-

Market volatility has risen significantly, particularly in the last several weeks, with daily Treasury yield swings of 10 basis points or more becoming the norm with municipals struggling to stabilize.

March 4 -

Refinitiv Lipper reported outflows after inflows of $216 million the previous week.

February 17 -

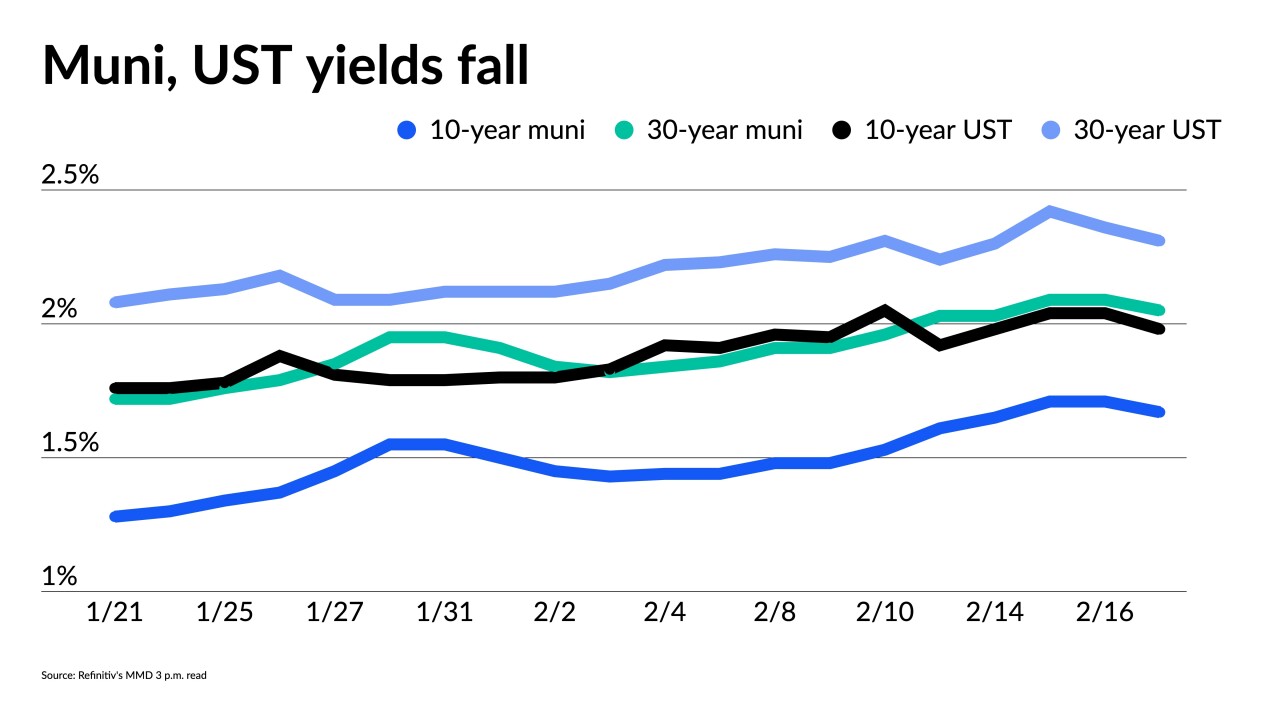

The U.S. Treasury selloff caught up to tax-exempts with two to three basis point cuts to scales, but munis still outperform.

January 4 -

Municipals triple-A benchmarks continue the trend of ignoring other markets to start 2022. The new year will likely usher in slower growth and continued inflationary pressures, analysts said.

January 3 -

Muni bonds have not been not the quick way to big returns in 2021. But for the right client, they are the perfect addition to a portfolio focused on stability and low risk, advisors say.

