Sandler & Co. is bookrunner.

San Mateo Union High School District, California, (Aaa///) is set to price $96.2 million of general obligation bonds on Thursday. Stifel, Nicolaus & Company Inc. is head underwriter.

Durango School District 9-R, La Plata County, Colorado, (Aa2///) is set to price $90 million of general obligation bonds, insured by Colorado State Intercept Program, serials 2024-2040. RBC Capital Markets is bookrunner.

The Unified School District No. 233, Johnson County, Kansas, (/AA//) is set to price $89.7 million of taxable general obligation refunding bonds on Wednesday. Piper Sandler & Co. is head underwriter.

Competitive deals

Nashville Davidson Counties, Tennessee (/AA//) is set to sell $551 million of general obligation unlimited tax bonds at 11 a.m. on Wednesday. Serials 2022-2041.

Little Rock School District #1, Arkansas (Aa2///) is set to sell $176.6 million of general obligation limited tax bonds at noon Wednesday. Serials 2026-2043.

Howard County, Maryland (/AAA//) is set to sell $123 million of general obligation unlimited tax bonds at 10:30 a.m. Wednesday. Serials 2022-2040. The issuer will also sell $26 million of GO ULT at 10:45 a.m. Wednesday.

Lynne Funk contributed to this report.