Municipals faced some pressure on bonds inside 10 years but ignored a large sell-off in the U.S. Treasury market after a higher consumer price index spooked investors on greater inflation concerns.

Triple-A benchmarks were little changed to a basis point weaker in spots while the five-year UST rose 14 basis points, the 10-year jumped 12 and the 20- and 30-year rose 9 and 10 basis points, respectively.

Ratios fell as a result. Municipal-to-Treasury ratios were at 50% in five years, at 70% in 10-years and 80% in 30-years, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five-year at 48%, the 10 at 72% and the 30 at 81%.

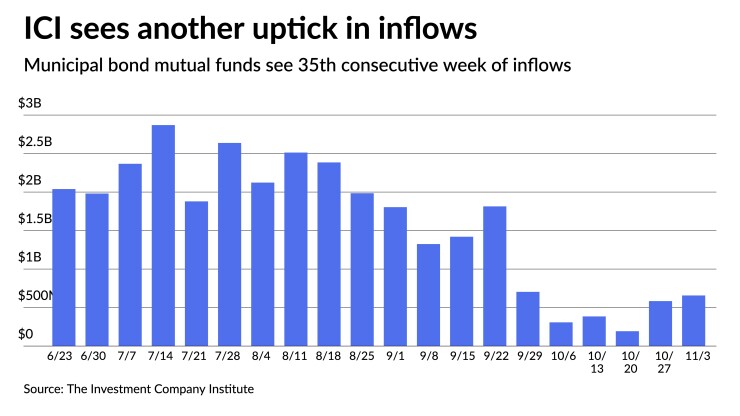

The Investment Company Institute reported $657 million of inflows into municipal bond mutual funds for the week ending Nov. 3, up from $584 million a week prior, marking the 35th consecutive week of inflows and bringing the total for the year to $78 billion.

Exchange-traded funds, though, saw a massive increase to $828 million of inflows, up from $43 million of inflows a week prior.

"I think mutual fund investors are avoiding adding money just before the record date for potential capital gains distributions," said Patrick Luby, senior municipal strategist at CreditSights. "Muni ETFs are a good way to maintain exposure to the investment class. Plus, the primary calendar was kind of anemic the last couple of weeks, so some institutional money may also have gone into the ETFs while awaiting long-term investment in bonds."

Municipal Market Analytics also noted this trend in its weekly Outlook, remarking the stronger ETF inflows "could reflect the better NAV trend, a potential Nov. 1 change to one or more auto-allocation models or, hypothetically, a more secular pivot in favor of ETFs vs. traditional funds."

With most of the new issues being crammed into Tuesday, there was little guidance from the primary; the secondary mostly digested that inventory. Trading did drift as the afternoon progressed with a few weaker prints exchanging hands. As is often the case with munis, Friday may be a catch-up day to UST losses.

Returns are back in the black now for munis with the Bloomberg Fixed Income Indices showing investment grades up 0.71% in November and 1.22% on the year, high-yield at 1.03% for the month and 7.19% on the year while taxables have returned 1.07% in November and 1.98% in 2021.

Informa: Money market muni funds fall

Tax-exempt municipal money market fund assets fell by $340.3 million, bringing their total down to $87.82 billion for the week ending Nov. 9, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 150 tax-free and municipal money-market funds sat at 0.01%, the same as the previous week.

Taxable money-fund assets gained $22.55 billion, bringing total net assets to $4.436 trillion. The average, seven-day simple yield for the 782 taxable reporting funds sat at 0.02%, same as the prior week.

Muni CUSIP volume rises

Monthly municipal volume rose in October, reversing a three-month downward trend. The aggregate total of all municipal securities, including municipal bonds, long-term and short-term notes, and commercial paper, rose 5.6% versus September totals.

For muni bonds specifically, there was an increase in request volume of 8.8% month-over-month, but they are down 3.3 % on a year-over-year basis.