December 29 -

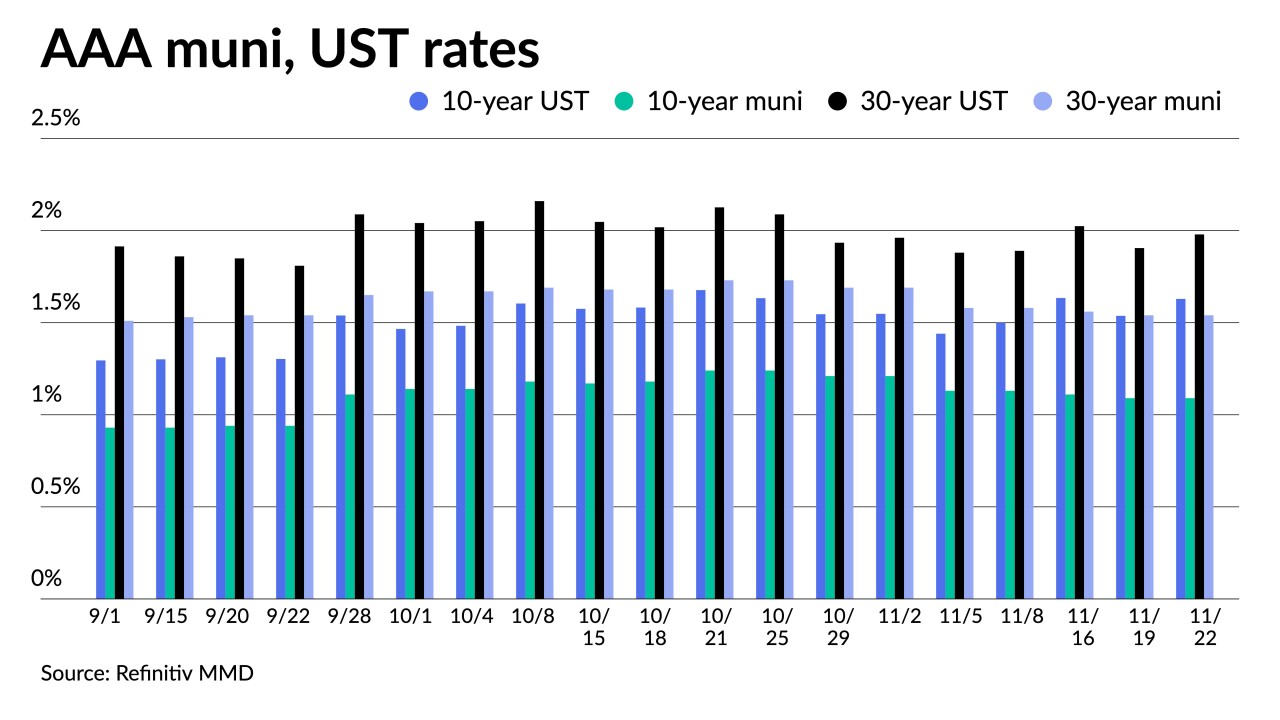

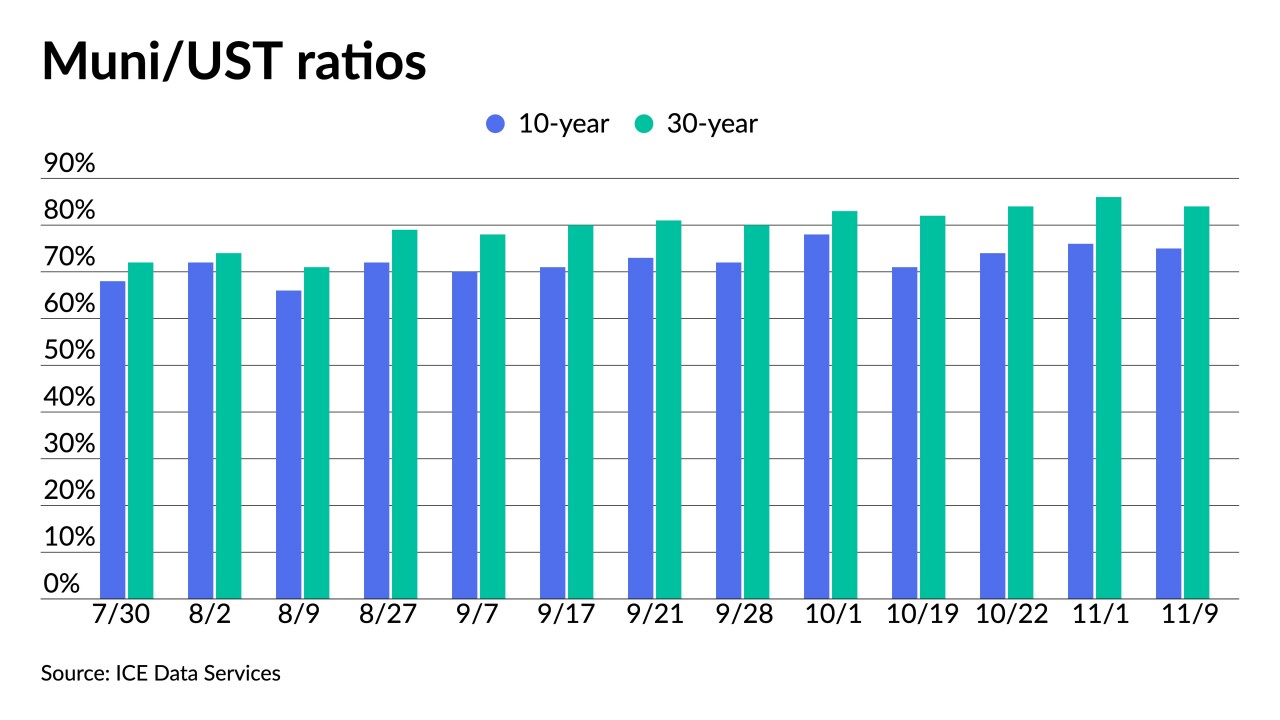

U.S. Treasuries saw losses pushing municipal to UST ratios on the 10- and 30-year lower again.

December 21 -

The Build Back Better in its current form essentially has been killed by Sen. Joe Manchin, likely limiting the potential for tax hikes in the coming year.

December 20 -

The $2.5 trillion increase is expected to get the U.S. through 2023.

December 15 -

With the leadership questions mostly answered, the Fed must figure out what to do about inflation. The markets expect the Fed will have to raise rates sooner than planned, and perhaps speed up taper to do so.

November 23 -

This week will be all about the secondary market given that the majority of issuance was priced earlier in the month while Dec. 1 coupon payments should make secondary offerings look attractive.

November 22 -

The Thanksgiving holiday-shortened week, next-to-no supply and few economic data releases should keep munis steady.

