-

The change to the final indexes is expected to expand each fund's investing universe, the firms said.

December 9 -

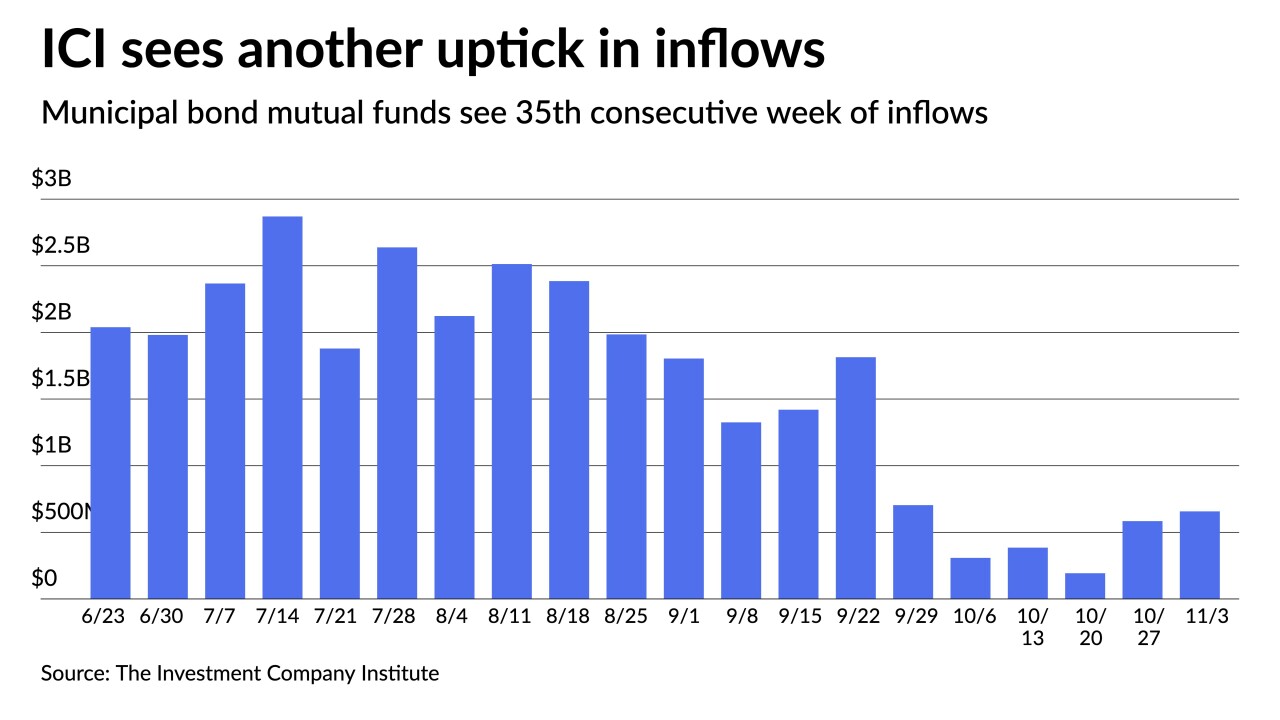

The Investment Company Institute reported $657 million of inflows into municipal bond mutual funds while ETFs saw $828 million of inflows, a massive increase over the $43 million reported a week prior.

November 10 -

The fund focuses on investment-grade state and local government debt funding sustainable development, including affordable housing, green spaces and hospitals.

September 10 -

Another $2 billion-plus was reported flowing into municipal bond mutual funds in the latest week, continuing to be a supportive demand component for munis.

August 11 -

The increasing influence of institutional market participants is even stronger in the taxable muni sector, a Municipal Securities Rulemaking Board report finds.

August 11 -

Bank holdings of municipal bonds increased by 9% in 2020 compared to 2019, according to a new Federal Reserve report.

March 11 -

Data released Monday showed economic strength with further improvement ahead. U.S. Treasuries were off by five basis points but municipals saw aggressive eight to 10 basis point swings to higher yields across the curve.

February 22 -

The top 20 more than doubled the gains of their fixed-income industry peers.

January 6 -

Global investment firm expands ETF suite to boost yield, liquidity, and diversification opportunities.

September 21 -

The Federal Reserve is close to standing up two corporate lending programs that could buy up to $750 billion in debt and exchange-traded funds under its emergency coronavirus actions.

May 4 -

Starting on March 10, ETF prices consistently diverged from benchmark indices and were underpriced for about 10 trading days before converging again.

April 15 -

Sowjana Sivaloganathan, who was municipal markets product manager at Bloomberg for the past 20 years, has joined Intercontinental Exchange’s ICE Data Services to focus on fixed-income product management.

March 9 -

It has been a couple of years since the market has seen an active January to start the year.

January 13 -

Hard on the heels of SEC adoption of Rule 6c-11, Intercontinental Exchange said it would launch ETF Hub to bring greater efficiency to the ETF primary.

September 27 -

-

An MSRB study gauges the effect exchange-traded funds may have on muni market liquidity, a key question in the minds of some regulators.

April 11 -

The web-based, shared content trading muni platform is adding new features and launching ETF and corporate bond software

March 12