“Municipal issuers came back strong in October, suggesting that the municipal appetite for raising new debt at historically low interest rates has not yet subsided," said Gerard Faulkner, direct of operations for CUSIP Global Services. "As we head into the fourth quarter, it is looking like new issuance request volume across most major asset classes will be on track to be roughly in line or higher than what we saw in 2020.”

On an annualized basis, municipal CUSIP identifier request volumes were down 6.4% through October.

Secondary trading

California 5s of 2022 at 0.09%. Georgia 5s of 2022 at 0.11%. Wisconsin 5s of 2023 at 0.26%. Loudoun County, Virginia, 5s of 2023 at 0.23%. Wisconsin 5s of 2024 at 0.28%.

Texas 5s of 2026 at 0.63%. New York Dorm NYU 5s of 2026 at 0.59%. Montgomery County, Maryland, 5s of 2027 at 0.81%. New York City 5s of 2027 at 0.66%.

Ohio 5s of 2028 at 0.76% (0.93% on 11/2). North Carolina 5s of 2029 at 1.00%. Ohio 5s of 2030 at 1.05% versus 1.06%-1.05% Tuesday, 1.09% Monday and 1.24% original.

New York City TFA 5s of 2031 at 1.28%. Fairfax County 4s of 2031 at 1.17%-1.15%. Washington 5s of 2032 at 1.23%.

New York City TFA 4s of 2038 at 1.65%-1.64%. Texas water 4s of 2044 at 1.72%. Los Angeles DWP 5s of 2051 at 1.55%-1.54% versus 1.56%-1.55% Tuesday.

AAA scales

According to Refinitiv MMD, yields were unchanged at 0.14% in 2022 and 0.23% in 2023. The 10-year at 1.08% and the yield on the 30-year at 1.53%.

The ICE municipal yield curve showed bonds rise one basis point to 0.15% in 2022 and 0.23% in 2023. The 10-year maturity rose one to 1.08% and the 30-year yield was steady at 1.56%.

The IHS Markit municipal analytics curve showed short yields flat at 0.14% in 2022 and at 0.21% in 2023. The 10-year yield at 1.06% and the 30-year yield at 1.54%.

The Bloomberg BVAL curve showed short yields rise one to 0.16% in 2022 and one to 0.21% in 2023. The 10-year yield rose two to 1.08% and the 30-year yield up two to 1.56%.

Treasuries sold off as did equities.

The five-year UST was yielding 1.222%, the 10-year at yielding 1.561%, the 20-year at 1.952% and the 30-year Treasury was yielding 1.913% near the close. The Dow Jones Industrial Average lost 213 points or 0.61%, the S&P was down 0.75% while the Nasdaq lost 1.57%.

Inflation front and center

“The Fed has an inflation problem and it’s getting worse,” said BlueBay Asset Management Chief Investment Strategist David Riley.

While taper buys the Federal Reserve time to assess its dual mandate goals, he said, “with headline and core inflation likely to be running at around 5% and the unemployment rate down to 4% by the time tapering ends in June of next year, the Fed will have to react by raising interest rates soon after.”

While the market expects two hikes next year, Riley said, “low yields on long-end Treasury bonds reflect a bond market that is pricing a very gradual pace of subsequent rate hikes with the Fed funds rate peaking at around 1.5%-1.75%.”

If the Fed falls behind the curve and has to raise rates aggressively, it could halt economic expansion, he noted.

Not only is inflation “showing no signs of abating — it is accelerating,” said Steve Chiavarone, portfolio manager and equity strategist at Federated Hermes. “The acceleration this month was broad-based, undercutting the argument that it is simply being driven by one or two anomalous categories.”

As a result, investors will price in more and earlier rate hikes, he said. “This also may increase the likelihood that the Fed will be forced to accelerate their pace of taper in January,” which could tamp longer-term growth.

Ned Davis, senior investment strategist at Ned Davis Research, is concerned by rising non-farm unit labor. “If this continues, the Fed’s belief that inflation is ‘transitory’ will likely be in trouble, and they could be forced to really tighten.”