November 19 -

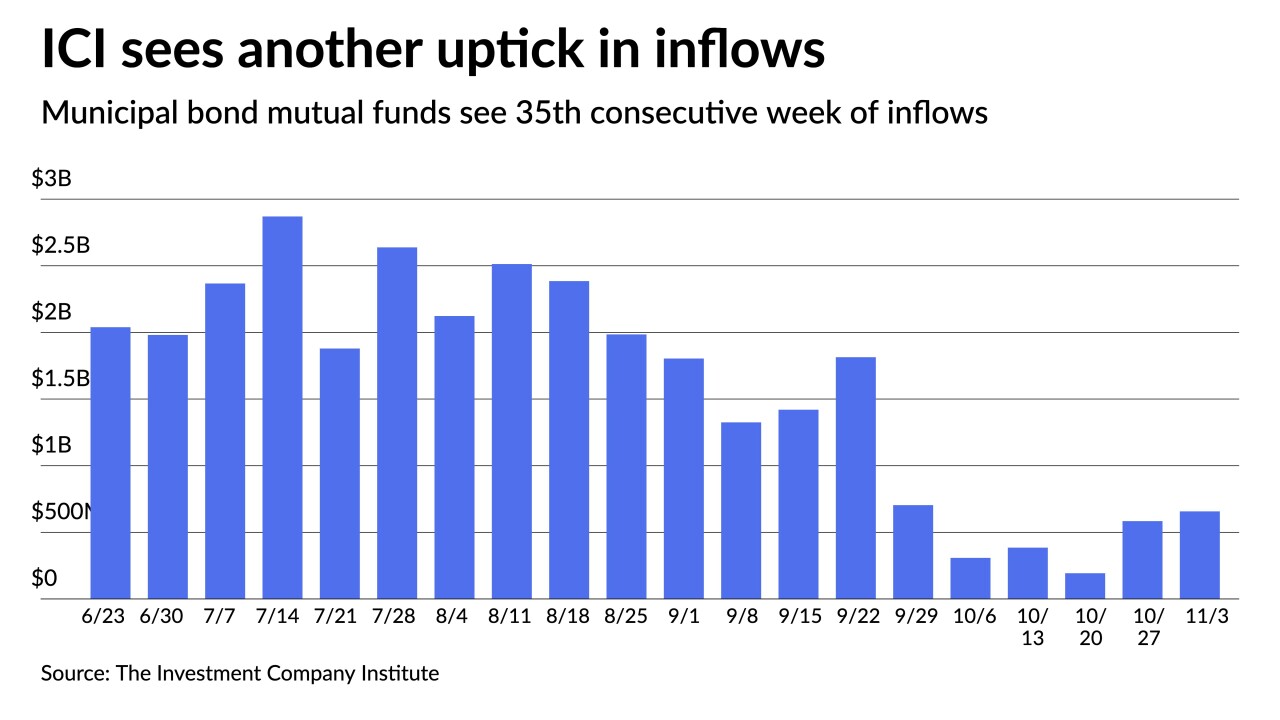

The Investment Company Institute reported $657 million of inflows into municipal bond mutual funds while ETFs saw $828 million of inflows, a massive increase over the $43 million reported a week prior.

November 10 -

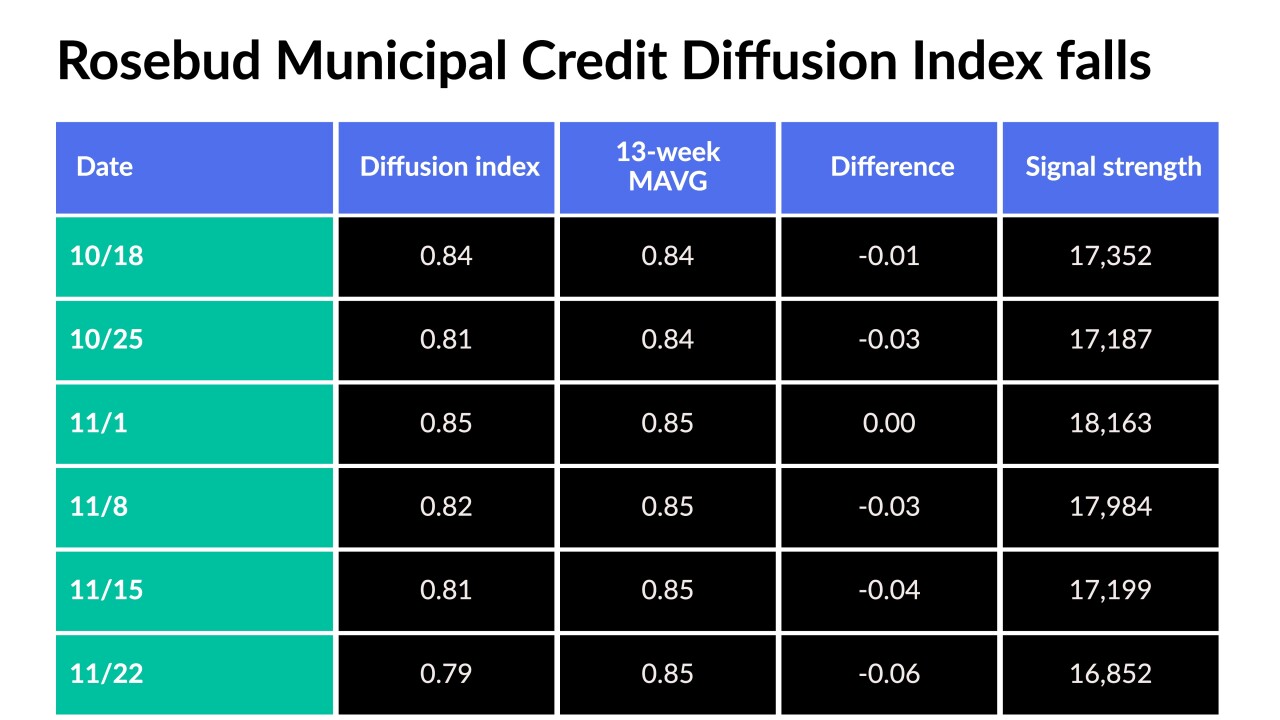

Triple-A benchmarks have fallen double digits since Nov. 1, with the largest moves out long. California, the District of Columbia, Wisconsin and other issuers part of a $6 billion new-issue calendar priced.

November 9 -

This Fixed-Income Pricing and Valuation (FIPV) Division will use BDA resources to represent professionals who price and value securities portfolios.

November 9 -

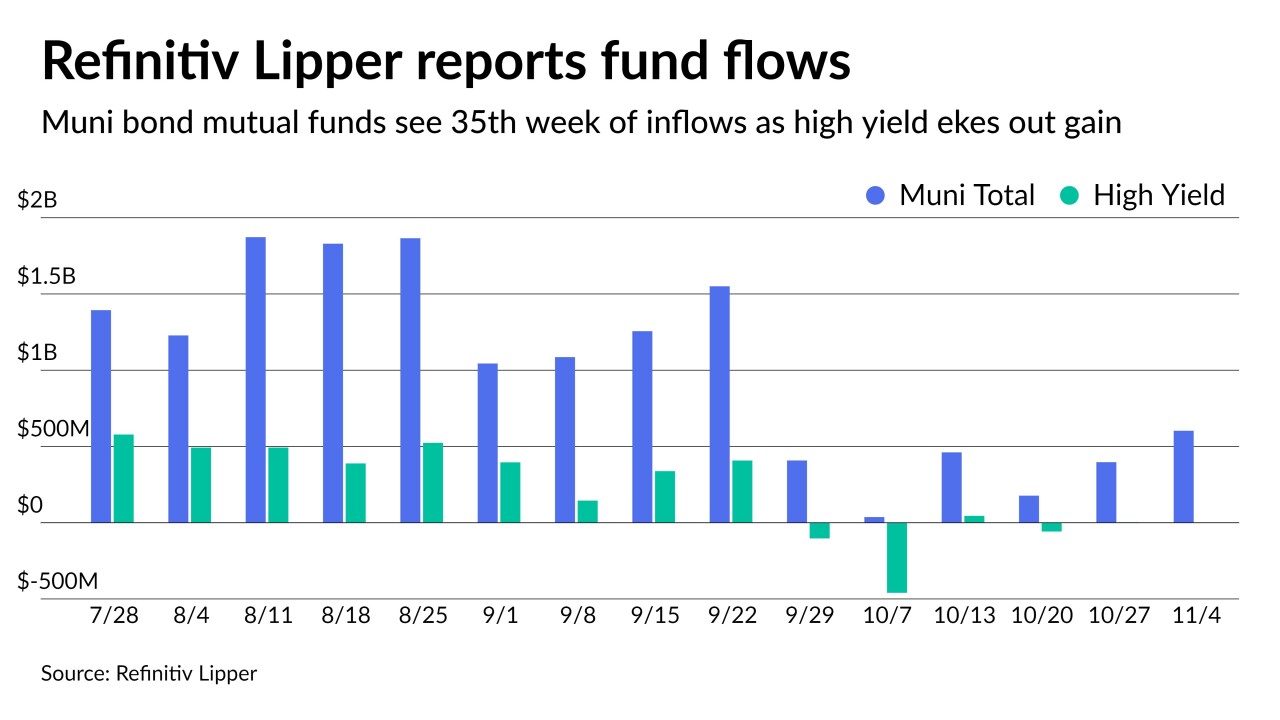

For 35 weeks in a row, investors have put cash into municipal bond funds as Refinitiv Lipper reported $603 million of inflows while high-yield funds eked out a gain of slightly more than $1 million.

November 4 -

The Treasury Department, for the first time in more than five years, will likely unveil a scaling down of its behemoth quarterly sale of longer-term securities.

November 1 -

Without the primary in play and a mostly muted secondary, triple-A yield curves were little changed, coming nowhere near the moves in UST with the 10- and 30-year falling five and six basis points as equities saw their worst day since May.

September 20 -

Geithner and colleagues including five former central bank heads released a raft of recommendations to bolster the resilience of the market for Treasuries.

July 28 -

How the pandemic is accelerating trends in financial advice and changing the way Americans manage their money.

-

The U.S. Treasury kept its quarterly auction of long-term debt, planned for next week, at a record size to help fund the government’s continuing wave of stimulus spending.

May 5