Wednesday’s higher-than expected 0.9% climb in CPI in October and 0.6% rise in core are beyond transitory, Riley said, with “no sign that the rise in inflation is near to peaking. In fact, upward pressure on inflation is extending beyond ‘re-opening’ effects such as the rebound in airline fares with shelter costs picking up and evidence that higher wages are feeding through to higher service price inflation.”

On an annual basis, the headline number rose 6.2% from last October, the highest since 1990, and the core jumped 4.6% from a year ago.

Indeed, after the release, “dollar and Treasury yields rallied as the argument that the Fed might be making a policy mistake grows,” said Edward Moya, senior market analyst for the Americas at OANDA.

But this one report won’t force the Fed’s hand, he said. “It may take a few more hotter-than-expected inflation reports before we see the Fed deliver a major reversal with their inflation is mostly transitory stance.”

Economists now expect “another hot report next month as price increases with rents and autos show no signs of easing,” Moya said.

The larger-than-expected gain and widespread increases “should dispel any notion that higher inflation is transitory,” said Allison Schrager, Manhattan Institute senior fellow. “And with winter coming, surging energy prices, and continued supply shortages, it could get worse. The longer inflation lasts, the more it gets built into longer term contracts and wages — and that could mean inflation stays with us for a few years and drives up the cost of borrowing.”

While monetary policy can’t fix “supply-driven inflation,” she said, “continued accommodation is not helping.”

Wednesday’s report shows firms are able to pass along costs to consumers. “We expect companies to become even bolder and more confident in their ability to raise prices to not only cover the spike in costs but to even expand margins for at least the next three quarters as prices increases are readily accepted and even expected by all now,” said Bryce Doty, senior portfolio manager at Sit Investment Associates.

Wells Fargo Securities Senior Economist Sarah House and Economist Michael Pugliese agree, inflation will climb “over the next few months, before starting to subside around the second quarter of next year.” But supply chain struggles and service-sector prices will keep inflation from “resemble[ing] anything close to the Fed's goal until 2023.”

And the “Fed [is] between a rock and a hard place,” they said. “Whether earlier Fed tightening will avoid a policy mistake or lead to one depends on the drivers of inflation.”

While inflation has been blamed on supply issues, “in our view, much of the discussion over supply constraints conflates the underlying drivers. For monetary policymakers, there is a difference between shortages due to production and transportation disruptions and shortages due to excessive demand. While both of these forces are at work in the current environment, we believe the latter is the bigger driver of elevated inflation right now.”

If the Fed waits to see inflation before raising rates, they said, they can fall behind thew curve, risking “an ultimately stricter policy stance that could induce a recession.” But moving too soon could also derail recovery, House and Pugliese said.

They believe “the unique drivers of the current inflation environment likely make inflation less sensitive to rate hikes than is normally the case.” Monetary policy won’t end the pandemic, get workers back into the labor force or eliminate supply chain issues.

“Tightening aggressively when the economy is still transitioning to its post-pandemic state risks a hard landing, and the lagged effect of monetary policy risks slowing the recovery at a time when buying patterns and spending growth are already normalizing,” they said. “It also risks choking off the labor demand that is likely to be the best bet for eventually drawing more workers back into the workforce, resolving labor supply woes and achieving maximum employment.”

The Federal Open Market Committee will remain patient, House and Pugliese predict, and offer “little firm forward guidance one way or the other on future rate hikes. If this seems a bit odd, bear in mind that the FOMC may be concerned about a policy mistake in both directions.”

Also released Wednesday, initial jobless claims dipped to 267,000 in the week ended Nov. 6 from 271,000 a week earlier.

“The labor market recovery is gaining steam, but for the U.S. to reach maximum employment the participation rate must increase significantly,” said OANDA’s Moya. “The labor market recovery still needs over 4 million jobs to get filled before returning to pre-pandemic levels and that seems unlikely to happen before tapering ends in June.”

Also, the U.S. government ran a $165.1 billion deficit in October and wholesale inventories grew 1.4% in September after an upwardly revised 1.3% increase in August, while wholesale sales gained 1.1%.